Nationwide Homeowners Insurance recently made some changes to its underwriting guidelines. To notify existing customers of these changes, they must receive the written notice attached as Exhibit A. The exhibit provides important information about changes in nationwide underwriting guidelines.

The basic policy includes dwelling coverage

Dwelling coverage is a critical part of your basic homeowner insurance policy. Your coverage should pay for the cost of rebuilding your home if necessary. Unlike most other types of insurance, home coverage is not a one-size-fits-all amount. The amount you need to buy depends on your specific home and your budget. If you’re not sure how much home coverage to purchase, talk to an appraiser or insurance agent. Another structure coverage, also known as coverage B, is also important. This type of coverage pays for damage to garages and other detached structures such as sheds. In most cases, coverage B is about 10% of the total accommodation limit.

Dwelling coverage also varies by type and level of coverage. Most policies exclude earthquakes, floods, sewer backups, and sinkholes. They also do not cover damages caused by negligence. You may need to purchase a rider to cover these items. Some policies also exclude damage caused by settling, explosion, or other factors. These are listed below. Depending on your policy, you may need to purchase separate coverage for these types of events.

Dwelling coverage is a critical part of your basic homeowner insurance policy. This policy not only protects the structure of your home but also any attached structures and appliances. Dwelling coverage typically covers repair or rebuilding costs after an event that damages a home. Your home insurance policy may also cover other structures attached to your home, such as a shed or garage. If you want to protect your home, you need a policy that covers these excesses as well.

Nationwide homeowners insurance coverage includes basic policies that offer dwelling coverage, protecting the structure of your home against risks such as fire, theft, and certain natural disasters.

Contents coverage pays for personal property

If you have a homeowners insurance policy, you may have separate coverage called contents coverage. Contents insurance will replace or repair your personal belongings if they are damaged by covered perils such as fire or theft. You should always discuss this coverage with your insurance agent to see what you can expect during the move. Be sure to check what your new homeowners insurance policy covers when moving. Some policies will not cover your belongings in storage or the car trunk. Fine art, antiques, and memorabilia are not covered by the standard contents policy.

Dwelling coverage is a common coverage for homeowners. It pays for damage to the physical structure of the home, including built-in appliances. Contents coverage pays for damaged personal property, such as furniture, clothing, and electronics. Personal liability insurance pays for expenses that result from an incident, such as medical or funeral expenses.

There are two types of content insurance. You can choose to purchase replacement cost coverage or actual cash value coverage. Replacement cost coverage pays for your personal property if it is damaged or destroyed by a covered peril. However, this type of coverage pays for only a portion of the actual purchase price. You can also opt for replacement cost coverage, which will reimburse you for the cost of an equivalent replacement of equal quality. Replacement cost coverage may require a higher policy premium.

Nationwide homeowners insurance reviews frequently highlight the company’s comprehensive coverage options and efficient claims handling (NerdWallet: Finance smarter) (Nationwide) (Harry Levine Insurance).

Discounts are available for living in a gated community

Living in a gated community can offer discounts on homeowners insurance. The discount depends on the number of years a person has been with their previous insurer. Having security guards on site, residence cards and key lock devices will also result in discounts. Additionally, some home insurance providers offer additional discounts for residents living in gated communities. However, it is always better to check the small print of the insurance contract.

While living in a gated community can be expensive, it offers an added layer of security. This means less risk of theft or vandalism. This fact has led many insurance providers to offer discounts to homeowners living in these communities. Because they have secure entrances, gated communities also tend to have less criminal activity than non-gated neighborhoods.

To explore these savings and get customized policy options, you can easily obtain Nationwide homeowners insurance quotes online or through their mobile app (NerdWallet: Finance smarter) (Nationwide).

Premiums vary depending on risk

Many factors determine the cost of homeowners insurance, including the location of your home. Homes in areas with extreme weather conditions command a higher premium than homes in more temperate climates. However, there are some factors that you can change to lower your premiums. Listed below are some tips for comparing rates.

One factor that affects the premium for nationwide homeowners insurance is the type of home you live in. Older homes are more expensive to insure, and homes with custom wood floors or plaster walls will have higher premiums. Whether you live in a big city or a rural area can have a big impact on premiums. A Nationwide agent can give you an estimate of what your insurance premium will be based on your specific home’s risk level.

