If you’re looking for life insurance, you’ve probably heard of different types of policies, including whole and term life. But what do these policies mean? And what factors affect them? In this article, we’ll examine some more common issues and discuss the state-specific factors affecting them. You may be surprised to learn that smoking, for example, can dramatically increase your life insurance rates.

Smoking can increase life insurance rates

The most obvious way that smoking can increase life insurance rates is through the use of cigarettes or tobacco. But other tobacco products, such as chewing tobacco, can be smoked and qualify for a smoke-free rating. Even cigar smokers can qualify for a non-smoker life insurance policy if they limit their use to a handful of cigars per year. If you are a smoker, however, your rates will be lower if you try to quit.

While there is no guaranteed cure for smoking-related illnesses, you can still get life insurance even if you quit. Smokers can opt for a term insurance policy and cancel it without incurring a fee. Once they stop smoking, they can convert to a whole life insurance policy and enjoy lower premiums. However, be aware that smokers may not be eligible for the preferential rate for several years after quitting. Right now, the best way to buy life insurance if you smoke is to quit now.

The American Red Cross estimates that smokers die every year in the US. Smoking accounts for nearly half of all lung cancer cases and is four times more likely to lead to a heart event. Because of the increased risk of death from smoking, insurance companies will increase your premium accordingly. Once you quit smoking, your premium will come down significantly. It is recommended to quit smoking for at least a year so that they do not smoke.

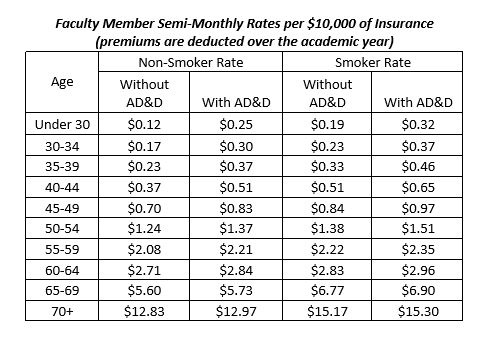

Smoking can significantly increase life insurance rates for smokers due to the health risks associated with tobacco use.

The simplicity and limited duration of term insurance help offer the best life insurance rates, making it a more affordable option for those seeking temporary financial protection or higher coverage at a lower cost.

Term insurance is cheaper than whole life insurance

There are many differences between whole life insurance and term life insurance. While whole life insurance lasts for a lifetime, term life policies only last for a specific period. Term life insurance premiums are significantly lower. Usually paid out only if the policyholder dies during that time. On the other hand, whole life insurance includes a savings component that can be accessed during one’s lifetime. These savings can cover a variety of expenses, including mortgage payments, college tuition, and funeral expenses.

Term life insurance is cheaper than whole life insurance. But it has many drawbacks. For instance, its competitiveness period is long. The policyholder may pay less and the insurance company reserves the right to reject claims for various reasons. Term insurance is cheaper than whole life insurance. But cannot afford high premiums. A term life policy is a good choice for young people and those on a tight budget.

Term insurance premiums are lower than whole life premiums because premiums are priced at a level for a specific period. Typically, a 30-year-old, non-smoking, healthy man will pay about 5.8 times the cost of a 40-year term life policy, but the difference is much greater for a woman. This is why term insurance is also cheaper than whole life.

Whole life insurance rates are higher because it offer lifelong coverage and builds cash value over time, making it a more expensive option.

State-specific factors that affect life insurance rates

While geography may not directly affect your premium, some state-specific factors can have a profound effect on your rate. While some insurance companies charge higher premiums in certain states, others do not. Generally, the rate of a life insurance policy is not affected by your state of residence. The location of your home doesn’t even affect your health class. State-specific factors can influence your rate, however, as can your credit score.

Age is the most important factor when it comes to the risk of death. This means that young people live longer than older people. This means that younger people generally pay lower life insurance premiums than their older counterparts. Insurance carriers use historical data to determine premiums and discounts, and older people live longer than younger people. As a result, women are often cheaper to insure than older men. Additionally, insurance companies take gender into account while calculating premiums. Women, in particular, tend to live longer than men. Their premiums reflect this.

Underwriting is another factor that can affect your rate. Insurance companies charge more for coverage for high-risk and high-cost jobs. A previous history of car accidents or driving violations can skyrocket your premiums. A criminal record can also make it impossible to get affordable life insurance coverage. Additionally, insurance companies will perform a soft credit check while determining your life insurance premium.

Mortality rates and overall health trends in the state are also taken into account by insurance companies, including options such as life insurance with premium returns. The rates vary from state to state.