When it comes to Comparison car insurance policies, you have to look beyond the basic coverage. The fine details of each policy can vary greatly. Some cover less and exclude some protections. Others offer extra benefits you won’t find in competitors. Here are some tips to make the process easy. Also, be sure to consider your credit score, as this may impact your coverage and premium. Read on to learn more about the details of car insurance policies.

Getting quotes from multiple insurers – Car Insurance Comparison

If you are in the market for new car insurance it is important to get it. A few quotes from various insurance providers. You can compare their quotes to find out which insurer has the best price. But you should also consider the coverage limits and out-of-pocket costs that each policy offers. To get the best deal, you should get at least three quotes from different companies. This has some advantages.

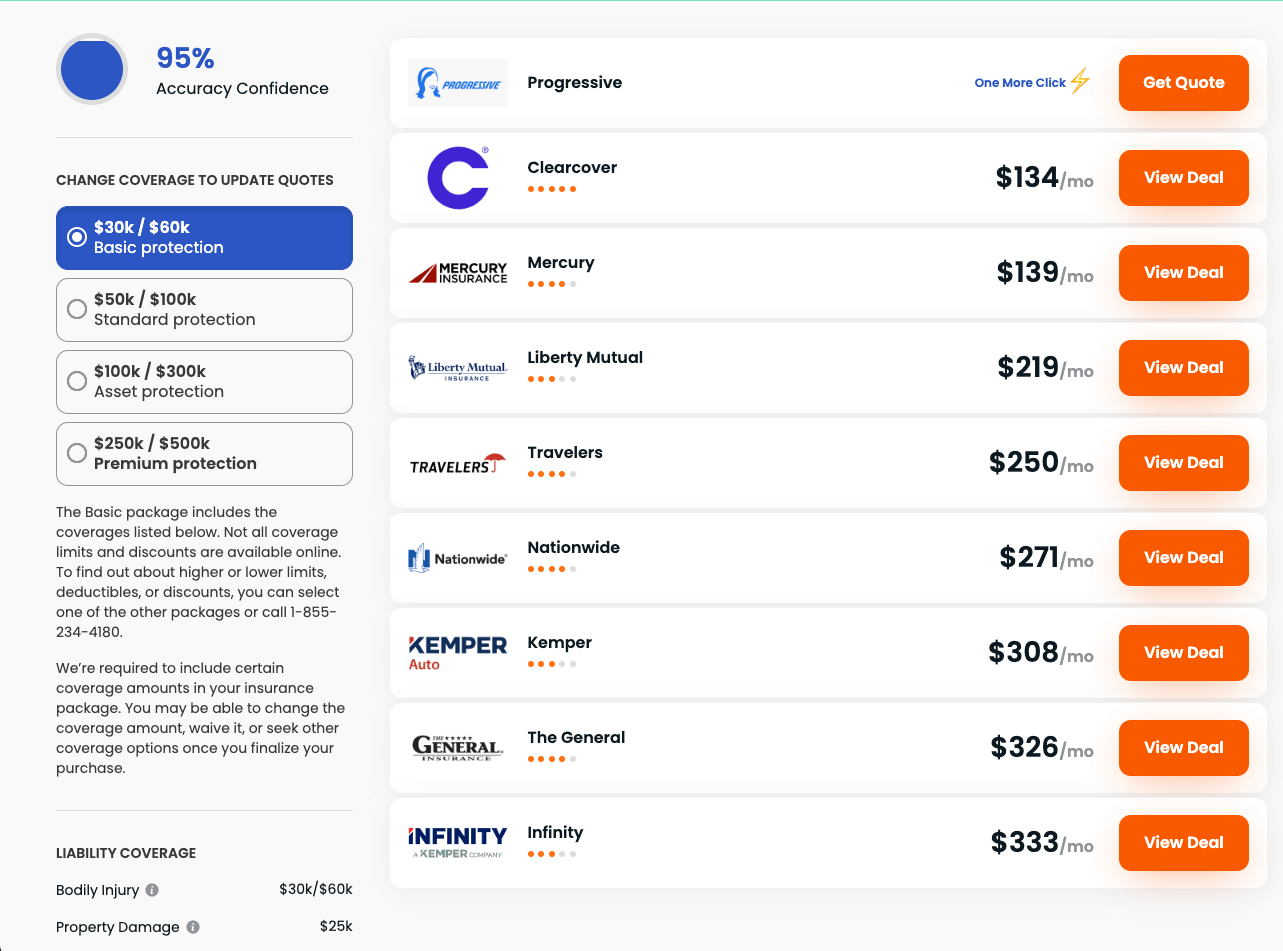

Using an online comparison tool is an excellent way to compare insurance quotes. When comparing quotes, make sure to use the same information. This can be difficult to do if you don’t use the same information from each provider. Also, try to shop around based on the customer reviews of each insurance company. In addition to this, you can also check with your state insurance department to find out if consumers have filed complaints against a particular company. Using a comparison tool like QuoteWizard can help you make an informed decision.

