Auto insurance rates depend on many factors, including your gender, age, driving record, and location. Your credit score also plays a big role. The worse your driving record, the higher your rates. You can’t hurt your credit rating by getting several quotes and comparing car insurance to get the best rate.

Rates vary by state

Auto V rates vary from state to state. That country may be different. And there is even more variation in neighboring states. For example, Michigan, the location of the United States automobile industry, studies and has a higher rate than Ohio. Both of which are neighboring states. Many are lower than the rates in Ohio. This is due to different children. Some of which are within your control.

Comparing car insurance rates varies based on many factors, including neighborhood location and demographics. Some states require more coverage than others. States with high crime rates or dense metropolitan areas require higher levels of coverage. Race is also a factor, but it is a relatively small difference. In Arkansas, women pay only 2% more than men on average. Women pay 7 percent more in Georgia and Louisiana.

Credit score affects rates

If you have a good credit score. So you can enjoy significantly lower insurance rates. No matter what type of coverage you need, your credit score will determine the amount you pay each year. If you have poor credit, however, you will almost certainly pay double what other drivers pay each year. If you’re wondering what that means for your car insurance rates. So keep reading.

A credit score isn’t the only thing that determines insurance premiums. Your driving history also plays a major role. Driving history will increase your premium. Poor credit can also signal irresponsible behavior. Even if your score isn’t completely bad, it’s not a big deal.

In a recent study by the Federal Trade Commission and the McCombs School of Business at the University of Texas at Austin, insurance companies cherry-pick 30 of 130 elements in your report to determine your risk of filing a claim. If you have a low credit score, you may find yourself paying too much for insurance. There is no problem in claiming.

If your credit score improves, your current insurance company will lower your rates. If your score improves, your car insurance premiums will also decrease. Your credit score has improved. So you will qualify for cheaper insurance rates than people with good credit.

Credit score affects car insurance premiums in 49 states. Car insurance companies in Massachusetts, Hawaii, and California do not need to consider your credit score. While many other states, such as Michigan and Massachusetts, do not require comparing car insurance companies to consider your credit history.

Online quote tools help you find the best rate

If you choose to do research, you can benefit from their advice and recommendations on the best policies and rates. You can also get these agents from yourself. Keep in mind that using an agent takes longer. Officers in their respective positions can help you if you need help. Browsers can make it more efficient for you, but can also take longer to view.

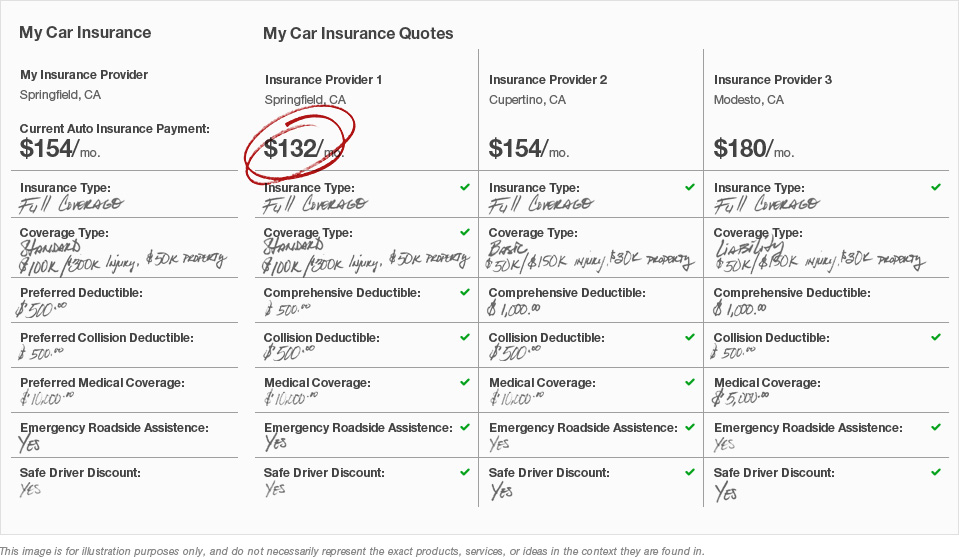

To use the online quote tool, you need to enter your zip code and select the type of coverage you want. After that, you will be given quotes from eight different insurance companies, with each company showing their prices including discounts and deductibles. Once you’ve narrowed down the list of companies, you can choose to buy a plan directly from Insurify. You can secure coverage in two minutes.

While many leading insurance comparison sites are similar in terms of services and results. They may provide inaccurate information or only a few quotes. For this reason, you should avoid lead-generation sites and try to stick to reputable, well-known companies. A trusted insurance comparison site will not sell your information to insurance companies. It’s also best to avoid lead-generation sites that promise multiple quotes but only sell your information to their advertising partners. Which are usually insurance companies.

You can use the multi-quote insurance comparison tool to compare car insurance policy rates. It allows choosing. This is especially useful if you drive on busy streets or park your car in a garage. If you are not sure what type of coverage you need. Then an insurance agent can help you. If you can’t find the best price online, you can always use an independent insurance agent.