If you’re looking for the best value life insurance, the Legal & General brand is worth considering. Its benefits include no medical examination, affordable premiums, or medical check-up requirements. Insurance experts can help you navigate their products and the application process. If you are confused about what type of policy you need. As a company, Legal & General has received several industry awards including Best Life Insurance Provider at the Personal Touch Awards 2014 and Protection Provider of the Decade at the LifeSearch Awards 2013.

Term life insurance

Term life insurance provides financial coverage against death for a specified period. A term life insurance policy can last anywhere from one to 30 years and is intended to replace an individual’s income in the event of death. It can also provide the funds needed to cover expenses such as a mortgage or school fees. This type of life insurance is cheap and easy to get. However, it is important to note that a term life insurance policy covers you only for the period specified in the contract.

Term life insurance policies are often called “term” or “teaser policies” because they only last for a certain period. In most cases, the premium is non-refundable, but you can choose to convert your policy to a permanent life policy with a return of premium option. You can also buy a convertible term life insurance policy, which allows you to convert your term policy into a permanent policy. However, the conversion term policy must be completed within a specified period.

Another advantage of Legal & General is their extensive product line. The company offers various term life insurance policies. He also has a universal life insurance policy with a tenure of up to 40 years. They have nine riders and fewer complaints. A legal and general life insurance company is a solid choice for individuals of any age or financial status. Its high ratings and low customer complaint index make it one of the most affordable options for life insurance.

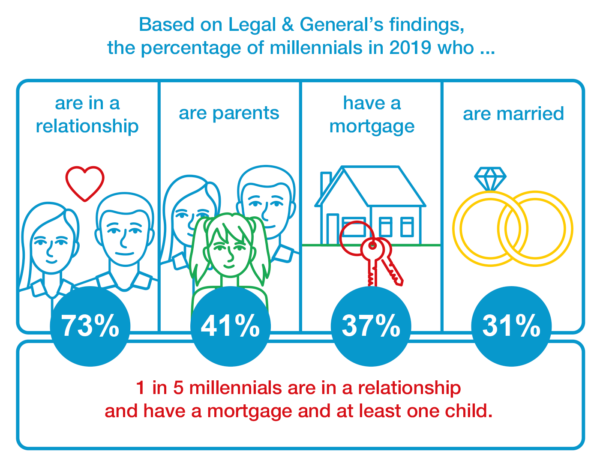

Legal & General life insurance is ideal for those seeking financial protection for their family during critical stages like paying off a mortgage or raising children.

Critical illness cover

Critical illness cover is an optional addition to a life insurance policy. which you can take to reduce the financial impact of an unexpected critical illness. Offers a wide range of benefits including coverage for various illnesses as well as children. Apart from life insurance and mortgage life insurance, Legal & General also offers critical illness coverage. However, whole life insurance is not offered by the insurance company.

Critical illness cover is designed to pay medical expenses associated with a specific critical illness. It covers expenses associated with cancer treatment, heart attack, and stroke, although not every type is covered. Some illnesses must be terminal and others may only lead to temporary symptoms. The standard terms and premium rates for critical illness insurance vary considerably depending on the policy. A person should be below 45 years of age when they buy the policy and when they exercise the option. Then his age should be less than 55 years.

Critical illness cover with legal and general life insurance has the same basic requirements as a standard life insurance policy. But often comes with other benefits. If you wish, you can add a child benefit to the policy and the additional benefit will not affect your existing policy. If you become permanently disabled, you can claim the full amount of your critical illness cover. Additional benefits will vary, so be sure to read the policy details carefully.

With this best value life insurance cover, you ensure comprehensive protection for your family, securing their future even in tough times.

Accidental death benefit

Accidental death benefit is the payment due to the beneficiary on the death of the insured. This type of benefit is generally payable in addition to the standard benefit payable on death due to natural causes. Accidental death benefits can extend up to one year after the accident. However, these benefits usually stop after the insured reaches a certain age. In such cases, it is best to get additional coverage to offset the cost of the accidental death benefit.

There are many benefits of legal and general life insurance. The company has an excellent record for payment of claims. It also gives excellent rates for serious illness. An accidental death benefit is a particularly valuable feature and is generally available without any medical underwriting. Accidental death benefit is also available with terminal illness policy. The policy can provide coverage up to the age of 95 years. Other benefits include free life cover before buying a home or getting mortgage protection. Additionally, flexible life cover can be purchased without any medical proof. Nurse support services offer second opinions and mental health support.

The most common reason for buying life insurance is to protect a family’s financial future. Most people name their spouse as a beneficiary because of common property laws. However, minor children cannot generally be named as beneficiaries. In such cases, the insurance company will need to manage the funds through a trust. Even if you don’t name a minor child as a beneficiary, an accidental death benefit can provide your beneficiary with the money they need to support themselves and their families.

When looking for the best cheap insurance in Florida, combining a policy with accidental death benefits ensures that you are securing both cost-effective and robust protection for your loved ones.

Premiums

Legal and General’s term plans offer fixed premiums for as low as PS6 per month. The scheme pays out on the death of the named insured person. There are no medical exclusions, and it is suitable for people aged 50 to 80 years. Members can also take out policies with lower premiums, reducing the annual policy fee to $60. Legal and General also offer a discount of up to 5% on the premium when buying a combined policy.

One of the UK’s most popular life insurance companies, Legal & General has won several awards, including the prestigious Moneyfacts Consumer Awards 2020. It also has a 5-star defacto rating. Legal and general life insurance policies offer a wide range of policies from single to joint policies. And it includes critical illness and terminal illness cover as standard. These benefits are a great addition to the policy and can help you get the coverage you need without breaking the bank.

Legal & General was founded in 1836 and paid its first life insurance claim in 1939. It has become one of the largest insurance companies in the world and has more than ten million customers worldwide. Premiums for legal and general life insurance are guaranteed every month. So that when the unexpected happens, you can feel confident knowing your loved ones. If you are worried about paying the premium, read this article for some useful tips.

For best value life insurance, it’s important to compare premium rates, coverage options, and benefits offered by different providers.

Terms of policy

Although not accredited by the Better Business Bureau, Legal & General has a good star rating on TrustPilot. They offer terms up to 40 years as well as universal and term life policies with nine riders. Their customer satisfaction score is average, with few complaints. If you are concerned about the terms of your policy, the legal and general complaint history is not that impressive.

According to many legal & general reviews, policyholders value straightforward terms, affordable premiums, and the ability to customize their coverage based on individual needs.

It usually details the payment schedule, exclusions, and limitations on claims or benefits, including information about the average cash value of life insurance.