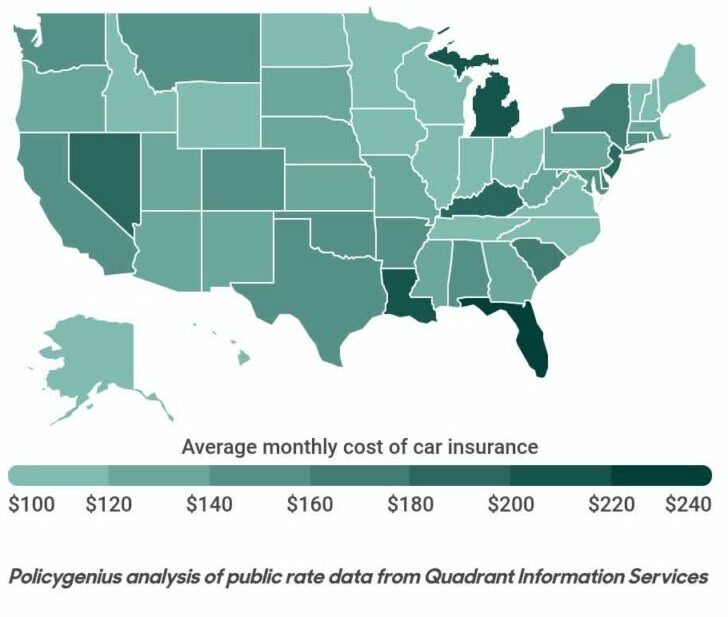

You may have noticed that average car insurance costs vary significantly from state to state. Each state has its laws and regulations regarding auto insurance, auto accidents, thefts, and the frequency of drivers driving without valid insurance. Depending on your age, gender, and driving history, you could pay about $1,800 more in Maine than in Louisiana. That doesn’t mean you have to pay that much.

Average Cost of Car Insurance

Each state has different auto insurance rates that vary based on various criteria. State insurance laws, the number of uninsured drivers, and weather conditions are some of the variables that determine the cost of insurance. These factors can result in a wide range of costs, from a few hundred dollars to thousands of dollars, depending on the type of coverage and the type of vehicle. Some jurisdictions consider credit scores to determine auto insurance rates. While California and Massachusetts are not.

MoneyGeek examined thousands of bids to determine the average cost of coverage to get a broad idea of the cost of auto insurance. Minimum liability insurance does not cover your car, only damage to other cars. A comprehensive coverage policy also covers losses due to accidents, natural calamities, theft, and other incidents. To compare the average cost of insurance, consider increasing your deductible, switching to usage-based coverage, and applying all available discounts.

Factors Affecting Your Premium

Those who commute find their premiums are higher than those traveling less than an hour each way. Likewise, more driving means more risk. The cost of car insurance is affected by location. Accidents, theft, and vandalism are generally more common in urban areas. Car insurance rates are also influenced by gender and age. Generally, younger drivers pay more.

Minimum Auto Insurance Requirements

What level of coverage is required for vehicle insurance? The minimum required for auto insurance can vary significantly by state. Use this list from NerdWallet to determine the requirements for your state and compare rates accordingly. You should also be aware that some Medicare and Medicaid clients have lower PIP restrictions than others. Whatever your circumstances, having adequate coverage is important. Even if you only have minimal coverage, you’ll likely be glad you did.

Buying additional coverage can be beneficial when liability coverage is the minimum required in car insurance. Medical expenses for other drivers or passengers injured in a collision are covered under Personal Injury Protection (PIP). It can help cover the cost of substitute services or lost wages. Some insurance also covers funeral fees. The minimum coverage amount will depend on the state and its laws. In New York, it’s best to buy more than you need.

Average Car Insurance Rates By Age

Generally speaking, insurance costs are higher for drivers in their late 30s to early 50s. Because they think more responsibly and maturely As a driver ages, your premium will increase as your driving experience decreases. Because the older you are, the more likely you are to have an accident. Insurance companies also consider your health. Because people with health problems are more likely to be involved in an accident.

While Massachusetts restricts the age to determine auto insurance premiums. Other states still allow insurance companies to consider your driving history when setting your rate. Young drivers are charged higher rates than drivers who have been driving for a while. Insurance companies also consider other factors such as your driving history to determine how much your premium will be. A good rule of thumb is to get a free quote before you decide to sign up for coverage.

A person’s age and driving record, among other things, affect the average cost of auto insurance. Women are more involved in fatal car accidents than men. Their rate is significantly higher than their male counterparts. In Maryland, women over 50 pay the same insurance premiums as men. While contrary to the estimates of some insurance companies. There is one big discrepancy. In New York, women can pay $636 more than men for the same coverage if they are older than their male counterparts.

Male vs. Female Car Insurance Rates

Auto insurance companies have been in the news for decades. Gender should be considered when setting prices. Some states today have begun banning the use of gender to determine rates. Data suggests that typical premiums for women are higher than for men. Even if the situation is not completely clear. How a person behaves in the type of automobile they drive has a lot to do with their gender. Even if it doesn’t have an obvious impact on insurance costs.

For young men, gender plays a role in auto insurance premiums. Young men pay 14% more than young women. However, the gap narrows with age. Six states still do not allow consideration of gender in premium pricing. Only Massachusetts and New York allow insurance companies to price premiums based on gender. The good news is that New York is one of the few states that does. which would allow transgender drivers to purchase insurance based on the gender marker on their license.

Auto insurance companies can use the data to assess risk levels and calculate average prices despite gender disparities. while men pay higher average rates. Women then pay only 1% less. In other words, the differences between men and women are mostly rounding errors. While the gender gap narrows over time, it remains large enough to pose a problem for female drivers. If you’re wondering if gender affects the cost of vehicle insurance, take a look at:

California car insurance rates by state location

Insurance companies use a combination of factors to determine the average cost of car insurance for drivers. Metropolitan areas generally have higher auto insurance costs than suburban areas. They also consider the cost of medical care and auto repairs. Of course, a driver’s zip code can also affect their rate. Cities with more crime and more traffic may also cost more to insure. Rural communities, on the other hand, are less likely to have high rates.

However, many other factors affect auto insurance premiums. Where you live has a significant impact on the overall cost. You should shop around to get a quote in your home state to see how much you can save on your premium. You can request a quote by giving your home address to the insurance company. Be sure to compare policies when comparing insurance quotes as each business will have a different pricing structure.