Many factors affect car insurance prices, and your state is no exception. Read on to learn what makes your premiums rise depending on what state you live in, and what make and model of car you drive. You may be surprised at how much of a difference these factors can make. And remember that car insurance companies are not all the same, so if you have the same vehicle and the same driving record, you may find a better rate elsewhere.

Variables that affect car insurance prices

Young drivers pay more for car insurance than their older counterparts. That’s because teens have a higher accident rate than any other age group. The fatality rate for young drivers is about three times higher per mile than that of 20-year-old drivers. However, the cost of coverage may be less than you think. Read on to learn about some of the variables that affect car insurance prices. Some of the most common variables are listed below.

Type of car – Your vehicle’s safety rating is a factor in how much you pay. This factor is determined by the Insurance Information Institute, an industry-backed nonprofit. It assesses car models’ safety records and their potential to cause damage to other vehicles. Higher safety ratings mean lower insurance premiums, but some manufacturers offer discounts if you have multiple policies or have a high credit score. Some companies offer multiple policy discounts and homeowner discounts to their customers.

The age and gender of the driver are also factors in your insurance rate. A young driver with a poor driving record may have to pay more. People who travel long distances or drive luxury cars may have to pay more. Insurers consider the risk of being in an accident since more miles mean more danger.

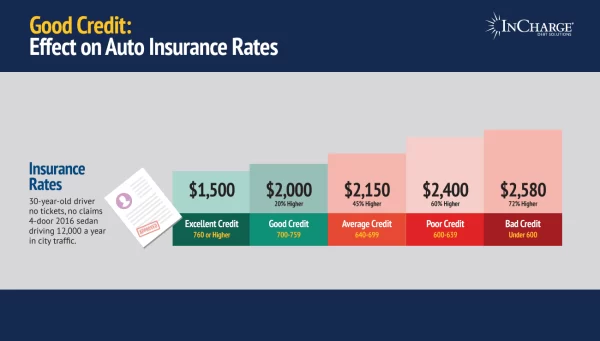

A credit score is also a factor in your rating. A poor credit score will increase your insurance premiums. This is because drivers with bad credit file more claims and this increases insurance costs for them. As a result, the difference between good and bad credit car insurance rates is more than $1,500 annually, which is about $784 for a six-month policy and about $130 per month.

Variables that affect car insurance rates by state

When buying auto insurance, several factors affect the cost. The type of car you drive can play a big role in the cost of your premiums. The Insurance Information Institute, an industry-backed nonprofit that educates consumers on insurance issues, rates cars based on their safety record and their ability to cause damage to other vehicles.

Another factor that affects car insurance rates by state is the state’s minimum liability coverage. For example, drivers in Massachusetts must carry 20/40/5 liability coverage, while drivers in Rhode Island must carry a minimum of 25/50/25. Generally, those who live in hurricane-prone states will see their premiums increase by several hundred dollars.

Gender also plays a major role in your premium. While men are typically charged higher premiums, female drivers usually pay lower premiums than their male counterparts. Rates for men are typically higher than women, but rates for women tend to be lower as they get older and married. However, some states have outlawed this practice.

Car choice and driving habits are also big factors. Some drivers choose luxury cars, which will increase their premiums. Another driver may choose to reduce their coverage, which can increase their costs. It’s best to research your options before making a decision. However, you should be aware that your car’s safety features can affect your insurance premiums. If you’re considering purchasing a luxury vehicle, keep in mind that higher-end cars tend to be more expensive to repair or replace.

Variables that affect car insurance prices by make and model

Many factors can affect car insurance premiums, including the make and model of the car. The cost of medical care, litigation, and car repairs are all factors that affect insurance premiums. Climate, population and weather patterns can also affect insurance rates. Car insurers charge more for cars with more advanced safety features. And, women have fewer accidents and fewer serious accidents.

The price of your car and its features are also important considerations. Insurance companies look at other drivers who drive the same model as you. They also check the risks associated with that particular car model. The more expensive, imported, or luxury car you drive, the more it will cost to repair or replace. Also, the more expensive the car, the higher the insurance rate. A vehicle with high-end safety equipment like anti-lock brakes may have a lower insurance rate. Insurers may also charge more for liability insurance if the model is more expensive than a standard car.

Your car’s safety rating is another important factor. While most cars don’t cost as much as luxury vehicles, sports cars and trucks are more likely to be involved in accidents, which can lead to higher insurance rates. While safety features can lower insurance premiums, you’ll need to make changes to your vehicle to make it safer. If you’re thinking about buying a new car, you should first check with the insurance company to find out what the price range is for your particular model of car.