The John Hancock Life Insurance Company was founded on April 21, 1862. It was named for the prominent American patriot John Hancock. Since then, the company has provided life insurance to more than four million Americans. If you are looking for an insurance policy, you can choose from a term, universal, or indexed universal life policy. Read on to learn more about each. Also, look at the Disability Income Rider and the Total Disability Waiver.

Term life insurance

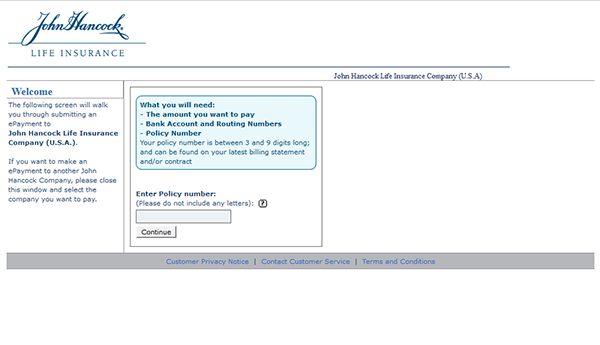

Customers of John Hancock Term Life Insurance may be unhappy with its customer service, which can be unhelpful and unpredictable. Customers can initiate online requests for quotes or policies. An assistant at the company’s Boston headquarters will contact them or email them to collect additional information. While the John Hancock website lacks a live chat feature and digital tools, it does offer a quote tool and a comparison of its various products. Customers may also be interested in a unique rewards program that rewards people with a healthy lifestyle.

The company sells two main types of life insurance: term and universal. Term life insurance policies come with higher coverage limits. The policy term can last anywhere from 10 to 30 years. These policies usually require a medical exam to qualify. Insurers are required to provide health information including body mass index (BMI), height, weight, and blood pressure. Some policies also have rider options, such as a waiver of premium, which pays the premium if the insured becomes disabled. However, this adds a layer of underwriting to the base premium.

John Hancock’s term life insurance policy offers many benefits to customers. Its competitive premium is a major selling point. Moreover, John Hancock offers vitality programs for its clients. Vitality GO is available free of charge on all John Hancock policies. Vitality Plus is a different option for consumers who want to improve their health. Participation in these programs is not required. However, policyholders will be sent a welcome kit once they buy a policy from John Hancock.

A John Hancock life insurance policy provides affordable and reliable financial protection tailored to individual needs.

Indexed universal life insurance

If you are interested in saving for retirement and don’t have much money, an index universal life insurance policy is an option. Term life insurance ends when you pay the premium. Index Universal Life Insurance expires only when the cash value in your policy account reaches a certain amount. Traditional life insurance companies invest in government-backed mortgages and corporate bonds and typically pay only modest returns each year.

One of the advantages of indexed universal life insurance is the fact that it offers more flexibility in retirement planning than most traditional life insurance plans. This is because you can fund the policy with more money than required and the excess funds go into an account that earns interest based on the index. This way, you won’t risk losing money when the market goes down and you won’t have to worry about paying too much in premiums.

Indexed universal life insurance for John Enoch is available in 25 states today. Once approved, the company plans to roll out the products across the country. The company offers two different types of indexed universal life insurance policies: accumulation and survivorship. Accumulation products are also available to John Hancock customers. If you’re not sure whether you should buy indexed universal life insurance, be sure to ask your financial advisor about the benefits of each product.

An index universal life insurance policy offers many benefits. Its flexible premium and death benefit may vary depending on market conditions. Unlike a traditional life insurance policy, an index universal life insurance policy allows you to invest money in an equity index account and avoid the risk of volatile markets. You can also choose to invest part of the premium amount in an equity index account and use the rest for a tax-free cash value account.

John Hancock Universal Life Insurance also includes innovative features like lifestyle programs. which rewards healthy lifestyle choices.

Total disability waiver

John Hancock Total Disability Waiver waives your premium for the policy for the period of disability. If you are an adult and still able to pay for your life insurance you can opt for this rider as an additional premium. Total disability waiver covers you up to five thousand dollars per month in premiums. It is also available on Jeevan Shakti term policies at no extra cost. You can also add a disability income rider if you are disabled and unable to work for at least 90 days.

The plaintiff in this case is Audrey B. Cave, a resident of California. She was issued a certificate from the John Hancock Mutual Life Insurance Company stating that she was permanently disabled. On proving that she would be entitled to five hundred dollars. Disability waiver was based on the definition of total disability as a permanent and irreparable impairment that prevents the insured from pursuing or engaging in other productive pursuits.

Another way to get disability benefits is to add a critical illness rider to your policy. This rider provides funding in the event of a qualifying critical illness. This rider is available on any permanent policy offered by John Hancock. It won’t reduce your death benefit, and it reimburses qualified long-term care expenses each month. The critical illness rider has some other benefits.

Overall, John Hancock has an excellent life insurance product with middle-of-the-road premiums. While underwriting can be tight. They are quite fair with their policies. Apart from being high-risk underwriting guides, they also offer wellness programs to their clients. One such wellness program is John Hancock Aspire, which rewards customers for maintaining good health. You may also be eligible for discounts on select items.

Policies with John Hancock Customer Service include this option. which is backed by their highly-rated team dedicated to assisting policyholders with claims and benefit inquiries.

Disability income rider

If you are disabled and need additional income to cover monthly expenses, you may want to consider adding a disability income rider on John Hancock life insurance. This rider prevents your policy from lapsing while you are disabled. Premium waives up to 12 months. It will also provide you supplemental income for a specific period, usually 90 days. A disability income rider can provide you with a monthly benefit of up to five thousand dollars per month if you become totally and permanently disabled.

A disability can drastically reduce your quality of life and leave your family with an unexpected financial burden. A standard life insurance policy won’t pay out if you become disabled, while a disability income rider can ease your financial worries and allow you to focus on quality of life rather than the cost of care. To learn more about disability income riders, contact an insurance agent today. And don’t forget to check with your agent about the terms and conditions of this optional rider.

Another useful feature of the Disability Income Rider on John Hancock Life Insurance is that it pays a monthly income of 1% of your policy’s coverage if you become disabled. It is important to understand the specifics of disability insurance before you purchase one. A disability income rider may not cover things like a disability waiver of premium. Be sure to read the fine print of any disability insurance rider before purchasing it.

This makes the John Hancock life insurance claim process efficient. which ensures timely access to benefits in challenging times.