10 Year Term Life Insurance is a great option to protect the future of your loved ones. You can make mortgage payments, pay for your home, and pay other living expenses, and a 10-year policy can help you reach financial milestones. A 10-year policy is relatively inexpensive. So you don’t have to worry about the high cost or the safety net that a permanent insurance policy offers. Read on to learn more about this insurance option.

Benefits of 10 year term life insurance

A 10 year term life insurance policy provides significant peace of mind. The premiums and coverage are based on various individual factors. Age and gender are the most important, followed by medical and family history. Normally, a medical history report is received through a health physical, and questions about previous health conditions and conditions are asked. A no-exam policy is also available. In either case, the premiums and coverage are hanging on your options.

If your goals are long-term, a 10-year term life insurance policy is not the best choice. If you are looking for financial security for a young child, you may not want to buy this type of insurance because the coverage will expire before your child grows up. Similarly, if you are in your 30s or 40s, a 10-year term policy may not be the best option because you will likely be working for more than ten years. Additionally, you may want to consider the value of the policy once you reach retirement age.

A provides a tiered benefit structure and guarantees premiums for the first ten years. This type of coverage is usually affordable, and premiums will not increase or decrease for a decade. In addition, coverage can be renewed up to age 75. There are conditions for extending the coverage, so it’s best to read the policy description carefully. Also, you can choose between monthly, quarterly, and semi-annual payments.

Besides being cheaper than other policies, a 10-year term policy is also easier to convert. Suppose Steve, age 47, is interested in buying whole life insurance but can’t afford the premiums. In this case, he can convert his 10-year term policy to a permanent one without undergoing a medical exam. This type of insurance is a good option if you are in a position where you don’t have a lot of money.

10 year term life insurance cost

If you’re a parent with a young daughter, a 10-year term life insurance policy may be the best solution. It covers your child’s life until they graduate from college. It can provide your family with the financial security they need. For example, if your daughter is fourteen years old, the death benefit from this policy will help cover the cost of her education. Similarly, if you have a mortgage and house payment, a 10-year term life insurance policy will help cover these expenses and provide financial security to your family.

The cost of 10-year term life insurance will vary based on your lifestyle and health history. Health factors like your work and hobbies can affect your rate. Smokers and people with high blood pressure may pay more than those without any health conditions. However, people without smoking or high BMI may find it useful to purchase a 10-year policy, as it offers the lowest premiums. In addition, a 10-year policy is useful if you don’t have long-term coverage and are in good overall health.

The price of a 10 year term life insurance quote can increase as you get older. As life expectancy drops, premium rates rise. The table below shows how premiums change with age. When shopping for life insurance, it’s very important to compare prices from multiple providers. You might be surprised by the price difference! However, a 10-year term life insurance policy remains a more affordable option than permanent life insurance. Additionally, it provides valuable time to assess the cost of a permanent policy and determine the best long-term financial strategy for your needs.

Age eligibility

If you’re considering purchasing a 10 year term life insurance policy, the first thing you need to know is how old you must be to qualify. While some companies have a lower age limit, others have no age limit at all. The age you are is important, as it influences the premium rates you pay. Your age will also affect your ability to buy individual policy riders and non-medical underwriting options. If you’re under sixty, you should wait until after you finish treatment for any fixable diseases. For example, if you’re receiving chemotherapy for cancer, you may want to hold off until your cancer is in remission before purchasing a policy.

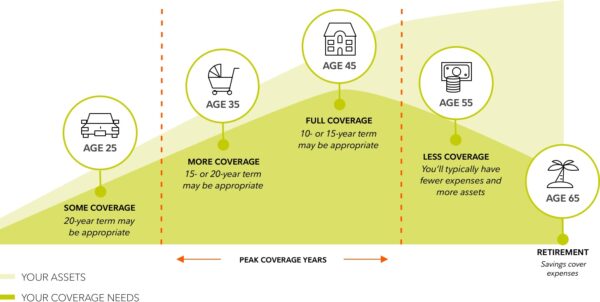

There are several benefits to purchasing a policy early in life. The 10 year term life insurance rates are lower when you’re younger than 45. However, if you wait until you’re older, you’ll likely pay higher rates. Here’s a breakdown of term life insurance rates by age. Hopefully, this information will be helpful. When you’re ready to purchase a term life insurance policy, you can make the right choice for your financial future.

A 10-year term life insurance policy may cost anywhere from ten to seventy dollars per month, depending on how much coverage you need and your age. Most people under fifty will spend as little as $20 per month for $250,000 in coverage. It’s important to get quotes from several companies before you commit. As you grow older, however, you may want to look into getting a policy with longer terms. This way, your family will be protected should you pass away prematurely.

Other factors to consider

A 10-year term life insurance policy will last for the shortest time, but there are other factors to consider before making your purchase. Your family’s needs are also an important factor when choosing the right length of term for you. If you have dependents and need a large amount of insurance to pay off your mortgage, a 10-year policy might be the right choice. You should compare prices from several providers before choosing.

Term life insurance rates are generally affordable, although they do vary. Smokers and older adults typically pay more. Term life insurance has no cash value, so you’ll only receive a payout if you die during the term of the policy. Furthermore, unlike permanent life insurance, term life insurance has no option to get premiums. Instead, all premiums go toward keeping the policy in force, which means you’re not building a nest egg.

Another factor to consider when buying a 10-year term life insurance policy is the cost. Renewal fees can be high, especially for those with little extra cash. This could make it difficult to get permanent coverage or a longer term policy. If you are young and healthy, a 10-year term life insurance policy can give you the coverage you need for a decade, while also ensuring that your family is taken care of while you are away.

Other factors to consider when purchasing the best 10 year term life insurance policy include your current and future financial commitments. If your family is small, you may require more coverage in ten years. In either case, a 10-year term life insurance policy can be a smart choice for financial security. When making your conclusion, evaluate how long you will need coverage and determine a budget for monthly and annual premiums. Comparing different policies will help you find the most affordable and complete option to protect your loved ones.