An adequately funded irrevocable life insurance trust holds income-producing assets to cover the premiums on the grantor’s life insurance policy. The transfer of assets is generally not done with one lump sum. Gift taxes would apply to the transferred assets, just as they would to the assets left in the insured grantor’s estate. However, the insured grantor must include the income earned by the assets on their income tax return.

irrevocable life insurance trust cost

Setting up an irrevocable life insurance trust can cost several thousand dollars. A lawyer specialises in estate planning and can help you decide if you need to set up such a trust. Once you have determined that you want to create an ILIT, you will need to hire an estate attorney to draft the document. There are many advantages to creating an ILIT, but the cost is worth it. Once your beneficiary has the benefits of a trust, you can leave them more money than you would otherwise.

One of the most significant advantages of setting up an irrevocable life insurance trust (ILIT) is the enhanced asset protection it offers for your family. By transferring ownership of your life insurance policy to the trust, you can significantly reduce the taxable value of your estate while safeguarding the policy from creditors. A carefully drafted and well-managed ILIT also gives beneficiaries the flexibility to receive payments on a schedule that suits their needs. This feature is especially valuable for beneficiaries who rely on government benefits, ensuring they maintain eligibility while still accessing the trust’s funds.

Setting up an irrevocable life insurance trust is generally easy and affordable. However, it’s essential to seek legal advice before finalising the document. Costs can vary based on the trust’s complexity, the number of policies involved, and any estate tax concerns. If you’re unfamiliar with estate planning, using a financial advisor is recommended. Additionally, SmartAsset’s free estate planning guide can be a valuable resource.

Another advantage of an irrevocable life insurance trust is that you can name any life insurance trust beneficiary you choose. There are no legal barriers to setting up this type of trust, giving you complete control over who receives the benefits. However, if the donor dies within three years of creating the trust, the life insurance policy may still be considered a taxable asset. For this reason, irrevocable life insurance trusts remain the best option for many families looking to protect their assets and provide for their beneficiaries.

Another advantage of an ILIT is that it avoids estate taxes by avoiding the need to sell high-value assets. You can also use the annual gift tax exclusion — $15,000 per beneficiary in 2019 — to pay life insurance premiums. Although today’s estate tax laws make an ILIT less beneficial than in the past, it’s still a strategy worth considering.

Setting up a trust is a great way to protect your assets from the claims of creditors after your death. A good trust will protect your assets from creditors and the wrath of family members. The cost of setting up a trust is typically low, but it does require a significant amount of money. You should consider these costs before you start. It’s worth it to take the time to set up such a trust.

Estate tax savings

When setting up an estate plan, one option to reduce estate taxes is an irrevocable life insurance trust. An irrevocable life insurance trust will keep the value of a life insurance policy outside the estate when the grantor passes away. This is especially useful for people with large estates. In addition, a trust will enable the grantor to control the payout to beneficiaries. This may be a good option if you are concerned about your young heirs spending their inheritance on their own needs.

