When you buy car insurance online, you may be tempted to choose the first website you find. Choosing the right company for your needs is essential for several reasons, from coverage amounts to credit history. But before you make your decision, take some time to do your homework. In this article, I’ll tell you about three things you should do before purchasing insurance online. Check your credit score, compare rates, and get an instant quote.

Do your homework before buying car insurance online

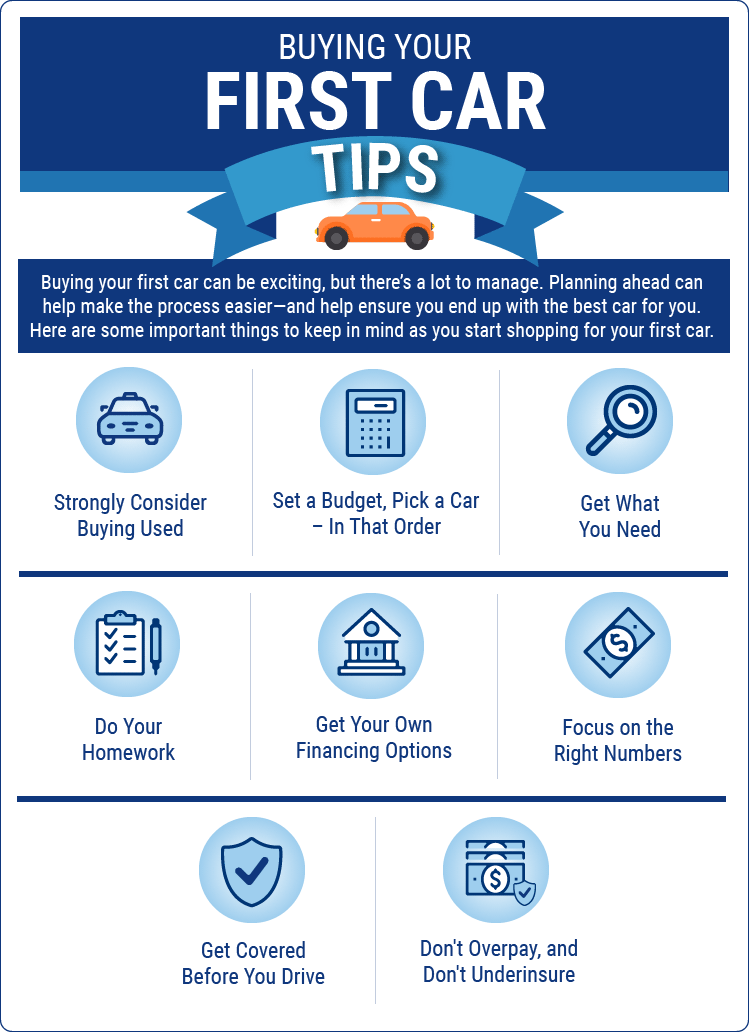

Before buying car insurance online, you should do your research. It is not always the cheapest option. While you may be tempted to go with the lowest price, you should also make sure the company is financially stable and offers quality customer service. You can check out the financial standing of companies by checking out the consumer complaint ratios or state insurance departments. You can also get more information from independent insurance agents or online consumer information sites.

Make sure you set aside enough time to complete the process. Gather the necessary information – a valid driver’s license number, vehicle registration, make and model, etc. – and compare the quotes. Once you have a list of companies to contact, call or visit their website. Remember, not all insurance companies participate in one-stop shopping sites, so you should do your research before purchasing a policy. Also, make sure to check reviews online before finalizing your policy with a company.

Before buying auto insurance, you should know how to evaluate your coverage in case of an accident. Consider how much you can afford to spend on insurance and what your state’s requirements are. Don’t forget to write down any concerns or questions you have before making your decision. Remember that most states require minimum liability coverage. So be sure to find out what the minimum coverage requirements are. Don’t forget to compare the policies of different providers and decide according to their prices.

It is essential to know your driving history and record. Many insurers use credit score information to price their policies. In addition, drivers with good credit scores tend to have lower insurance costs. So, check your credit history often. You must be completely honest and accurate in providing this information. Failure to do so could lead to policy cancellation, increased premiums, and even legal action. Do your homework before buying car insurance online.

Doing your research before buying car insurance online is critical to finding the best deal. It is important to know the discounts you’re eligible for and how much the final premium price will be. Remember that some companies offer better prices for people who do. Those who have more than one vehicle or many other insurance policies. Buying insurance online can be easy and convenient, but you should still do your research and compare quotes from different companies. You can even compare car insurance quotes online and combine the two.

