Guaranteed acceptance life insurance is a type of AARP life insurance for seniors who no longer require a premium. Once you reach the age of 95, you do not have to pay your premium. This type of policy provides cash value that grows tax-deferred. The loan can also be against the cash value of the policy, although this will be an interest-bearing loan. This is not the only benefit of the policy.

Term life insurance

There are two types of AARP term life insurance for seniors. The first level is a beneficial life insurance policy, meaning the monthly premium will be fixed. Another type, guaranteed issue life insurance, has a waiting period but does not require a medical exam. The death benefit is guaranteed for the entire policy period. Before signing, buyers of this type of insurance should compare the cost of their new policy and its terms and conditions.

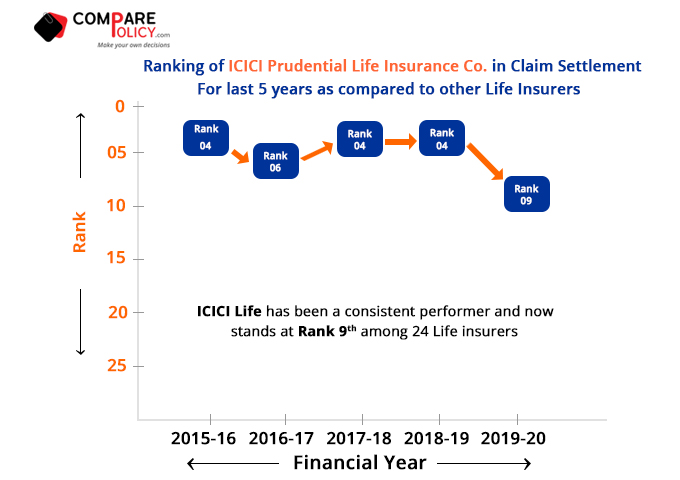

AARP is not accredited with the Better Business Bureau but has received high customer service scores from other agencies. However, most complaints are about their other services, such as delayed payment of claims. The company has been given an average rating by Trustpilot. However, its website is difficult to navigate. Regardless, this is a good start for anyone considering AARP life insurance for seniors. If you are considering this insurance plan, you can compare up to four companies and get quotes.

Aarp term life insurance rates for seniors are generally low, with premiums ranging from $11 per month to $342 per year. The cost of this insurance will increase every five years when you reach the next age group. It also expires after you reach age 80, so you’ll need to make sure you’re willing to pay the premium every year. You can get a cheaper policy if you don’t have any medical problems.

For those interested in AARP life insurance, the AARP Life Insurance customer service team is available to assist with questions, policy management, and ensuring members receive the right coverage for their needs.

The AARP life insurance claim process is straightforward. which ensures that beneficiaries receive payments quickly to cover critical expenses during difficult times.

Whole life insurance

There are many benefits of getting AARP whole life insurance for seniors. Most of these policies do not require a medical exam, which is great for senior citizens who don’t qualify for traditional policies. Moreover, in this type of policy, the policyholder does not need to pay the premium as long as his health remains good. As a member of AARP, you can stop paying premiums if you turn 95.

The most important advantage of getting Aarp whole life insurance for seniors is its low cost. This insurance is cheap and affordable. However, this type of policy is limited in its coverage. Which is only $50,000. If you want more coverage, you will have to pay additional premiums. Aarp also offers guaranteed issue plans, which means you won’t need a medical exam to apply.

AARP offers two types of insurance for seniors: term and whole life. Term life covers you on your first day, while whole life policies have a two-year waiting period. While AARP whole life insurance for seniors offers a first-day coverage option. Then you may have to wait two years before your policy is approved. The process for getting AARP whole life insurance for seniors is relatively straightforward. You will need to fill out an online application and answer some health questions. Once you complete the online application, an AARP underwriter will evaluate your information and make a decision. Most applications will be approved within 14 days.

These AARP life insurance plans help cover final expenses, and debts or leave a financial legacy. AARP members enjoy special rates, making these plans accessible and flexible.

Guaranteed acceptance policy

AARP’s Assured Acceptance Life Insurance for Seniors is a solid product, but there are a few things to keep in mind. The AARP website says that the policy requires no health questions, but this is not the case. Additionally, the policy requires a two-year waiting period. That means non-members can’t take advantage of AARP’s Guaranteed Acceptance Policy.

AARP Guaranteed Acceptance plans require a medical exam to obtain coverage. However, you will need to answer questions about your health during the application process. If you don’t think you qualify for the policy, you should consider other insurance companies. For example, you might want to look into a whole life insurance policy. In this case, a whole life insurance policy may be less expensive than a term policy.

AARP Life Insurance Guaranteed Acceptance Policy requires the issue age to be between 50 and 74 years. This is the minimum and maximum age at which you can apply for coverage. Once you apply, AARP life insurance underwriters will review your information and contact you if you qualify. Generally, your application will be approved within 14 days. It should take you no more than 15 minutes to complete.

Many AARP policies are available. The most common is a guaranteed acceptance policy. This type of policy does not require any medical examination and is good for those who do not need much life coverage. Coverage amounts range from $10,000 to $100,000. This type of policy is also available for young people who are not yet ready to buy permanent life insurance. You can buy it through an insurance agent, and it will remain in effect until your death.

The Aarp life insurance for seniors cost is essential, as it can vary based on factors like age and health.

Living benefit rider

When considering purchasing life insurance for seniors, it is important to compare premiums. AARP insurance policies can range from $25,000 to $100,000 in value. It is important to consider your specific needs and goals before making a decision. For example, a senior may need more coverage than a young family. If so, an AARP life insurance policy with a living benefit rider may be the right choice.

AARP life insurance policies that include a living benefit rider allow beneficiaries to receive a portion of the death benefit early. Certain riders are triggered when the policyholder has less than twelve months to live. This option is available only to members with guaranteed issue policies. AARP also offers the option of waiving premiums for nursing home residents or terminally ill individuals. Additionally, if the insured is terminally ill, the policy allows them to avail 50% of the death benefit while alive.

Unlike some other policies, AARP life insurance for seniors does not interrupt coverage after the child reaches age 21. It consists of level premiums for the remaining life of the insured. Another benefit of an AARP policy is that the cash value grows slowly, so it’s possible to build money over decades. This feature is especially attractive to those who want to protect their children against the costs that come with an early death.

If you’re looking for a life insurance policy that can pay out up to $100,000, an AARP Whole Life policy is a great option. AARP offers life insurance for seniors that doesn’t require a medical exam and allows you to convert it to a permanent policy once you turn 95. In addition to the living benefit rider, AARP Life Insurance for Seniors can also carry a permanent policy. Unlike many other insurance policies, this policy does not require a medical exam, and premium payments can stop when you reach the age of 95.