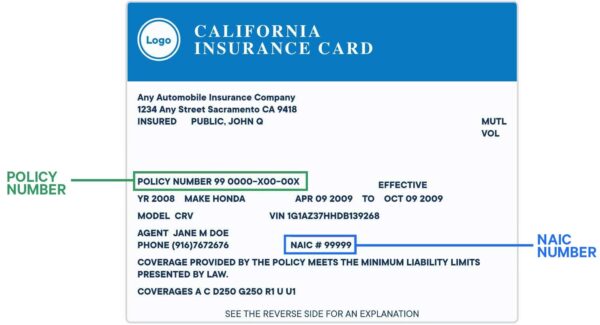

If you want to get a nationwide print insurance card from your life insurance company, you can do it online. This card can be downloaded from the Nationwide mobile app. Can be mailed or picked up in person. Nationwide has you covered, regardless of how you want to prove your coverage. Here are three different ways to get your proof of insurance:

Auto insurance – Nationwide Print Insurance Card

Whether you’ve been in a car accident, or you just want to save some money, having proof of insurance is important. This can come in the form of a printout, nationwide insurance ID cards, or even an email. While you can easily store a nationwide print insurance card in your glove compartment, it’s also convenient to email it to yourself. Many insurance companies now allow you to access your nationwide insurance card through mobile apps.

Nationwide offers a variety of add-on coverages that help you save money on your auto insurance. The company offers a vanishing deductible that waives your deductible if you are involved in an accident. They also offer identity fraud insurance to protect your personal information. If you own a valuable car, you can opt for the Valuable Plus endorsement, which will cover the car rental costs in case of an accident.

While a nationwide policy has many advantages, you should consider comparing quotes from other companies before choosing one. The average premium nationwide for a good driver is $1,540. While the premium of Farmers and Geckos is slightly higher. Car insurance companies prefer good drivers. They rarely file claims or get into accidents. You should shop around before choosing a policy, as you can save hundreds of dollars.

Homeowners Insurance – Nationwide Print Insurance Card

If you consider your company’s statement owners insurance, check the National Business Media policy. This policy includes only the amount of coverage that you are eligible for. Such as home and personal property insurance. You can purchase insurance in other ways to protect outbuildings with covered security conditions. You can add loss-of-use coverage to your search to help request a covered repair or replacement. The coverage helps you pay for medical bills and alternative expenses if one is created on your property.

Before you get your policy, you should collect all the details about your property. Collect any previous and current homeowners insurance policies if you have them. By doing this, you will be eligible for discounts when you have multiple policies with the company.

Nationwide Motorcycle Insurance

Nationwide motorcycle insurance is an excellent choice for your bike as it offers many benefits. Coverage options include collision, comprehensive, and liability insurance. You can also get a discount for paying your policy in full. In addition to its benefits, Nationwide has several additional policies that can save you money. Listed below are some of the discounts available to you. Find out which policy will give you the best value for your money. Then, contact Nationwide today for more information.

Renters Insurance – Get A Free Quote

There are a variety of ways to find renters insurance, including online quotes, independent agents, and local companies. It is best to compare quotes from at least three different companies. Then choose the best based on price, customer service, and financial ratings. Some policies may also require additional coverage for local disasters.

When purchasing renters insurance, be sure to consider all of your coverage options. Different companies charge different rates for the same coverage. Fortunately, you can find nationwide plans with affordable premiums. If you plan to add additional coverage, you will pay a higher premium. You can always opt for a higher deductible to lower your monthly premium. Depending on your budget, you may also want to compare prices from different companies.

Nationwide Life insurance

If you want to get print insurance cards from your life insurance company, you can do it online across the country. Getting one is easy if you have an online account. And you can change your policy and pay your bill whenever you need. If you don’t already have a Nationwide account, you can register for one online with the app and access your policies wherever you go.