How to check your credit score and report – Car Insurance

When buying car insurance online, you may be tempted to use your credit score. Your credit score affects many other financial transactions, including car insurance. Most car insurance companies use your credit score to determine your insurance premium. You should be aware of this fact before purchasing. In addition to the insurance company score, your credit report also includes information such as: What lenders need to know if you have a low credit score. So this can affect the price you pay for your policy.

It is not impossible to repair your credit history before buying car insurance online. By making regular payments, clearing your financial history, and not opening any new accounts you can improve your overall score and get the best deals. Try setting up automatic payment reminders to keep your credit rating in good shape and don’t borrow more than you need. You can also try applying for a low mileage discount. For example, if you carpool regularly, your insurance company may give you a discount for low mileage.

Your credit score is based on five factors: your payment history, your balances, your length of credit history, and the number of new lines of debt. In addition to these factors, your credit score is influenced by how long you have had accounts. If you have been using your credit for more than five years, your score will be lower than someone with a shorter history. If you have a high credit score, however, your credit score may be higher if you are more responsible for the credit lines you already have.

Although it’s possible to purchase cheap car insurance without checking your credit, it is crucial to remember that your credit score will have an impact on your overall insurance rate. It is not possible to get the best rate based only on your driving record, so you’ll need to compare quotes from different insurance companies before making a final decision. Once you’ve narrowed down your search, you’ll be well on your way to finding a great deal on your insurance.

Get an instant quote

It is best to get an instant quote when buying car insurance online. This can help you compare quotes from different companies and choose the best one for your needs. It can save you time, too. By gathering all of the information you need in advance, you can find the most affordable policy in no time. To make sure you’re getting the most affordable policy, follow the tips listed below:

Once you complete the information required by the insurer, the quote will be available to you within seconds. An instant auto insurance quote shows a breakdown of coverage, deductibles, policy limits, and more. It will also show you if you qualify for any discounts. It is important to read the fine print on coverage before purchasing. Taking the time to read the fine print will ensure that your insurance policy covers your needs.

Aside from personal information, an instant auto insurance quote will also ask for your address, driver’s license number, and age. This information helps determine the type of risks your vehicle faces. You should also include your driving history and credit score. An accurate driving history will help the insurer determine the type of insurance you need. Aside from that, an instant quote will also help you get a comparison of different companies.

You can also contact various companies for more information to get an instant auto insurance quote. Comparison websites will allow you to contact as many insurance companies as you need while others will let you complete the process yourself. Many of these sites will ask for your contact information and guide you through the process. During the process, you can select the insurance policy you want to buy. If you want more coverage, you can opt for additional add-ons.

Once you’ve chosen the company that best suits your needs, make sure you have all the necessary information handy. Some companies allow you to buy the policy the same day you receive it. In some cases, the policy may even take effect the day you buy it! If you are short on time. So a comparison website can give you a better idea of what to expect. You can choose the best insurance policy and get a better deal.

Compare rates

When you can compare car insurance rates offline. After that, it is recommended to use an online service. Not only will you get many more quotes, but you’ll also be able to explore your options and bag discounts. Using an online comparison service is also easy – all you need is a computer and a stable internet connection. In just a few minutes you can get quotes from dozens of companies and compare them side by side. You can even choose between multiple policies and business liability insurance.

When comparing car insurance rates online, it’s helpful to get as many quotes as possible for the same level of coverage. While it’s important to compare prices for the same coverage, it’s also a good idea to get quotes from different companies that offer the same additional services and discounts. You can collect as many quotes as you want – about five to ten – by filling out the quote form for each company. Be sure to include all important insurance details, such as deductibles. Also, compare the prices of each line item.

To compare auto insurance rates, start by determining how much coverage you need. Rates can vary dramatically based on personal factors, such as your age, gender, driving record, and location. There’s also a risk rating factor for your area. Bad credit scores and a poor driving record can increase your premiums considerably. But don’t worry – getting several quotes won’t hurt your credit score. It may help your score!

You can also compare your coverage by zip code. Most insurers will calculate their car insurance rates based on a zip code. You can get a better deal in a rural area than a city dweller. If you live in an area where the number of floods is higher than average, it’s better to opt for a higher coverage level. If you live in an area where the rate is higher than average, you’ll want to get a higher level of coverage for your car.