You have decided to get your teenager a car. How do you find Car Insurance For Teens that is affordable and provides adequate coverage? If you’re not sure, read on to find out what you should look for in an insurance policy. Don’t forget to compare rates between companies.

Shared plan

Teenagers are a relatively new category of drivers. This new group of drivers is more expensive. There are ways to lower the cost of your teen’s insurance. While you should check multiple quotes, it’s also important to understand the different types of coverage and discounts available.

Against what can be different insurance to get the best deal right. Many offer different discounts for different insurance grades or certain policies. By combining these discounts, individuals can save up to 35% on the premium. The pros and cons should also be discussed with your preferences. Costs for your purchase can be negotiated. Have a plan before signing up for new car insurance.

Car insurance for teens can be a significant financial consideration for families.

Travelers

So you can add it to your car insurance policy. If you don’t want to take out a separate policy, you can ask your insurance provider if your teen can be added to the parent’s policy. There are a few options you can explore before purchasing a policy for your teen. In addition to adding your child to your policy, you can also tell your insurance provider that you do not want coverage for your teen. By adding your teenager to your policy, you will avoid the hassle of filing a claim. On the other hand, a named exclusion means that the driver is not covered in any accident with you. Not all companies or states allow you to add your teen as an exclusion.

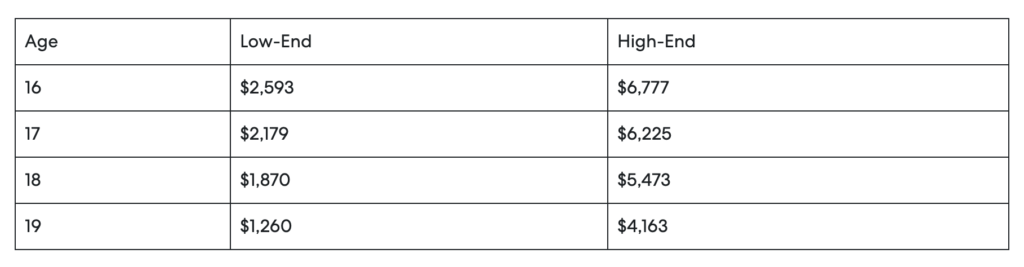

When you compare car insurance quotes for teenagers, you will find that their rates vary significantly. You can expect to pay anywhere from $1,865 to $6,237 per year for insurance for two parents of sixteen. Compared to an individual policy, adding your teen to your existing policy will save you $1690 per year. If you’re worried about this, remember that a separate policy is still half the price of your teen’s car insurance policy, despite the lower rate.

Progressive

Progressive offers many discounts on individual policies and family policies for both active drivers. This discount includes “good student” and “good grade” discounts. Which varies from state to state. Typically, a full-time student who carries a “B” average of 23 years or less is for this relaxation. Areas where they grow their ownership may offer additional discounts on V policies. For more information on Watch Teen discounts offered by Progressive, read on.

A snapshot program, called progressive usage-based insurance. It allows policyholders to pay their premiums based on how many miles they drive and how often they use their vehicles. According to a JD Power study, progressive consumers save an average of $146 per year. If your teen can’t afford the premium, you can make full payments every six months instead. Pay-in-full discounts usually last for six months. Teen drivers typically drive less than the average adult. So using a snapshot device will help them save money.

Mercury

If you’re shopping for a teenager’s auto insurance, consider Mercury. Teenagers are more likely to be involved in accidents than older drivers. Their premium rates reflect that. Teenagers pay an average of $2,554 per year, compared to $2,228 for older drivers. If you have at least one fatal accident on your driving record, your premium rate may be higher than with a different insurance company.

The company also offers special coverage for families with teenagers. Teen car insurance from Mercury includes coverage for rental cars if your teen is in an accident. Teens can save money on their car insurance when they follow a few tips from Mercury Insurance. Parents who pay attention to their teen’s safety rating can get a lower policy price.

Mercury insurance has many advantages. They are available in most states, and they offer various discounts. They have lower customer satisfaction ratings than some other car insurance companies. For this reason, parents may want to find another auto insurance company. Mercury Insurance has a JD Low rating by Power, which ranks auto insurance companies on a five-star system. This is due to the high number of complaints and low customer satisfaction ratings.

USAA

Check if you graduate from high school or college. So consider USAA Car Insurance for growth. They mean ask questions drivers come as a party. Readiness of experience relates to insurance and claims in Bij. However, the company offers a student discount. The average woman on policy premium is around 8% in the UK. Vargo students can also take advantage of other student discounts, including good distance. The best way to get the best deal on auto insurance for Sikhs is to shop around and find one that works best for your family.

Tin Driver is based on the average annual cost for every three drivers and one vehicle. It shows the difference in premium before and after adding a teenager to the policy. Because it will increase if the teenager drives a sports car, motorcycle, or hybrid. For parents, the young driver rate also depends on the cost of the vehicle and the type of driver.

Auto-Owners

If you have a teenage driver in your family, you may want to consider adding your teen to your auto insurance policy. If your teen driver receives multiple tickets or accidents. Then your insurer may drop your coverage. While this will keep your current insurer happy, it will also allow you to compare other insurance policies for a cheaper teen policy.

When you shop for a teen car insurance policy, you get a lot of numbers. By creating your manufacturer’s driving habits with a telematics device, you can make your insurance rates lower. Enroll your drive in a monitoring program, reporting to your insurance or how often the company does it. This dividend you can run on your beneficiary auto insurance.

Teen car insurance rates vary considerably. Insurance companies have different rules and regulations regarding the minimum and maximum amount of coverage. Your state may have minimal coverage or even no requirements. Your teenage age will determine how much premium you will have to pay. You will need to select a plan based on your teen’s age, zip code, driving history, and vehicle type.

Safe driver programs

Car insurance companies have safe driver programs for teens. These programs educate new drivers about safe driving practices. Tin provides resources for every stage of driving. Some insurance companies now offer electronic devices to track young driver behavior. Allstate, for example, has its DriveWise program. which installs a small device in the car and collects information about how the vehicle is used. This information is used to reduce the number of claims made by young drivers and improve overall safety in automobiles.

Named exclusion

Buy your security driver car insurance period, and you can entice everyone to request, including Grandma Hanel. This is not a supremely clever move. A person may have a DUI or lose their license. If they join the temple they will not appreciate lower rates. You can think of your desire as a driver to focus on the cost of VimPrime.

This is a common practice among car insurance providers and is usually necessary to protect innocent victims of unruly teenagers. Many parents find this difficult. They often pay exorbitant premiums for their teen driver’s insurance policies. Oklahoma law specifically allows for the exclusion of minors’ names. In most cases, this exclusion does not apply to reckless drivers. In some cases, the state legislature may allow it to protect a named driver.