If you’re looking for cheap car insurance, you’ve come to the right place. You can save money by combining several policies into one. Many insurers offer discounts for multiple policies, including homeowners and auto insurance. You can also qualify for a senior citizen or retiree discount, or pay less for your car insurance if it has certain safety features installed. Getting the best deal is easy when you know what to look for in a policy.

Good driver discounts – Best Car Insurance Deals

If you’ve been a safe driver for at least three years, you may be eligible for a good driver discount on your car insurance policy. This discount is available from most Best Car Insurance Deals companies and is based on several factors. Many of these discounts are tiered and depend on your age and driving history. Some insurers offer a 10 percent good driver discount, while others will give you a 25 percent discount. A good driver discount is a great way to lower your insurance premiums.

Many auto insurance companies give a good driver discount because they can measure your driving habits and reward you for them. People who drive less and make fewer claims are considered good drivers. Many insurance companies also give a discount to drivers who take a defensive driving course. This type of discount can be as high as forty percent. You may also qualify for a school or club discount. Members of professional organizations, alumni from certain universities, and those who have served in the military may also qualify for good driver discounts.

GEICO also offers a good driver discount for those who drive safely. This discount will cut your premium by around 26%. Other discounts include accident forgiveness and medical payments. These benefits cover the medical expenses of drivers or passengers in an accident. A seatbelt discount will also help you save money. In addition to the good driver discount, you may be eligible for accident forgiveness and seatbelt discounts. While these are not mandatory discounts, they can help you save more money.

Safe vehicle discounts – Best Car Insurance Deals

Keeping an accident-free driving record can help you save money on your car insurance. Most car insurance companies will offer discounts for accident-free drivers, which can be up to 22%. Other ways to reduce your premiums are to wear a seat belt or take a defensive driving course. If you’re over 55, it might be necessary to take a course. Some insurers will require you to take one to get the discount.

Passive restraints, automatic seat belts, and anti-lock brakes are all ways to save on your car insurance premiums. Some insurance companies will even provide discounts on medical payments if you have these features installed in your vehicle. Other discounts include anti-theft devices and factory-installed anti-lock braking systems. These features make you less of a target for car thieves and can save you up to 40% on medical coverage.

Anti-theft devices, steering wheel locks, and alarm systems can all reduce your vehicle’s risk of theft. Having these devices can also lower your insurance premiums by as much as 10%. Many carriers are willing to give you a discount if you have these safety features installed in your vehicle. While the discounts vary, it’s worth checking with your insurance provider to see which one offers the best discount for your needs.

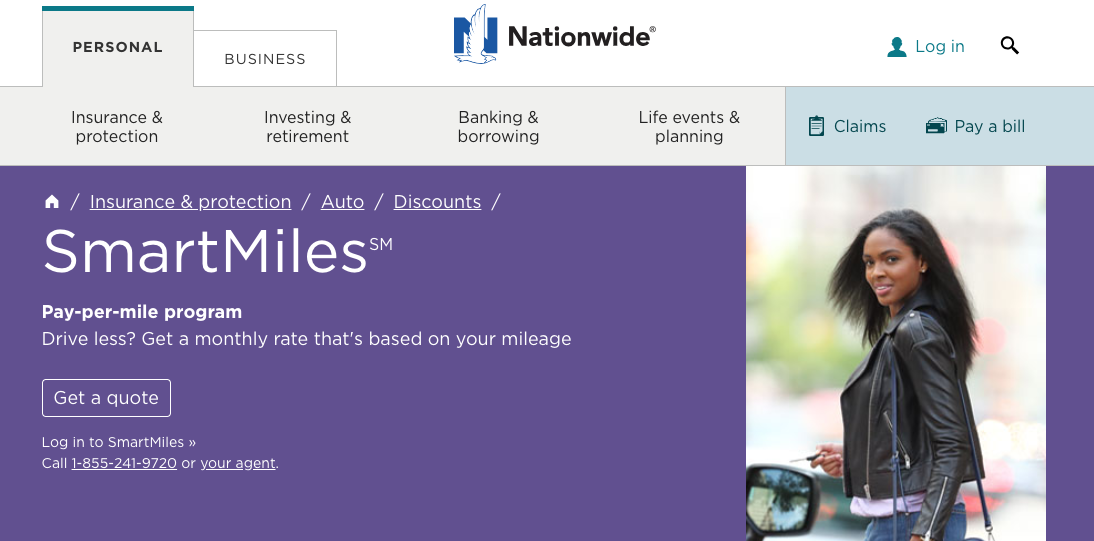

Low mileage discounts

Low-mileage car insurance discounts can help you save money on your premiums. You may qualify for a low-mileage discount if you use public transportation or work from home. This discount can significantly reduce your premiums and is available from most car insurance companies. You should be aware, however, that many low-mileage discount programs are not published. The amount of mileage you drive each year will be the main determining factor in the low-mileage discount you’ll receive. Often, these discounts can amount to as much as $100 per year.