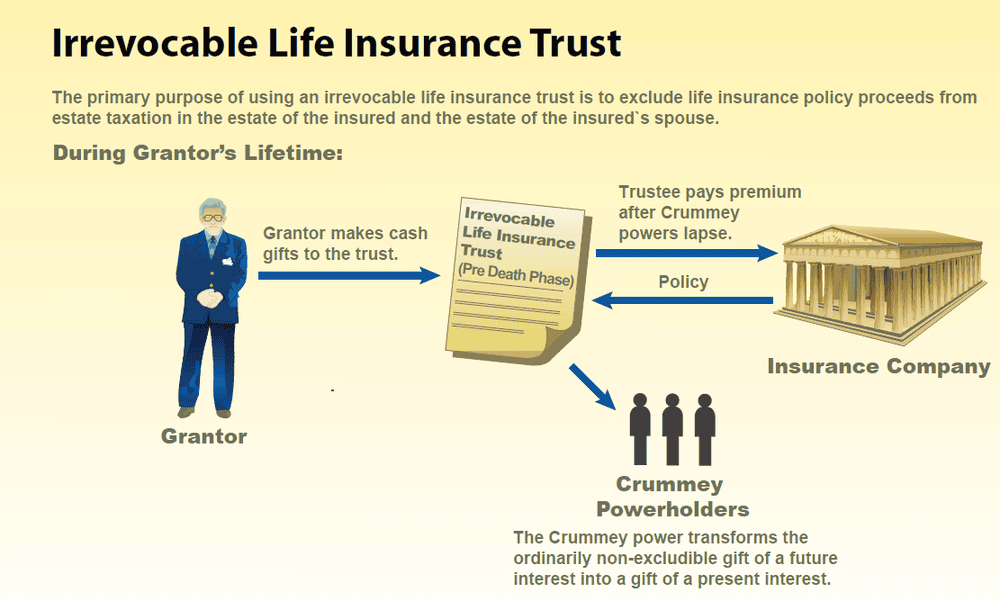

In addition to minimising estate taxes, irrevocable trusts will protect the assets of your beneficiaries from claims made by creditors. Since an irrevocable life insurance trust does not change its terms, the proceeds are not subject to estate tax. This means that your beneficiaries will have access to the assets in the trust until you change the terms. If you want to make changes to the terms of your irrevocable trust, you must send a “Crummey notice” to your beneficiaries. The Crummey notice provides beneficiaries with a certain amount of time to withdraw funds.

Another option is to purchase a life insurance policy through an ILIT. Although this option is more complex, ILITs are effective for individuals with large estates. For example, if a client owns a $5 million life insurance policy, they can transfer this policy to the ILIT. This arrangement lets the couple defer estate tax until the surviving spouse passes away, helping them avoid paying estate taxes altogether.

In some cases, an irrevocable life insurance trust may cause a gift tax problem. This is because a transfer to a trust does not qualify for the $15,000 yearly exclusion for gifts. The recipient must have a present interest in the money that is transferred. A promise to give money in the future doesn’t count as a present interest, so most trust gifts aren’t tax-deductible. However, a ‘Crummey’ power lets beneficiaries withdraw funds from the trust for up to 30 days after the transfer.

However, the estate tax exemption for individuals and couples is also subject to change. It currently stands at $11.7 million per person, but it could fall to half within a few years. The size of the policy can reduce the amount of money exempted from estate taxes sooner. A substantial life insurance policy can make a massive difference in the size of the estate. If you don’t have enough money to pay the estate tax, an irrevocable life insurance trust is a good option.

Control over asset management and distribution

Controlling the asset management and distribution of an irrevocable life insurance trust can be an excellent option. This type of trust lets you leave a portion of your estate to your beneficiaries. Depending on the trust’s terms, they can receive their benefits in installments or upon reaching a certain age. However, it should be noted that the ILIT is very particular.

The grantor of an irrevocable life insurance trust is the person who provides funds or assets to the trust. There can be more than one grantor, including married couples. In some instances, both grantors may be named on insurance policies in the trust. In a common example, a married couple holds a second-to-die permanent life insurance policy within an ILIT, with each spouse contributing funds to the trust.

An irrevocable life insurance trust is another option for transferring assets. Choosing this option is ideal for those who wish to minimise their estate taxes. Tax authorities consider the death benefit from an irrevocable life insurance policy an asset. Because of this, using an irrevocable life insurance trust can significantly reduce estate taxes. By selecting this option, you can be sure that your business will continue to operate after your death.

Control over asset management and distribution in an irrevocable life insurance trust is essential for transferring a life insurance policy to beneficiaries. Transferring ownership can reduce the taxable value of your estate. It can also protect the policy from creditors. Additionally, an irrevocable trust allows beneficiaries to receive payments at a time they choose. This is especially helpful for those receiving government benefits.

Control over the asset management and distribution of an irrevocable life insurance trust is a benefit that many individuals seek. The death benefits that a grantor protects will not be subject to creditors. Also, many people use a trust as an estate tax strategy. Placing life insurance in an ILIT can help reduce the size of your estate and limit gift tax consequences. With guidance from a financial advisor, an irrevocable life insurance trust can be a valuable tool for estate planning.

An irrevocable life insurance trust may offer more tax benefits than a revocable one. However, these benefits only apply after the grantor’s death or once the trust term ends. During this time, the trustees control the trust’s distribution. They must also provide income to beneficiaries, which can cause problems for those unhappy with the arrangement.