When looking for a car insurance policy, you should be sure to ask your agent for a USAA car insurance quote. Not only will you get a free quote, but you’ll also be able to read about all the different types of coverage and discounts available. Here are some tips to keep in mind when comparing quotes:

About coverage options – USAA Car Insurance Quote

If you’re shopping for auto insurance, it’s a good idea to compare deductibles and coverage options from several companies. You can also read about their customer service and complaints. A high complaint number can mean poor service. That doesn’t mean the company has terrible service. The National Association of Insurance Commissioners tracks consumer complaints and sets the USAA average number. USAA offers a variety of coverage options for those who want a comprehensive policy.

If you are a member of the military, you may qualify for a discount from USAA. In addition to the military installation discount, drivers can get 15% more comprehensive coverage if they have their vehicles garaged on a military base. How many years you have had the policy? Accordingly, loyalty discounts will also help you save money. For example, if you have a parent with a USAA policy, you can get a 10% discount.

In addition to discounted premiums, you can also get cheap car insurance from USAA. USAA car insurance quotes vary based on your zip code, vehicle, and age. Most drivers pay forty to thirty percent less than the national average. Even if you don’t belong to the USAA group, you can get cheaper rates from Geico, State Farm, and others. Don’t forget to ask about fare reimbursement if you have a teenager.

USAA’s rating is excellent, and it’s no wonder USAA receives top marks from major consumer rating agencies. Their full and minimum coverage premiums are among the lowest in the business. Customers who have used their USAA insurance services. They appreciate the efficient claims process and helpful agents. Many customers report being very satisfied with their service. So some have complained of high premiums.

Discounts for active-duty military members

USAA car insurance discounts for active-duty military members and veterans to lower the overall cost of your policy. Military deployments can complicate bill-paying. You can save money by taking advantage of discounts offered by the company.

While USAA and Geico are the most recognizable names in car insurance for service members, there are many other options available. You can choose a company that offers the best combination of affordable rates and excellent service. If you are in the military, USAA car insurance discounts for active-duty military members are one of the best options for you. Geico and Esurance also offer car insurance discounts for service members.

Geico offers military auto insurance discounts that apply to active duty and retired members. The company offers emergency deployment discounts for members deployed to areas of “imminent danger.” You can also take advantage of an additional 15% military discount from Geico when you are a federal employee. Geico auto insurance discounts may not be available in all states. If you’re currently serving in the military and trying to get affordable coverage, that’s a good place to start.

Price for non-military drivers

Military members are often eligible for discounts on their car insurance. This is especially true if the member is currently deployed without family. Often, these discounts can save a member up to 60%. Not all states are eligible for this discount. There are a few other ways to get discounts that USAA offers. You can also use online comparison shopping to get a good price on car insurance.

Among the benefits offered by USAA is the lowest premium. Other companies can often match USAA’s rates. Geico is one such insurance company. For those looking for cheap car insurance for non-military members, Geico may be a better option. While calculating rates, insurance companies consider both gender and age. Using accident data, they determine that men are more dangerous drivers than women.

If you are a member of the military, USAA may be your best option for car insurance. If you’re not in the military, however, Geico or State Farm may be comparable. Both companies offer big discounts for military and veteran customers. If you’re not a member of the military, GEICO offers great deals on car insurance for military members and veterans.

Aside from lower premiums, USAA offers telemetrics, which allows policyholders to adjust their rates based on their driving habits. This applies in most states. Signing up for Telemetrics is free, and you can save up to 30% on premiums by following safe driving practices. USAA caters to military life, including extended benefits, vehicle storage discounts, and other special services.

Rates for vehicles with high-end features

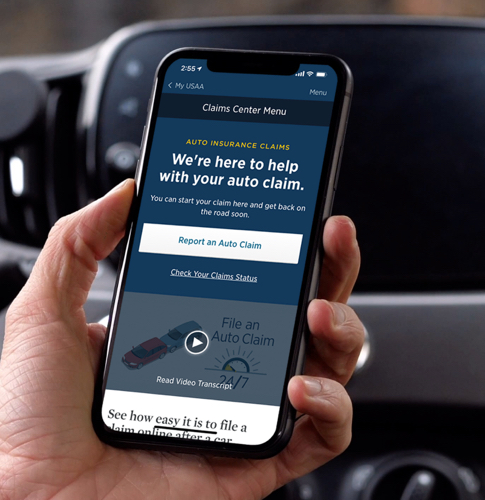

For those interested in finding out how much USAA car insurance will cost their vehicles with the most features, the process is relatively simple. Visit USAA’s website and fill out a simple quote form. You will have to fill in some basic personal information and the model and make of your vehicle. Next, you’ll see a personalized quote that includes your SSN.

The number of complaints filed against the insurer can affect the price. NCIC produces an annual index that measures levels of customer satisfaction. Each insurer’s score is a national average. Companies with high NPS show better service and increased revenue.

Many insurance companies also factor in the policyholder’s credit history. People with poor credit scores will pay more for car insurance. While USAA’s rates aren’t the lowest in this category, they’re still about $900 below the national average. Geico has the lowest rate in this category nationwide. To find out if USAA is right for you, compare your USAA Car Insurance Quote with other insurance companies.

If you want to make sure you have the best possible coverage for your vehicle. That’s why USAA has a team of independent insurance commissioners to help you find the right policy for your vehicle. These individuals ensure you get the best possible coverage at the lowest cost. They will also ensure that you have the limits and coverage that are right for you. Get the right coverage for your money and avoid paying more than you need.