There are many different types of coverage available for Nationwide Mobile Home Insurance. Interested in getting additional coverage for your home? Some places are especially susceptible to extreme weather disasters, like hurricanes. You may also want to get flood insurance if you live in a hurricane-prone area. Another coverage you may want to add is earthquake coverage. You might also want to include scheduled personal property coverage and identity theft protection. Some policies even provide discounts if you sign up for multiple coverages.

Foremost offers mobile home insurance

Foremost offers nationwide mobile home insurance coverage with a good consumer complaint index. Although it does not offer instant online quotes, it does offer a form to enter details about your mobile home and receive a quote within 24 hours. It offers endorsements for high-risk areas as well. And because they are one of the largest insurers in the country, you can rest assured that the company will provide the coverage you need.

If you’re looking for mobile home insurance, keep in mind that coverage amounts vary depending on the location, age, and type of park. In family parks, for example, you might get a policy with a different limit than one for a newer mobile home. In adult parks, the liability limit can be $300,000. While the limit for older mobile home insurance outside the park may be $50,000. Insurers base policy limits on the likelihood of losses in each environment.

Foremost has partnered with big-name insurance companies for its foremost mobile home insurance coverage. They are backed by Farmers Insurance. Which provides the best financial backing. Another excellent manufacturer of manufactured home insurance is American Family, which offers a transit endorsement for mobile homes. If your mobile home is newer than four years. So you may be eligible for a discounted premium. If you choose Foremost. So you can enjoy the flexibility of choosing your coverage to suit your lifestyle.

Consumers can choose from a variety of companies when searching for coverage. The best mobile home insurance companies tend to have the highest rating from the Better Business Bureau. Insurance companies with high ratings are generally reliable and trustworthy. They also adhere to customer service standards. and is committed to maintaining a good reputation. So, when searching for home insurance, keep your budget and your mobile home insurance coverage needs in mind and choose Foremost. You’ll be glad you did!

Mobile home insurance can help protect the structure of your mobile home as well as the contents within. You may want to choose replacement cost coverage if you own expensive items. In the event of a fire, you can have your belongings replaced with new ones. You can even choose coverage for the land that your mobile home is on. If you’re concerned about liability, check with your insurance agent about what limits you need to cover the mobile home.

American Modern offers manufactured home insurance

American Modern offers manufactured home insurance nationwide. This type of policy covers several types of properties. The dwelling coverage pays for repairs or replacement after a covered peril. Personal property coverage covers your belongings and may pay for the full cost of an item, minus depreciation, or it may cover the full replacement value of a similar new model. Foremost offers earthquake and professional liability coverage as well as transportation of your mobile home between different locations.

In the event of a disaster, your policy will reimburse you for the actual cash value of your manufactured home, not the depreciated value. However, American Modern does not offer hurricane protection or named peril protection. But, if you live in Florida, you may want to consider this insurance. It also offers comprehensive coverage and great customer service. American Modern Golf Cart also offers insurance for rental homes and boats.

Insurify is another tool for comparing insurance quotes. The site compares multiple companies and takes the guesswork out of comparing premiums. Insurify’s website helps find affordable home insurance. Even though manufactured homes are considered high risk for insurance companies. Policies provide comprehensive coverage. And sometimes certain manufactured home coverage is included. We have listed the features of each policy to make the process easier.

In addition to the physical property coverage, the company also offers personal liability and personal property insurance for mobile homes. The former is designed to cover your mobile home and personal belongings in case of a disaster. Personal property coverage, meanwhile, doesn’t cover vehicles, while liability coverage covers medical expenses. Both are important aspects of mobile home insurance, and American Modern offers manufactured home insurance nationwide. This coverage is meant to meet the needs of mobile homeowners. Designed to keep you and your family safe.

The cost of insurance for mobile homes can vary from a few hundred dollars to over $1,000 per year. It depends on location, age, and value. Also, the deductible, coverage limits, and policy type all affect premiums. Many people are worried that mobile homes depreciate, but the opposite is true. A well-maintained mobile home may appreciate year after year. Its classic beauty can also increase its value.