Gabi – The Gabi comparison tool allows you to compare quotes from different insurers. This service requires you to enter your occupation, your annual income, and the make and model of your car. You can get personalized quotes by phone or email from the company. Another useful tool for comparing multiple insurers’ quotes is Policygenius. This company specializes in bundled home and auto insurance quotes. The Gabi team will contact you to provide personalized quotes within 48 hours.

In addition to this, it is important to understand the difference between auto insurance quotes from different companies. Because each insurer assesses risk differently, the rates from different insurers can vary dramatically. However, there are some common factors that all insurers use to calculate the costs of policies. If you have a bad driving record, it may be better to choose another insurer. A higher-risk driver has a lower insurance premium.

Getting quotes from multiple insurers can save you money. The easiest way to do this is to use the internet or visit a local agent. These agents will help you identify your needs and customize the best policy for you. When shopping for car insurance, don’t forget to have the details of your vehicle handy, such as your license number and insurance documents. You can compare proposals and ask questions until you’ve found the right one.

Setting up similar deductibles – Car Insurance Comparison

When setting up similar deductibles for car insurance comparison, keep in mind that some states may raise the deductible to make the premium cheaper. A $1,000 deductible is often the norm, but you should think about the risks. If you have a clean driving record, you may want to consider raising your deductible to avoid financial hardship. If you live in a high-crime area. So increasing your deductible can increase the risk of theft or damage to the car.

When setting the same deductible for car insurance your budget, the value of your car and you need to file a claim. Be sure to consider whether or not. Generally speaking, a high deductible may make more sense for older cars with low values. A lower deductible may be better for high-risk areas or people who rarely need to file a claim. In any case, you should be prepared to pay the deductible before the insurance company will pay for the repairs.

Comparing coverage levels

When shopping around for car insurance, compare the different coverage levels and costs. While a low-cost policy will certainly save you money, you are compromising on coverage levels. Be sure to research coverage limits and deductibles to ensure you’re getting the right amount of coverage for your needs. By following these tips, you can find the best coverage plan for you and your vehicle. Listed below are some tips for comparing coverage levels and prices.

Compare minimum coverage levels for your state. Insurance companies base their rates on minimum coverage levels set by state laws. When comparing quotes, be sure to include information on your car, including its make, model, and year. You may also be asked about how many miles you drive annually. If you have a car that is older than yours, make sure you select a lower coverage level. Some insurance carriers will lower your rate based on your age.

Consider the amount of coverage you need before you choose a car insurance policy. The amount of coverage you need depends on your age, the value of your assets, and your financial situation. For example, a low-value driver doesn’t need high liability limits. On the other hand, someone with more assets or a newer car should choose higher limits. The same goes for comprehensive coverage. If you are looking for an affordable insurance plan, consider adding an optional policy.

When comparing coverage levels when buying car insurance, compare the coverage levels and rates offered by several insurers. Depending on the coverage you need, you may find a lower rate when you add extra coverage, such as uninsured motorist property damage and collision. However, you should ensure that the policy shows the same coverage details, as different insurance companies may offer different discounts to attract customers. Also, read reviews of insurers. You can learn about the company’s claims process and customer service.

Considering credit score

If you are looking to insure your car, you’ll want to compare rates for different types of coverage. Your insurance premium is affected by several factors, including your credit score. In some states, your credit score is not used in calculating your rate, but it can make a big difference. To make the most informed decision, you should shop around for several different quotes from different providers. This way, you can ensure that you’re getting the best deal possible.

Your credit score plays a key role in predicting whether you’ll file a claim on your policy. It is a strong predictor of future accidents. It is more powerful than any other factor. According to a recent study by Progressive Insurance, consumers with the lowest credit scores are twice as likely to file a claim. Having a poor credit score also means that your car insurance rates will be higher than they would be if you were on a perfect driving record.

While a poor credit rating may raise your insurance rates dramatically, good credit can lower them significantly. Depending on your ZIP code, age, and driving record, having a good credit score can save you hundreds of dollars per year. Additionally, many insurance companies have specific guidelines for drivers with bad credit. And they won’t offer you coverage if your score is below average. To make the process even easier, you can get a car insurance comparison with the help of online tools.

Your credit score is essential because you don’t want to pay more than you have to. Insurance companies won’t penalize you for checking your credit score – they encourage it. Moreover, your credit score is an indication of your responsibility and risk. A driver with good credit is less likely to cause an accident. Fortunately, it’s not that hard to find affordable insurance. You just have to know how to compare quotes.