To qualify for a low mileage discount, you can show the insurance company that you only drive a few hundred miles a year. If you have changed your mileage, be sure to ask your current insurer if they offer low-mileage discounts. Even if they don’t, you can use a pay-per-mile program to get lower mileage car insurance rates. These programs usually include a base rate and a per-mile rate for each month. If you have a smartphone, use it to record your driving.

Low mileage car insurance discounts are available from most car insurance companies. However, the percentage varies. For example, some insurance companies may decide to offer low mileage discounts to drivers with low mileage. While others do not give much importance to this. As such, drivers should carefully read the terms and conditions of the policy before accepting it. By understanding the terms and conditions of your insurance policy, you can prepare yourself for future payments.

Pay-in-full discounts

You may be wondering if paid-in-full discounts on car insurance exist. They are available from five of the 10 largest insurance companies. These discounts are given because you have chosen to pay your premium in full each year, rather than in monthly installments. The amount of discount you receive varies by insurance company but typically ranges from 5% to 10%. Some insurance companies do not offer paid-in-full discounts, so make sure to check the policy details to be sure.

Another common discount is the loyalty discount. This discount is often applied to a customer’s policy if they have kept their insurance with the same company for at least six months. Others will give you discounts for multiple vehicles or if you pay your insurance in full every month. These discounts are often more valuable than the renewal discount you get from your current insurer, so it’s always worth shopping around to find the best deal.

You can apply for vehicle equipment discounts, including anti-lock braking systems, as long as your car has a factory-installed anti-lock braking system. You can also stack multiple discounts to receive a higher discount. Some insurers allow you to stack discounts, so make sure to check the policy details carefully. You can also take advantage of payment discounts by paying your bills on time, setting up auto-pay, or going paperless. More companies are turning their attention to the future of car insurance and have several discounts available to consumers.

Multi-vehicle discounts

If you own more than one car, you may qualify for a multi-vehicle discount on your Best Car Insurance Deals. This discount is generally applied to insurance policies for all cars registered under the same household. Some insurers also offer this discount to adult children who live with their parents. However, this discount is not available for all vehicles. This type of discount does not apply to storage insurance. Some insurance companies require that all cars be registered under the same household to qualify.

Multi-vehicle discounts on car insurers can help you save money on your annual premium. In addition to multi-vehicle discounts, you may also qualify for other discounts such as winter tires or bundling auto and home insurance. Many insurance companies offer this discount for multiple vehicles. And your policy may be different. It is a good idea to compare insurance plans offered by different companies to get the best multi-vehicle discount.

The best multi-car discounts can save you 10 to 25 percent on your auto insurance premium. This discount applies to the liability collision and comprehensive coverage portions of your policy. The maximum amount you can save depends on the specific carrier and the number of vehicles you have insured. You should ask your insurance agent about the multi-car discount you qualify for. You can also use your multi-vehicle discount with other discounts to get more discounts on your auto insurance.

Airbag discounts

Airbags are a good way to protect yourself from accidents, and some insurance companies will offer significant discounts for those equipped with them. Airbags are now legally required in cars in the U.S., and they can reduce your insurance costs by 2% to 30%. While the safety features in the car may seem trivial, they can help you avoid serious injuries. To find the best deals, compare car insurance companies’ policies.

The more airbags your car has, the higher the discount you will be eligible for. For instance, having side airbags or dual front airbags can save you up to 15 percent. Most airbag discounts are applied to the medical payments portion of the premium, but you can also receive a discount if you are a member of an alumni association. Additionally, installing an anti-lock braking system can save you up to 5% on your premium.

You may also qualify for discounts if your vehicle is equipped with anti-lock brakes, stability control, or a seatbelt. These safety features may qualify you for a 20% discount or more on your insurance coverage. In some cases, the airbags themselves may also be eligible for a discount. For example, American family consumers who have factory-installed airbags can save up to 30 percent on their insurance premiums.