State Farm offers mobile home insurance

State Farm offers comprehensive mobile home insurance that protects against direct physical loss to the dwelling. The policy also covers your personal property from named perils. Because mobile homes are susceptible to damage from wind, theft, and vandalism, they are more expensive to insure. Fortunately, State Farm offers coverage for older mobile homes, which can be expensive to insure. Read on to learn more about state farm mobile home insurance.

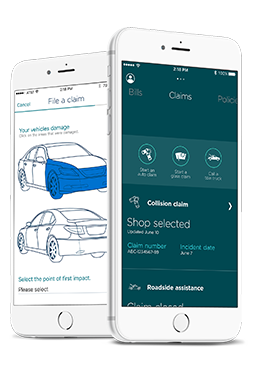

Another benefit of State Farm is its online presence. Their website has individual sections for each service offered, including online quote requests, account login, bill-pay, and claims filing. State Farm also has a mobile home insurance policy search tool on its site. In addition to this, you can use their online agent locator to find a local agent. While you may not need to file a claim yourself, you will want to know that you’re covered in case of an emergency.

While State Farm didn’t receive the highest rating from A.M. Best, its financial stability is still strong. The company’s Aa1 rating indicates that it is stable enough to pay policy claims. And since the company is so large, it has the financial strength to adapt to any calamities and continue to grow. So, if you’re looking for nationwide mobile home insurance, consider contacting State Farm today!

When comparing quotes from different insurers, you should consider how much coverage you need and what additional features you’d like to add. Some areas are prone to certain weather disasters, so you’ll want to consider purchasing flood insurance if you live in a hurricane-prone area. Other coverage options to consider include earthquakes and scheduled personal property. Depending on the age of your mobile home you may also want to include identity theft protection.

State Farm is not the only company that provides mobile home insurance. You can also get coverage for your RV through Allstate. It has a loss ratio of 60 percent and also offers several specialized coverage options for mobile homes. For example, they offer personal property endorsements for higher-value items. They also offer a discount for multi-policy coverage, the original owner discount, and the security system discount. The company has an A+ rating with the Better Business Bureau.

Allstate offers discounts on mobile home insurance

Allstate offers discounts on mobile home insurance for several reasons, including the original title holder, multi-policy discounts, and remaining claims-free. Discounts can help consumers save money on their coverage and are worth considering for homeowners. These discounts can include discounts for putting in extra security devices, fire sprinklers, and impact-resistant roofs. The best way to find the right discount for your situation is to ask your local Allstate agent for more information.

One way to get the lowest possible rate is to bundle multiple insurance policies with one company. Getting quotes from several companies is essential to comparing and contrasting costs and coverage. It is recommended to get at least three quotes before deciding on a policy. It’s also a good idea to get these same-day quotes, as rates and terms can change at any time. You can also use a comparison website to find the best possible rate.

Discounts for mobile home insurance can vary widely between companies, so it’s best to shop around. Allstate offers several discounts on mobile home insurance, depending on the size and location of the property. Also offers discounts if you’re the original owner, use a security device, or sign up for automatic payments. For example, if you have a child in college, Allstate offers a discount for this as well.

Allstate is not accredited by the Better Business Bureau and has an A+ rating. The Better Business Bureau doesn’t sort reviews based on insurance type so we couldn’t find any specific mobile home insurance reviews on Allstate’s website. However, our research showed that Allstate’s premiums are lower than those of competitors. A comparison of all insurance companies is worth considering. You can compare rates and discounts by checking the ratings of various companies.

American Family is another great mobile home insurance provider. It offers standard mobile home coverage along with additional options, such as water damage and siding replacement. The company guarantees that any repairs use matching siding. But if you want more protection you can opt for water damage coverage. A unique Allstate mobile home insurance discount is reserved for original titleholders. You can also find good resources on the Allstate website.