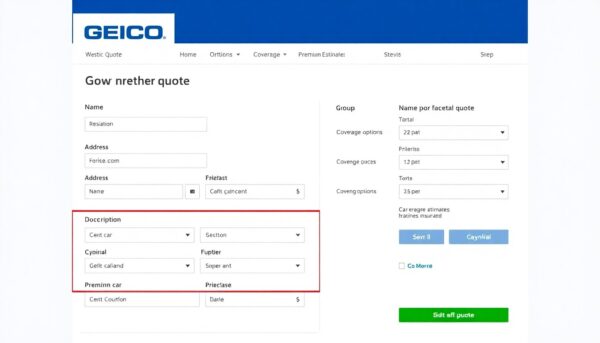

Getting a Geico quote online is a convenient way to compare rates. You will be asked to provide personal information, including your date of birth and address. You will also be asked about the make and model of your car, as car insurance companies base their rates on the characteristics of your vehicle. After entering this information, you can continue requesting a Geico quote. You may also want to enroll in a telematics program or cancel your current policy to get a more accurate quote.

Get a free geico car insurance quote online

Geico offers a simple and affordable auto insurance policy with several add-ons. Like significant car insurance providers, the company provides liability policies, property damage coverage, bodily injury coverage, and more. Geico also has an industry-leading mobile app. Geico also offers a mobile app that allows policyholders to manage their accounts and policy information. Moreover, the company discounts drivers who bundle their policies with others.

GEICO is available for all types of vehicles and drivers. The DriveEasy telematics program will analyze your driving habits and may lower your rates. You can also avoid installment charges if you pay your premiums in full. For an easy and convenient experience, Geico offers a mobile app. This app lets you manage your policy, pay bills, file claims, and chat with a virtual assistant.

New York residents can find affordable auto insurance rates with GEICO. New York City has over eight million residents and is known for its bustling metropolis life. GEICO offers cheap car insurance in all five boroughs. As a leading car insurance provider, the company proudly provides competitive car insurance rates for New Yorkers. Just learn about GEICO’s different discounts to save money on your auto insurance.

Geico is a well-known auto insurance provider that consistently earns high marks from professional rating agencies and has few customer complaints despite its size. J.D. Power rated Geico as the sixth-best auto insurance company, with a second-best complaint index rating. The company’s complaint index rating is below the national average. GEICO’s complaints primarily relate to claims handling.

Compare rates

Many factors can influence the premium on a GEICO policy. Your location, for example, will significantly impact the price you pay. Drivers in a small town will pay less than those in a large city like Miami. In addition to your location, other factors can impact your premium, including your credit score, type of car, personal driving record, the number of vehicles you insure, and more.

One thing to consider when comparing rates on Geico is their BBB rating. While you shouldn’t go with the insurer with the highest BBB rating, Geico has a good reputation for resolving complaints promptly. It also has muscular financial strength. It is also worth reading online reviews of each company to see whether customers have had a positive or negative experience with their insurance company.

Geico has reasonable teen driver insurance rates. In addition to offering competitive rates, Geico offers many add-ons to help protect young drivers. This includes liability insurance, collision coverage, comprehensive coverage, and more. Those who are students may also be interested in Geico’s student discount, which is 15%. Geico also offers discounts for combining several policies, including car insurance and other coverage types.

In the U.S. insurance shopping study, Geico edged out Liberty Mutual. Customers rated insurers on five-point scales based on price, policy offerings, experience with local agents, and website quality. Geico also rated the quality of its call center and overall website as higher. Those who prefer Geico over Liberty Mutual for their customer service have a better experience with this insurer.

Use online comparison tools or visit insurance company websites to save time. Additionally, explore GEICO quote online reviews to learn from customer experiences and assess the company’s credibility.

Cancel your policy online

Cancelling your Geico policy online is as easy as filling out an application. However, you should review the cancellation terms before you do so, as they may differ slightly from state to state. For example, if you’re canceling your coverage in the middle of a term, you might be charged a short rate. This type of policy increases your premiums for the remainder of the term by a certain percentage and subtracts pro-rated fees from the higher amount.

