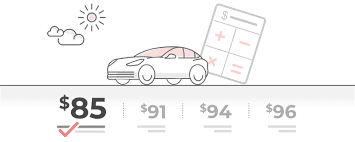

Car insurance estimator Car insurance cost calculator tools become invaluable when it comes to your financial planning. They help you get a clear understanding of the potential costs. Unlock financial clarity with our car insurance estimator. Check your car insurance price based on your driving history, coverage choices, vehicle details, and more.

Car Insurance Costs

A car insurance estimate tool takes into account various factors. Your driving history, coverage choices, vehicle details, more. By providing accurate information you can get a more reliable estimate of your future insurance costs.

Car Insurance Cost Calculator: Cracking the Numbers

The car insurance cost calculator simplifies the complex process of premium calculation. It considers variables like your age, gender, location, and credit history to produce an estimate tailored to your circumstances.

Contacting Geico Car Insurance: Phone Number and STD Code

For those interested in Geico car insurance access to their phone number is essential. This direct line allows you to discuss policy details, ask questions and get a comprehensive understanding of their offerings.

Navigating Geico Car Insurance: Getting in Touch

Geico car insurance phone numbers provide a direct link to their customer service experts. Even if you are a new existing customer, their representatives can guide you through the policy features and further discounts available.

Estimate, Inquire, Insure: Geico Car Insurance Number

As you navigate the world of car insurance estimates and inquiries, the Geico car insurance number serves as your connection to a well-informed coverage experience. Their knowledgeable representatives can help you confidently choose the right insurance.

Estimating your car insurance costs is made easier with tools like the car insurance estimator cost calculator. Whether you’re considering other Geico car insurance options, having access to relevant resources like phone numbers empowers you to make informed decisions about coverage. Remember, every aspect – from driving history to coverage preferences – contributes to your final premium. Exploring your options thoroughly ensures you find the best policy for your needs.