Term life insurance is an affordable, flexible way to provide coverage in the event of your death. This insurance is available through a professional adviser. This article will explain the advantages and disadvantages of term life insurance. Also known as term life insurance provides coverage for a specific period. The relevant tenure may be up to five years. The policy can be extended if your circumstances change.

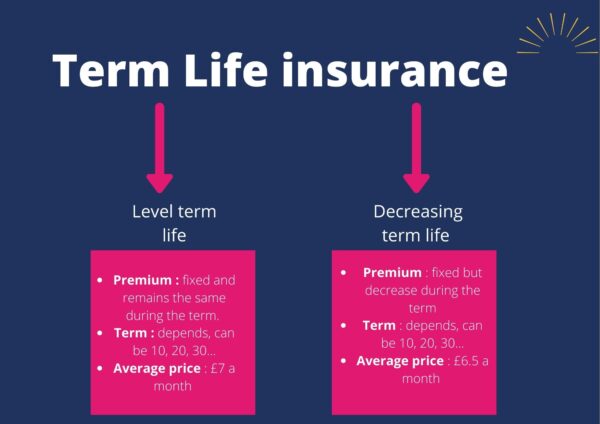

Type of life insurance

Term life insurance is life insurance that is active only for a specific period. Usually between 10 and 30 years. People who want to secure a financial future for their family can opt for term life insurance instead of permanent one. Compared to permanent life insurance, term life insurance premiums are about two to three times cheaper. In many cases, there is a cheaper option, so it may be worth looking into.

Term life insurance premium is determined by several factors including the age and health of the applicant. Generally speaking, the younger you are, the lower the premium. An insurer’s financial strength rating will not significantly affect the premium. When shopping for a term life insurance policy, expect to get similar quotes from different companies. Compare the companies’ financial strength ratings and consider any policy riders.

Term life insurance is an option for people who are insecure about their health. Term life insurance provides death benefits if you die. But don’t create a cash value account. A permanent life insurance policy includes a cash value account. A cash value account can accumulate limited interest and has a payment limit. However, some permanent life insurance policyholders use cash value accounts to build wealth. It is important to compare life insurance quotes from several providers to get the best deal.

It offers flexibility

When buying life insurance, you will be faced with many choices. You can choose to pay a higher monthly premium or make your coverage flexible. Both options preserve death benefits and cash values. The main difference is that a flexible premium policy does not allow you to invest the cash value of your policy in the stock market. You will need to know your financial goals before purchasing life insurance to ensure that your policy meets these goals.

It is inexpensive

A recent study conducted by the Life Insurance Marketing and Research Association found that Americans overestimate the cost of life insurance. This is especially true among young people, who believe that the policy will cost three times more than that. A $250,000 term life policy can cost as little as $160 per year, or $13 per month. Additionally, you may be able to get additional coverage, such as a term rider.

A good choice for people with fixed income as the premium is relatively lower than permanent. Many insurance companies offer affordable packages for people on a tight budget, so you can get enough coverage without breaking the bank. MoneyGeek has explored term life insurance quotes and offers to see which one is best for your needs. Does not accumulate cash value and is more affordable as it does not involve an investment component.

Term life insurance is the least expensive option. However, the coverage may not be adequate. Some people want permanent coverage but are not comfortable paying premiums for twenty to thirty years. While whole life insurance rates are more expensive than term coverage, they allow you to increase lifetime coverage and cash value. That means you can save big while protecting your family. If you buy term life insurance, make sure that the coverage will cover your financial liability. If it doesn’t, you will have a hard time finding another insurance option.

It is available through a professional advisor

Buying life insurance is a personal decision. Although the benefits of permanent insurance and term life insurance are comparable, some consumers prefer to shop around for the best deal. A professional advisor can talk you through the benefits of each. It is important to understand the risks and benefits of both. A financial advisor can advise you on the right type of coverage for you. This article will provide an overview of the differences between term life insurance and permanent insurance.

It comes with a conversion rider

The main advantage of converting your policy to permanent is that your health rating remains the same. Which means you can continue to get coverage at the same rate as before. This is important because you don’t want to face an increase in rates if you have a health condition that makes you uninsurable. Additionally, converting your term policy to a permanent policy allows you to build cash value while preserving your coverage. Once you convert, your new permanent life insurance policy will provide life insurance coverage for your entire lifetime, and the cash value can be increased over time.

In some situations, there is sufficient protection for the elderly, especially dependents and those without financial obligations. More than 51 million American households are multigenerational and may need term policy coverage. However, there are some situations when you may want to access the cash value from your term policy. If this is the case, you can add a conversion rider to your policy to access the cash value.

A conversion rider guarantees you the right to convert your term policy to a permanent plan. This facility allows you to convert your policy to a permanent plan without undergoing a medical examination or answering health questions. This feature is especially useful for people whose health is at low risk and who hope to transition to a permanent policy.