Another factor that affects the premium is the insurance company. Some insurance companies charge much lower premiums than others for the same coverage. Some charge less than others for higher levels of coverage. Others may charge higher premiums for higher-risk properties. However, you can find low-risk insurance options by comparing premiums across insurance companies. A homeowner’s insurance policy will reflect the risks of the home and the response time of the insurance company.

Another factor that influences the cost of homeowners insurance is the deductible. If you own a low-risk home, you can lower your premium by increasing your deductible. Some companies offer a $500 deductible, while others require a $1000 deductible. However, you must make sure that you can afford to pay that deductible. The higher the deductible, the lower the premium.

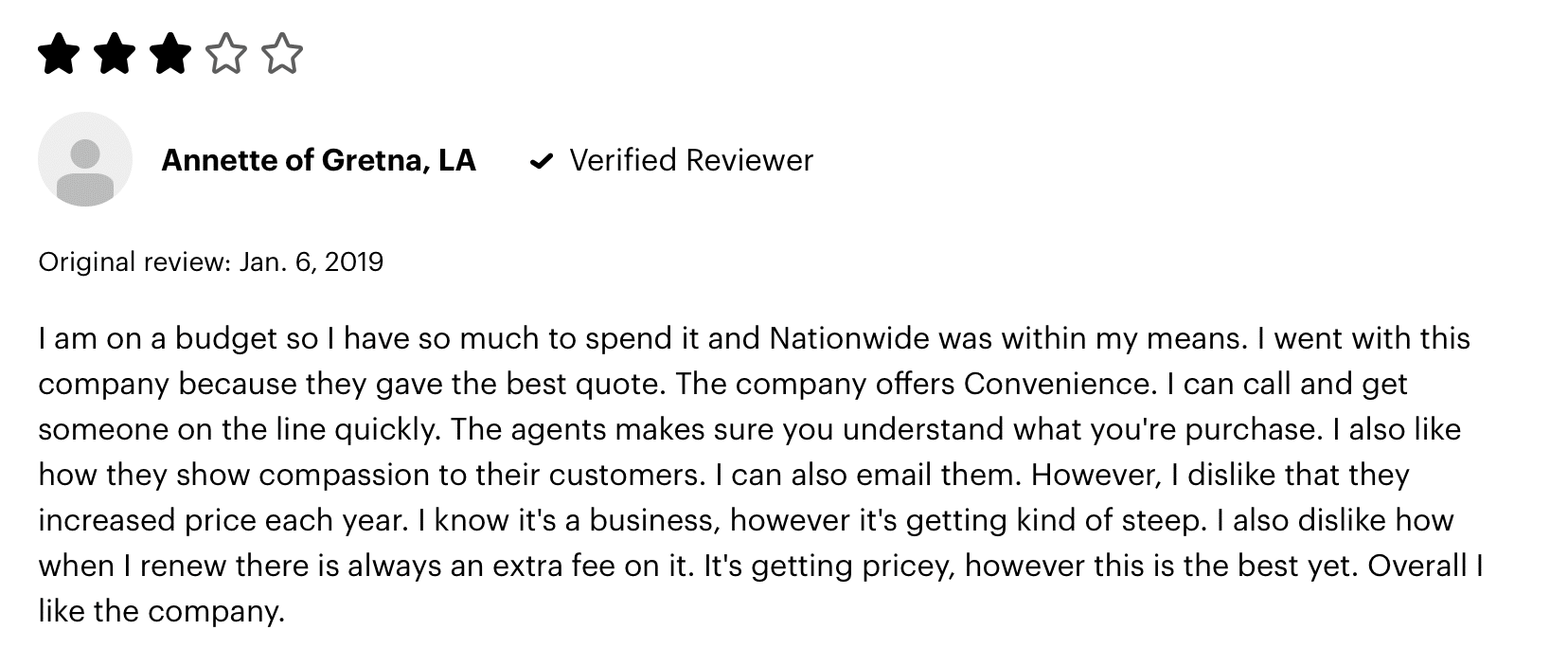

Customer service is above average

Although Nationwide ranks below the national average when it comes to customer service, its reputation for quality coverage is above average. While Nationwide has earned an A+ rating from the Better Business Bureau, its overall complaint index is lower than the national average. If customer service is your number one priority, you may want to consider an alternative such as Hartford or Erie Insurance.