Choosing car insurance for seniors can be confusing. You can choose between Geico, USAA, Esurance, or AARP. But which one is the right choice for you? Read on to find out which insurance company offers the best rates for seniors. You might be surprised at how affordable car insurance can be! And remember: the best car insurance for seniors does not necessarily mean the most expensive policy. The best insurance for seniors is affordable and offers peace of mind.

Geico – Car Insurance for Seniors

If you’re an older driver, you’ll want to consider GEICO’s car insurance for seniors program. The company’s DriveEasy program, available in many states, will track your driving habits and give you discounts for safe driving. You can expect to pay higher rates for more dangerous driving. But you are guaranteed to keep your policy for as long as you want. Geico offers several options for seniors to choose from, including a policy that will automatically renew every year.

GEICO also has a low-mileage program that lets older drivers pay less per mile driven than younger drivers. Geico’s DriveEasy program is a unique feature that analyzes driving data to provide you with a personalized quote. By providing your driving data to this program, you can avoid paying installments on your policy. As long as you drive safely, you can be guaranteed a lower rate for your Geico car insurance for seniors.

GEICO offers many discounts for older drivers, including safe driving and AARP membership. These discounts can help you save money on a new or used car and won’t increase once you’ve had an accident. GEICO’s discounts also apply to other types of coverage, including collision and comprehensive, which protect your car in the event of damage outside of an accident. You may also want to consider purchasing full coverage car insurance for seniors. This can help you protect your nest egg in case you need to replace it.

If you’re an older driver, you may want to consider State Farm car insurance for seniors. This insurance company has local agents in every state. You’d be surprised how affordable State Farm can be. But it is not the best option for everyone. Besides GEICO, State Farm also offers several discounts, including the popular Allstate Rewards program, which awards safe driving. The company also has a Milewise program and Drivewise.

Geico car insurance for seniors differs from other car insurance plans. Rate quotes will depend on several factors, including your age, the type of vehicle you drive, and your coverage needs. By comparing multiple quotes, you’ll be able to find the best rate. A typical Geico senior policy is based on liability insurance, 100/300/100 liability insurance, comprehensive coverage, and collision coverage. You can choose a policy that offers the best combination of these features and more.

USAA for car insurance for seniors

When you get a quote from USAA for car insurance for seniors. You will then be prompted to provide your SSN. After that, you can answer a few questions about the safety features of your car and the types of coverage you need. It then shows you your personalized quote, including price comparisons with other car insurance companies. Moreover, you can even add additional drivers to your policy to reduce the premium.

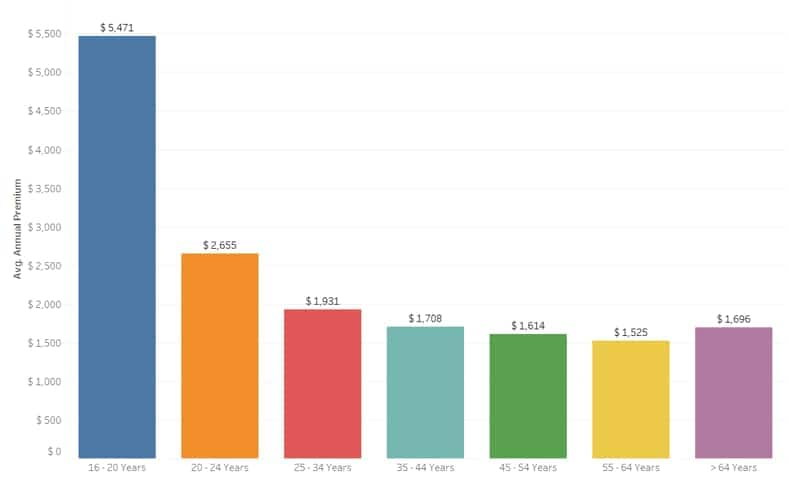

You’ll pay a premium based on a variety of factors, including your age and type of car. You can expect to pay more even when you are probably the safest driver. If you have accidents, get premiums, move volition or even get a DUI. Your location also plays a role in your rate, including the ZIP code and the risk of severe weather. If you’re moving to a new area, consider using a cost of living tool to compare car insurance rates in your area.

