In today’s market, 1 Month Car Insurance has become a popular option for many drivers. Before opting for this type of insurance, it is important to know the pros and cons of the plan. You will also learn how to find a policy and get a quote. To make your search easier, we’ve broken it down into five steps. Continue reading to learn more! Getting a quote is the first step.

Benefits – 1 Month Car Insurance

If you only use your vehicle occasionally or don’t need it for a long period, one month car insurance can be a great option. It offers all the benefits of a traditional annual car insurance plan but with a shorter term and much lower rates. Those who are unsure about their insurance needs. As such it can be a more reasonable option for those who are learning to drive a new vehicle.

One of the most important benefits of paying in advance for your car insurance is the discount. Many insurance companies offer additional discounts to drivers who pay their premiums in full. Companies like Progressive, Farmers, and Allstate offer additional discounts for paying your premium in full. Besides giving you peace of mind, you won’t incur late fees or cancel your insurance. Plus, paying for your insurance upfront means a lower bill each month, so you’ll have more money to spend on other expenses.

Cost of Insurance – 1 Month Car Insurance

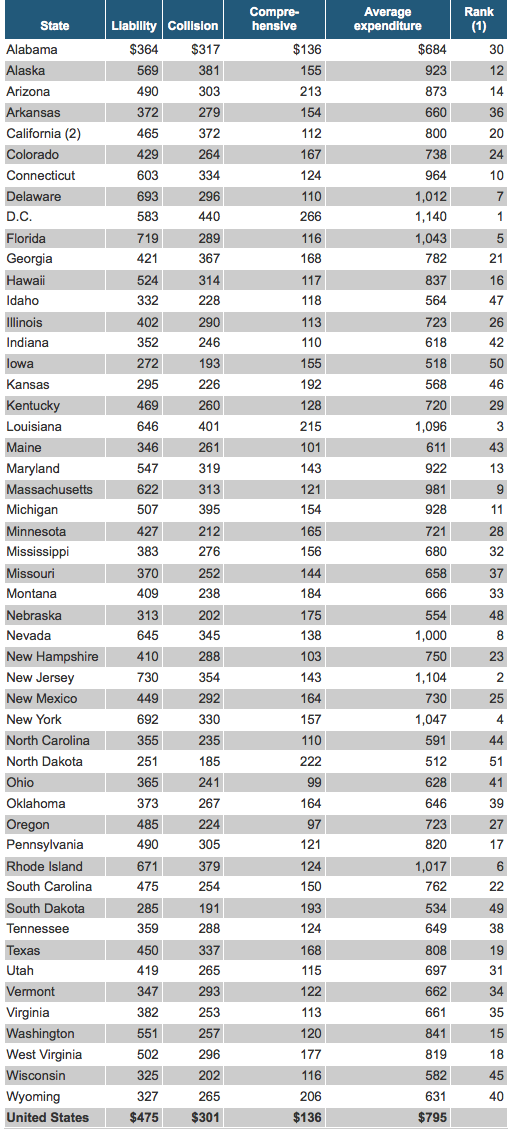

How much should you pay for car insurance? The average cost of insurance for a full coverage policy is $136. For comparison, the minimum coverage policy will cost you $47 per month. Full coverage insurance pays when your car is stolen or in an accident. Minimum coverage only covers damage to another vehicle or person if you are at fault. The deductible is $500. Depending on your age, driving history, and financial status, you can get a 20 percent discount with some companies.

The type of car you drive can affect your monthly insurance rate. While color doesn’t play a big role, the engine and body type will determine your monthly premium. New vehicles and sports cars are more expensive to repair and replace than older vehicles, so their insurance costs will also be higher. Fortunately, most insurance companies will give you a lower monthly rate if you have a high credit score. Some states have enacted laws that make it illegal to use credit scores as a factor in determining car insurance premiums, so be sure to check your state’s requirements before purchasing a policy.

Car insurance quotes can vary by a large margin. A policy that averages $199 per month can be much more than double that. However, it is still worth comparing quotes. The average cost of a car insurance policy is $2,388 per year or $199 per month. Auto insurance companies’ risk management processes determine the cost of insurance. By comparing hundreds of car insurance quotes from different companies, you will be able to choose the best one for you.

Finding a policy

One of the challenges of finding a temporary car insurance policy is finding a policy that only lasts for a month. Although you can find some policies that last six months or longer, most major insurance companies will not offer this option. However, some companies allow you to cancel the policy before the 6 month mark. Here are some tips to help you find the right policy for your needs. Also, remember that temporary car insurance is more affordable than you think.

Comparing policies from different companies can be helpful when looking for a monthly car insurance policy. You should also remember that car insurance is sold in six-month or one-year increments. While you can buy it month-to-month or upfront, it’s always a good idea to buy the shortest term and cancel it at the end of the month. In the US. No policy covers you for just one month.

One tip for finding the right temporary car insurance policy is to read the fine print. Most car insurance policies require drivers to pay a down payment equivalent to 30 to 45 days’ premium. For this reason, drivers may not get the full down payment back if they cancel five or six days into the policy. Also, some policies have a grace period in which they can avail collision and comprehensive coverage only up to 30 days after the policy inception.

Getting a quote

When comparing car insurance, getting a quote for 1 month of car insurance is a smart move. Quotes vary widely depending on your car model and driver history. To find the best rates, just enter your zip code below. Then, review the quotes and choose the one that meets your needs. You should be able to find the best price online. You can save money on your policy by shopping around and getting multiple quotes.

The advantages of using captive agents are many. They are more familiar with your specific needs and can guide you through the policy selection process. However, captive agents have lower satisfaction scores than independent agents. Also, captive agents are biased and may try to sell you additional products. Additionally, captive agents may be less honest about your needs. They will only offer quotes for the company they work for. In contrast, independent agents offer you more options and will give you quotes from a range of insurance companies.

Short-term car insurance policies are available from most insurance companies. These plans are cheap. Full payment is not required at the time of purchase. This is a great option for those who need a car rental for a short period or need a car policy for a student period. They are easily available online and can help you avoid any unexpected expenses. You can also find cheap temporary auto insurance policies by comparing different quotes.