AMCO agencies are the best way to get insurance for your business nationwide. You can also get a free consultation and quote from these insurance agencies. No matter what policy you choose, an AMCO Nationwide agent is always ready to help. Below you will find some tips for choosing a good insurance agent.

Amco Insurance Company

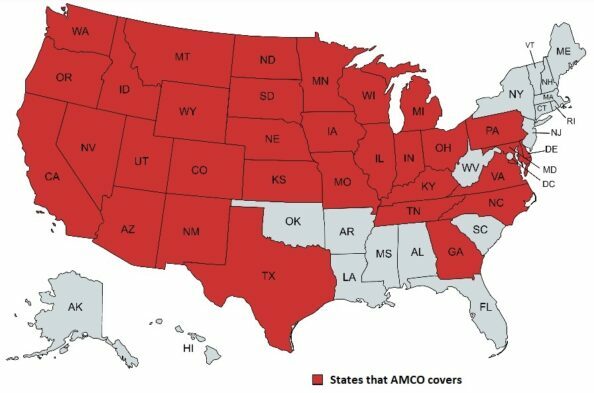

AMCO Insurance Company is a subsidiary of Allied Group Inc. Which is also affiliated with Nationwide Mutual Insurance Company. Founded in 1929, Allied Group Inc. From a small insurance company owned by policyholders to a national company with branches in 33 states. 2,500 of which are headquartered in Des Moines, Iowa, the company specializes in property and casualty insurance. Has primary SIC and NAICS classification as a direct carrier of property and liability insurance.

AMCO Insurance Company offers various personal and commercial insurance across the country. The company is in Des Moines, Iowa. It also has regional offices in Lincoln, Nebraska, Denver, Colorado, Gainesville, Florida, and Sacramento, California. AMCO is one of the largest insurance companies in the country and has been doing business there for nearly four decades. Allied Group has assets of over $119 billion. AMCO is a leading insurance provider for various needs.

Allied Group Inc.

Founded in 1987, Allied Group, Inc. is a recognized management organization. It is one of the few property management companies to achieve this designation. He has grown his management portfolio to include assets owned by investors, individuals, and non-profit organizations. The company does not own any of the properties it manages. Managing every community is a collaborative process. Senior management works with individual site management teams to ensure project quality and adherence to high property management standards.

Allied Group Inc. is a privately held company headquartered in Mendham, New Jersey. The company operates in five segments: Investment, Mortgage Loan Financing, Term Loan Financing, and SME Finance in property development and hotel operations managed by third parties. Other segments include elder care services, property management, and other businesses.

Defendants 911 and Servpro

The proposed Defendants Servpro and 911 are only tangentially involved in this case, but not important to the Plaintiff’s claims. According to Plaintiff’s allegations, Amco instructed 911 to assess the damage and then limited its remediation efforts. The Plaintiff was then directed to Servpro to repair the damage further. However, the proposed Defendants do not bear any responsibility for the damages resulting from the fire or its aftermath.

Policy at issue

Despite the title “Amco nationwide policy at issue,” the policy does not identify the insurer as a Nationwide company. The affidavit, however, does identify the insurer as “Allied Insurance.” Similarly, the customer service number of Amco plays the signature jingle of the Nationwide company. Furthermore, Amco appears on Thtionwide’s corporate overview as an affiliate. Thus, Amco’s policies are nationwide, but the company’s actions are not.

In addition, Amco failed to establish that the insurance policy it issued to Benjamin was under New York law. This is a presumption that the policy in Pennsylvania, where Amco has its principal office. As such, the Plaintiff cannot assert a personal jurisdictional claim in this state unless it establishes that Amco is domiciled in New York. Further, Amco did not serve Benjamin personally in New York, and the state court does not have personal jurisdiction over Amco.

Defendant’s arguments

In the case of Dethe fendant’s arguments in AMCO Nationwide v. Truck, the Defendant asserted that the trial court erred in ruling that the defendant defend the Plaintiff. The court rejected AMCO’s arguments, holding that the court’s reasoning justified its finding of a duty to defend and indemnify based on actual coverage and that the judgment awarded Truck half of his defense expenses, plus a settlement amount, by the evidence.

The court noted that the KCMA plaintiff did not inspect the cabinet before filing the case. The defendant argued that the plaintiff did not adequately inspect the cabinet. Thus defeating coverage under the BOP exclusion. This being true, it will be interesting to see if the court will decide this case in favor of the plaintiff.

State Farm Mutual Automobile Insurance Company’s leave to intervene

Court Macario Camus Vs. State Farm Mutual Automobile Insurance Company. In that action, the driver had a policy limit of $25,000 per person. State Farm intervened in November 2002. State Farm case around the issue of UIM liability. As such, the claim does not constitute a prejudicial pleading.

The court also ruled that State Farm’s petition to intervene was timely filed. Three months after the plaintiff filed her complaint, the company originally filed its initial motion to intervene. The district court found that State Farm had not shown a sufficient interest in the case. State Farm filed its instant motion four months later, three months before discovery and before any legally significant proceedings. Therefore, it was timely to intervene in the case.

While State Farm’s consolidated portfolio was never tested in court, the consolidated State Farm’s bond portfolio reduced his company’s overall yield. Although State Farm says the case does not involve its consolidated portfolio, Jones believes it has little to do with the case. A State Farm spokeswoman says the 2014 rat case has nothing to do with this case. The federal court’s decision on State Farm’s leave to intervene nationwide is not immediate, but a precedent for other cases.