Car insurance rates increase with age, so it’s important to compare prices before choosing a policy. Consider available discounts and renewal guarantees, which many companies offer. Seniors can also take advantage of other discounts that might be available to them, such as low-mileage discounts and a no-claims bonus. Moreover, if you’re retired and don’t commute to work, you can even qualify for a low-mileage discount. Just remember to compare quotes and choose the best company.

The cost of auto insurance for seniors can be very affordable or very expensive, depending on their age and the type of car they drive. For example, seniors who are 65 and over tend to have higher accident rates than drivers in their younger years. Additionally, older drivers are more expensive to treat after an accident. Luckily, car insurance for seniors provides coverage and peace of mind. But how do you choose the right plan? You should consider your income, type of vehicle, and savings before you choose a plan.

Another difference between USAA and GEICO is the amount of discounts available. GEICO is more affordable overall and offers several discounts. However, USAA doesn’t have many unique discounts, including a military discount. In comparison, the best deal for senior drivers is to go with GEICO. Its best deals include discounts for good student discounts, low mileage, and defensive driving. You can also take a defensive driving course to lower your insurance rates.

Esurance

As a senior citizen, you can take advantage of the auto insurance benefits provided by Esurance. Its policy covers disabled drivers and passengers for up to $4,000, but these benefits are only beneficial if you can still drive. Esurance’s website is easy to navigate and offers helpful information about car insurance for seniors. You can also find out your policy details and payment schedules online, through their mobile smartphone app, or by calling their customer service representatives. If you prefer a paper bill, you can request it for a small fee.

You can also compare rates through independent brokers. However, online shopping is quicker and gives you more control. You can compare rates by ZIP code. When comparing rates, make sure to choose an insurance policy that is appropriate for your needs. You should avoid coverage that is too high or too low. The same goes for disclosing any personal information, so be sure to check all the details before you buy. The best way to get an accurate quote is to compare rates and benefits.

You should know that senior drivers are more likely to have accidents than middle-aged drivers, and this increases the price of car insurance for seniors. The CDC reported that drivers 65 and older were involved in the car Seven times more accidents than middle-aged drivers. According to the CDC, there were more than 1 million crashes among older adults in 2018. Additionally, more than 250,000 people have been treated in emergency rooms for traffic-related injuries. Car accidents kill and injure an average of 27 adults every day.

Another good way to lower the price of your policy is to be a good driver. For example, you may want to check out the Esurance car insurance for seniors program. They have several different discounts available to senior drivers. And you may already have a car, but not the one you need. So, you’d better be a good driver. This insurance company gives you discounts for good driving.

AARP

AARP car insurance for seniors is quickly becoming a popular choice among older drivers. It has a large customer base. That’s why many senior drivers in new locations feel encouraged to sign up for a plan. There are many benefits to signing up for AARP car insurance for seniors, including discounts on auto insurance and roadside assistance. AARP is available in most states and can be purchased through specialist insurance agents.

Hartford’s AARP Auto Insurance offers several discounts for seniors, including a waived lower deductible for up to two cars or homes. It also offers a 24-hour claims hotline and guaranteed premium rates for 12 months. It covers reasonable expenses such as taxi fare and food if you are stranded more than 100 miles from home. Furthermore, you’ll have access to Hartford’s AARP Advantage Plus program, which covers a variety of benefits.

Another benefit of AARP car insurance for seniors is that the basic plan comes with medical payment coverage and personal injury protection (PIP). which covers the injuries you may sustain in an accident. PIP doesn’t matter who was at fault and will cover your medical bills and other expenses associated with the auto accident. These benefits can give seniors peace of mind during difficult times. AARP car insurance for seniors is a great option when you’re on a tight budget.

In addition to discounts for senior members, AARP also offers auto insurance policies for seniors. which is specifically for this demographic. Seniors can combine their auto and home insurance policies with Hartford to save money on car insurance. They’ll also receive discounts for safety features and energy efficiency. As a bonus, AARP members can even bundle these two insurances with home insurance to save even more money. Hartford also offers a loyalty discount for AARP car insurance.

AARP car insurance for seniors from Hartford is a popular option for those over 50. They offer a range of car insurance discounts as well as excellent claims service. They also have a 24-hour hotline and a robust online portal and mobile app. If you’re an AARP member, you can get a 10% discount on premiums through Hartford. In addition to the best rates, Hartford also offers personalized service and discounts for members.