If you are looking for a low-cost auto insurance plan, you can check Root Car Insurance Quote. This company uses telematics to calculate your rates. It’s a company that doesn’t cover high-risk drivers but offers free quotes and uses telematics to monitor driving behavior. Here are some things to consider before signing up with Root. Hopefully, this review has helped you decide if this company is right for you.

Root car insurance is a low-risk company

Whether or not root car insurance is a low-risk insurance company depends on your circumstances and driving record. This company offers insurance quotes only to good drivers and has lower rates than most traditional insurance companies. However, root has some disadvantages. First of all, it does not offer coverage for classic cars and collector cars, nor does it offer GAP coverage. After that, the company operates in only 29 states.

Although Root doesn’t have a financial rating, the company isn’t flying under the radar. In 2019, Standard & Poor’s reported on route insurance. The company’s premium increased from $4 million in 2017 to $106.4 million in 2018. This made them the third-fastest-growing auto insurer, but their losses doubled from $15.6 million the year before.

Another negative of Root is that it doesn’t offer personalized service or 24/7 customer support. Company representatives are not available by telephone. Still, it’s a good choice for drivers who prefer not to bother with paperwork or personal service. Company quotes are based on your driving habits and credit score.

While many companies offer rental car reimbursement, Root’s rental car insurance is particularly attractive. It offers coverage for rental cars and also reimburses you for the cost of Uber or Lyft rides. Additionally, Route provides rental car reimbursement coverage for three incidents per vehicle within the six-month policy term. The company also offers up to $100 in reimbursements for rental cars.

However, the company has a mixed online presence. It has a 4.5-star rating on Trustpilot and a one-star rating from the BBB. More than 50 consumers have filed complaints with the National Association of Insurance Commissioners about the company’s slow response times.

It offers free quotes

If you are looking for car insurance, you may be wondering how to get a free quote from Root. The company is growing rapidly. Not every state offers it. After you register and log into the Root app, the company will calculate your premium based on your driving habits.

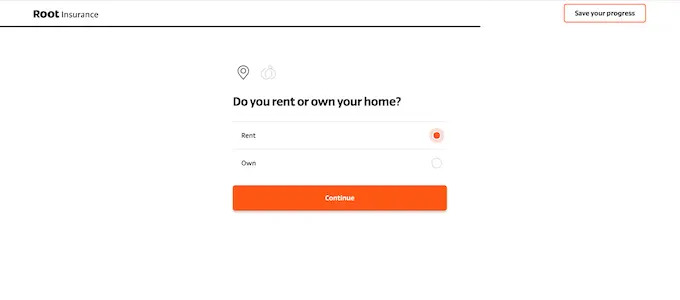

To receive your free quote, you need to complete a few questions on the Root website. Among other things, you need to enter your name, date of birth, address, marital status, and the type of car you want to insure. Once you complete these steps, you will receive your quote. If you are satisfied with the results, you can pay by credit card or by root application. You will also receive a separate insurance card by mail.

Once you receive your quote, you can purchase your policy and add additional drivers to it through the app. It also has an app that tracks your driving habits. Root also lets you customize your coverage, add other drivers to your policy, and cancel your current insurance policy. By completing this process, you can easily save money and avoid unnecessary expenses. And with Route’s free quote, you’ll be on your way to getting the perfect car insurance policy!

The Root Car Insurance site is simple and easy to navigate. You can compare rates and policies on the same website. This way, you won’t have to worry about getting into an auto accident because the insurance company will know your history. And you’ll have an instant quote, so you’ll know the cheapest rate, too! If you are a good driver and have a clean driving history, Root may be the right choice. However, if you are a bad driver or a new driver, you may be able to find better rates elsewhere.

It uses telematics to calculate rates

Telematics is a technology used to track the location and performance of vehicles. Telematics data can help companies accurately estimate accident losses and prevent fraud. Companies can also help refine and differentiate UBI products. Telematics safety benefits include reducing accident costs, improving response times, monitoring driver safety, and detecting stolen vehicles. Fleets are also helpful for companies because they can determine the most efficient routes and save money on gas.

To determine rates, Root uses telematics to track driving habits. This data is constantly updated, making it possible for drivers to manage their policies through a single application. Customers can pay in monthly installments or via credit card or Apple Pay. They may also send a separate insurance card. Root is the best choice for drivers who only drive a small amount and have good driving habits.

Telematics also helps insurance companies in setting rates. Telematics applications collect data about your driving behavior using devices such as global navigation systems or smartphones. These devices measure your speed, location, and more. This data can help car insurance companies provide you with an accurate quote based on your driving habits. Some insurance companies also use telematics to track driver behavior and offer discounts. The key to getting low car insurance rates is knowing your driving habits.

While it offers transparency and impressive efficiency, root car insurance also comes with some drawbacks. It is not the most affordable car insurance company, and it does not provide roadside assistance in California. The company is only available in certain areas and has more restrictions on its coverage than other car insurance companies. And despite its transparency and impressive efficiency, Root Car Insurance can deny most other claims.

It does not cover high-risk drivers

If you are a high-risk driver, you may find that a root car insurance quote is not the best option for you. Most insurance companies rely heavily on demographic data and credit reports to determine whether a driver is a good risk. But this is not the case with this route. The company looks at how you drive during your test drive as well as your credit report to determine your premium.

The company takes several general demographics into account when determining your rate, but it places more emphasis on driving habits than age or credit score. Instead, the root quote will be based on your driving habits, your location, and previous insurance history. You are also considered a high-risk driver if you have a history of driving violations or accidents. However, the best way to compare root quotes is to visit their website and see if they have a policy that suits your needs.

While the Better Business Bureau (BBB) gives it an A+ rating, complaints about the route have reached significant proportions. As a result, route complaints are much higher than the national average. Many have complained about delays in processing claims, and have been dropped from the scheme after the first monitoring period.

Root offers low-cost coverage for high-risk drivers. However, one major drawback of this company is that it does not offer specialist coverage for high-risk drivers. The company has pledged to remove credit scores from its pricing model by 2025. The company also has a reputation for denying coverage to high-risk drivers and has a high number of complaints.

Positive Root Insurance Google reviews, which is frequently commended for its creative pricing strategy based on driving behavior.