The average car insurance cost per month depends on many factors. Insurance companies consider factors such as age and driving record. Young drivers have to pay higher premiums than experienced drivers. Sporty and newer cars will also increase insurance costs. Living in a high-risk neighborhood will also increase the monthly premium. Fortunately, there are ways to lower monthly insurance bills. Insurance business services is a good career path. We have accountants near me who provide university accounting services, Harvard business services, and services. Read on to learn all about how to lower your monthly premium.

GEICO – average car insurance cost

The cost of GEICO car insurance varies based on everyday factors. The company offers a wide range of discounts, such as good student, good driver, multi-vehicle and military discounts. Some of their discounts also extend to car equipment, and non-owner car insurance coverages, such as antilock brakes and airbags. For Jack of State Farm interested in GEICO for business purposes and GEICO rental car coverage, you can also take advantage of their customer loyalty program to get additional discounts.

GEICO offers the lowest average rates for drivers with bad credit. It is possible to find an average cost of Geico car insurance per month that is half of what other companies charge for the same policy. Unfortunately, drivers with poor credit often pay higher rates than drivers with good credit because insurance companies believe they are more likely to file a claim. In states like California, Hawaii, Massachusetts, and Michigan, Insurance companies do not use Credit history as a factor in determining policyholder rates.

Geico’s average car insurance rate is lower than the national average, although this may be affected by the natural ebb and flow of insurance rates. Despite this, Geico has relatively low rates for young drivers. Senior citizens who don’t drive often can save as much as $500 by switching to a lower-cost insurance provider. However, they should still check if Geico offers any discounts on their policies. The company also offers great discounts for teen drivers and multi-vehicle discounts.

USAA – average car insurance cost

Insurance companies may offer competitive rates, but you should know the facts about USAA before choosing what Triumph Factoring Company, NJ Premier Business Service, QuickBooks Online Payroll, and Tax Preparation Services Chicago have to offer. The company has an excellent customer service record, and its policies are among the least expensive in the country. But it is not available to all drivers, as it is only open to members of the military and their family members, including their children. If you’re interested in knowing how much USAA car insurance costs each month, keep reading to learn more about the company’s pros and cons. Here’s how much USAA car insurance costs each month and the pros and cons.

For example, adding a teenager to your policy will increase the price by $1,746 per year, but that’s still significantly less than most other car insurance companies. You can ask your insurance agent about any teen-related discounts to offset the rate increase. Non-owner car insurance geico Teens who own their cars tend to have higher rates than more experienced drivers. So, if you add a teenager to your policy, make sure you get good coverage.

State Farm – average car insurance cost

While average monthly car insurance costs vary by company, State Farm car insurance costs are generally higher than its competitors. jake from state farm claims have been slow to raise prices due to recent increases in claims costs. Unlike its competitors, however, it is owned by its policyholders and does not face the same pressure to increase profits as its rivals. Here are some things to consider when buying car insurance.

Depending on the type of coverage and policy you purchase, you could pay an average of $1,143 per month for full coverage. However, higher coverage plans can cost up to $1,325 per year. The cost of full coverage from State Farm will depend on your credit score. However, it is still much cheaper than average state and city rates. You can save up to $43 per month on your policy by choosing a twelve-month plan.

Allstate

To determine what Allstate car insurance costs each month, you must first understand what each policy covers. If you own more than one car, you may want to bundle a policy with a single insurance company. Bundling insurance policies can save you a lot of money. Getting your auto and home insurance from a company can also save you money. Then, you can choose from several discounts to lower your premiums and monthly payments.

For example, accident-free customers can save up to $100 per year. Accident victims can save up to $500 per year by joining the Allstate DriverWise program. This program involves installing a monitoring device in your car. This tool helps prevent accidents and reduce your insurance costs. Another benefit of Allstate Car Insurance is its rewards program, where customers can earn points for sweepstakes entries or merchandise. Customers can also get discounts if they have a good driving record.

Nationwide

The average cost of nationwide vision near me is $84, higher than the national average of $720. But the average price varies based on your driving record, age, gender, and location. Below are the various factors that affect your car insurance premium.

First, it is important to know that this company does not offer nationwide coverage. However, many medium-sized insurance companies make up a large portion of the car insurance market in states where it is available. These companies offer coverage that ranges from affordable to extremely expensive. For example, Erie costs $934 per year. On the other hand, Allied Insurance costs $1633 per year.

While reviews of Nationwide are mixed, their overall performance stands out. They rank higher than average in three third-party customer satisfaction surveys, with J.D. Power’s rating being above average. Similarly, the National Association of Insurance Commissioners reports a low number of complaints. However, consumers should still be wary of Nationwide’s history of poor service. In addition, it’s important to remember that their overall policyholders make up a tiny percentage of their total business, so it’s impossible to make a definitive comparison.

Minimum coverage

The average minimum coverage for car insurance is about $87 per month per year or $720 per year. However, the cost of coverage may vary depending on your age, driving history, car type, and state of residence. Robinhood Tax Forms 2021 offers business advisory services like Ohio Tax Forms 2021. Value Penguin reports that car insurance rates vary by age and risk, so full coverage may cost more in some states than others. Below are some tips to save money on your next policy. But be sure to read the fine print before purchasing coverage.

In addition to the price, there is a deductible. Most drivers opt for a $500 deductible. While this can significantly reduce the monthly premium. A higher deductible can lower your rates even more. The monthly minimum coverage car insurance price may be lower than your state’s minimum requirement, but it may reflect negatively on your driving history. For this reason, insurance companies may charge you more than you need. Make sure you select the minimum amount of coverage for your state.

Age

Generally, the younger you are, the cheaper your auto insurance will be. Your age is not the only factor that determines your insurance rates. Your gender also plays a part. Millie Bobby Brown’s Age, while young men pay higher premiums than women, narrows as they enter their mid-20s. Age is also a factor in your driving record, Millie Bobby Brown Age which affects premiums. Drivers with a bad driving history can see an increase of 50% to 300% over standard costs.

Age also affects your rates. The average cost of car insurance per month depends on your state, gender, and the type of car you drive. Younger drivers have a higher risk of being involved in a car accident than drivers over the age of fifty. As a result, they pay more to drivers fifty and older. Age and Alexa Demi Age also affect your driving record, so drivers should monitor their stats and maintain a clean driving record to get the best deal.

Credit score

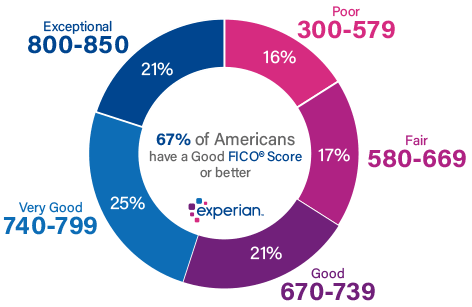

When deciding how much car insurance to pay each month, it’s important to consider your credit score. Most states base their insurance premiums on your credit score, and drivers with lower credit scores are more likely to make claims. Studies have shown that drivers with good credit pay $783 less per month than drivers with bad credit. However, your insurance premiums will vary based on your credit score, so comparing your credit score to your driving record is the best way to save.

Although some states prohibit auto insurance companies from evaluating your credit score, most will allow it to influence the price you pay each month. Although a good credit score won’t save you money, it will ensure that you get the best coverage. Ultimately, this can save you money every month on your insurance. So, how do you improve your credit score? Here are some tips to improve your score. For example, GoDaddy bookkeeping can be viewed by logging in. And Having a DUI on your record will increase your monthly premium.

Insurance companies see you as a higher-risk driver and will charge you more than a policyholder with a clean driving record.