Contact Geico customer service if you have changed your address, marital status, or other information since your last policy. They can pull up your account information and confirm the policy’s expiration date. If you’ve canceled your policy recently, have a new car insurance policy ready for when your old one expires. This way, you won’t risk losing coverage.

You can also cancel your GEICO policy by mail or phone. If you choose to cancel by mail, submitting your cancellation letter 30 days in advance is essential. This will give GEICO time to process your cancellation request. You can even call to cancel your policy via phone, though you should be firm in your decision. Make sure to specify the date you want to cancel your policy, and GEICO will get back to you as soon as possible.

Canceling your GEICO policy online is a simple process if you don’t want to deal with phone calls. Geico’s online account center makes adding new vehicles, changing insurance types, and even dropping coverage options easy. However, keeping your confirmation letter is essential if you need to call Geico to cancel your policy. You should be able to receive your refund check within a few weeks.

While exploring new options, consider getting a GEICO insurance quote online to compare rates and coverage, ensuring you make the best decision for your insurance needs.

Get a telematics program

Geico has been quietly rolling out its telematics program. The Geico DriveEasy app tracks driving habits such as speeding, active use of handheld phones, and more. Users earn points when they meet specific criteria. The program is free to use and requires no installation in the vehicle. Drivers can compare their scores with others, which can lead to discounts. However, drivers should make sure they are practicing safe driving habits to earn the highest scores.

Geico’s DriveEasy telematics program analyzes driving habits and provides discounts based on safety. While it does not directly reduce rates for safe drivers, it is still a good way to get deals on car insurance. Some drivers are uncomfortable with their insurers monitoring their driving habits. To get started with Geico’s telematics program, drivers should download the program’s mobile application.

DriveEasy is another usage-based insurance program that uses GPS and smartphone sensors to monitor driving habits. In theory, you will receive discounts if you drive safely and avoid distractions. The DriveEasy program penalizes drivers for being distracted while driving, but hands-free calls are not penalized. Geico is one of many car insurance companies nationwide that offer usage-based car insurance.

GEICO uses your driving score to determine premiums and discounts. It evaluates customer driving scores at renewal time. Most drivers continue to receive deals, but the riskier drivers may see their premiums increase. If you don’t like the idea of telematics, you can opt-out by removing yourself or your passengers from the program. Telematics is a great way to lower your insurance rates if you have the budget.

Get a discount for safe driving

Geico has some excellent options if you’re looking for cheap car insurance. Its driving app tracks your driving habits and rewards you with lower premiums. Safe drivers can also get a discount by going five years without an accident. Safe drivers enrolled in this program can save up to 26 percent on their premiums. Download the DriveEasy app and install it on your phone to qualify for this program. The app will automatically detect when you’re driving and report your information to GEICO.

There are other ways to qualify for a discount. Geico partners with professional associations, government organizations, and corporations. They have discounts for government employees and senior citizens. Young drivers can qualify for discounts, and so can students. Discounts for seat belt use are also available. Those who wear seat belts while driving can save up to 15% on their premiums. And if you’re a good student, you can save up to 12% or more by taking a defensive driving course.

Defensive driving discounts vary from state to state. However, they all are based on safe driving practices. Generally, after an accident, your accident-free discount is gone. After you’ve finished a defensive driving course, your discount will be valid for five years. You can also qualify for a good driver discount if you’ve had no accidents and have never received a moving violation.

If you’re looking for car insurance, you’ll find that Geico has some great options. The company’s website allows you to get an online quote for several types of coverage, including car insurance. You can also choose payment options and find the cheapest gas station near your home. Getting the best insurance saves time, money, and hassle. Geico is an excellent choice for many people, so don’t hesitate to get a quote today.

GEICO auto insurance quote today to see how safe driving can lower your premium while ensuring reliable coverage.