In Stirling, N.J., a woman with a clean driving record would pay $1,302 for full coverage car insurance. That includes liability, uninsured motorists, personal injury protection, and comprehensive and collision coverage. Dropping the latter two can save her $496 a year. This example also shows the difference between comprehensive and collision coverage. Full coverage car insurance costs more than half the amount of liability.

Geico

If you’re looking for a cheap full coverage car insurance policy, GEICO might be the right company for you. This company offers several discounts for drivers with bad driving records, including a discount for states that require FR-44 or SR-22 forms. While most companies won’t cover a person with either of these forms, Geico does. If you’ve had several infractions within the last three years, you’re a high-risk driver and more likely to file a claim.

While these discounts are great for many people, you may not need the maximum liability coverage. Having a higher deductible can reduce your premiums in the short-term, but you should remember to purchase the right amount of liability coverage to be safe. Geico and Progressive have the best cheap full coverage car insurance for bad drivers. Even if you’ve received multiple moving violations, they’ll give you the lowest rates.

Although most people don’t think of their insurance policies as cheap, GEICO’s full coverage policy can be very beneficial if you’re driving a sports car. The average cost of this type of insurance is $1,268 a year, and the monthly premium is as low as $106. To find the cheapest car insurance for you, try to get several quotes and compare them. The best way to compare different quotes is to do your research and determine if Geico is the cheapest full coverage car insurance company in your area.

Geico’s cheap full coverage car insurance isn’t as competitive as other companies, but the customer service level is great. It ties with Farmers and USAA when it comes to customer service. In December 2018, Geico’s financial strength was affirmed by Moody’s investor services. Because of this, Geico has solid financial strength and pays out its claims. You’ll be happy with Geico’s cheap full coverage car insurance, but there are some things you should know before signing up for this plan.

State Farm

State Farm has been in the car insurance business for decades and offers the lowest rates around. Its Steer Clear(r) program rewards safe driving and reduces rates. Drivers can take the program online or through an agent. The Steer Clear app can also be downloaded to your smartphone to save even more. In addition to its insurance policies, State Farm offers a wide range of resources for car owners, including account management, financial literacy, and driving tips.

Full coverage car insurance covers bodily injury liability, property damage liability, medical payments, rental cars, and more. Other benefits include emergency road service, which covers the costs of travel or lodging while your car is being repaired. Travel expense coverage, which reimburses you up to $250 for an emergency road trip, is also offered by State Farm. These benefits vary depending on the state and driver’s age, but the minimum limits are usually the same for men and women.

Many drivers can get lower rates with State Farm because they have several cars insured with the company. Other factors include good credit and accident-free driving, which can lower your insurance rates. Also, State Farm customers can use Jerry, a free app that pulls quotes from 50 of the nation’s top insurers in less than a minute. If you’re not sure whether State Farm is the right insurer for you, start by reviewing these discounts first.

The rates for full coverage are 23 percent lower than the national average. This is an outstanding savings when you consider the cost of an accident. This is a good rate for a full coverage policy, but it should be noted that the price of the policy depends on the type of accident you’ve had and the cost of repairs. However, you should still get several quotes and shop around until you find the best deal. If you have a history of accidents, consider State Farm, which will be the most affordable option.

USAA

USAA car insurance is affordable, and the company offers many discounts for members. In fact, they offer the most discounts, at 38. The company also offers many easy discounts, such as automatic billing. Other discounts include additional program coverages like rental car reimbursement. You can save money with USAA by shopping around for your auto insurance. However, keep in mind that you’ll pay higher premiums if you want all of these benefits.

As one of the top insurers in the country, USAA car insurance policies are some of the lowest nationwide. Its high customer satisfaction scores are reflected in the fact that 86% of respondents would recommend the company to other drivers. In fact, USAA has the highest customer satisfaction ratings of any car insurance company, and is a good choice for active and retired military. If you are considering USAA car insurance, read on to learn more about it.

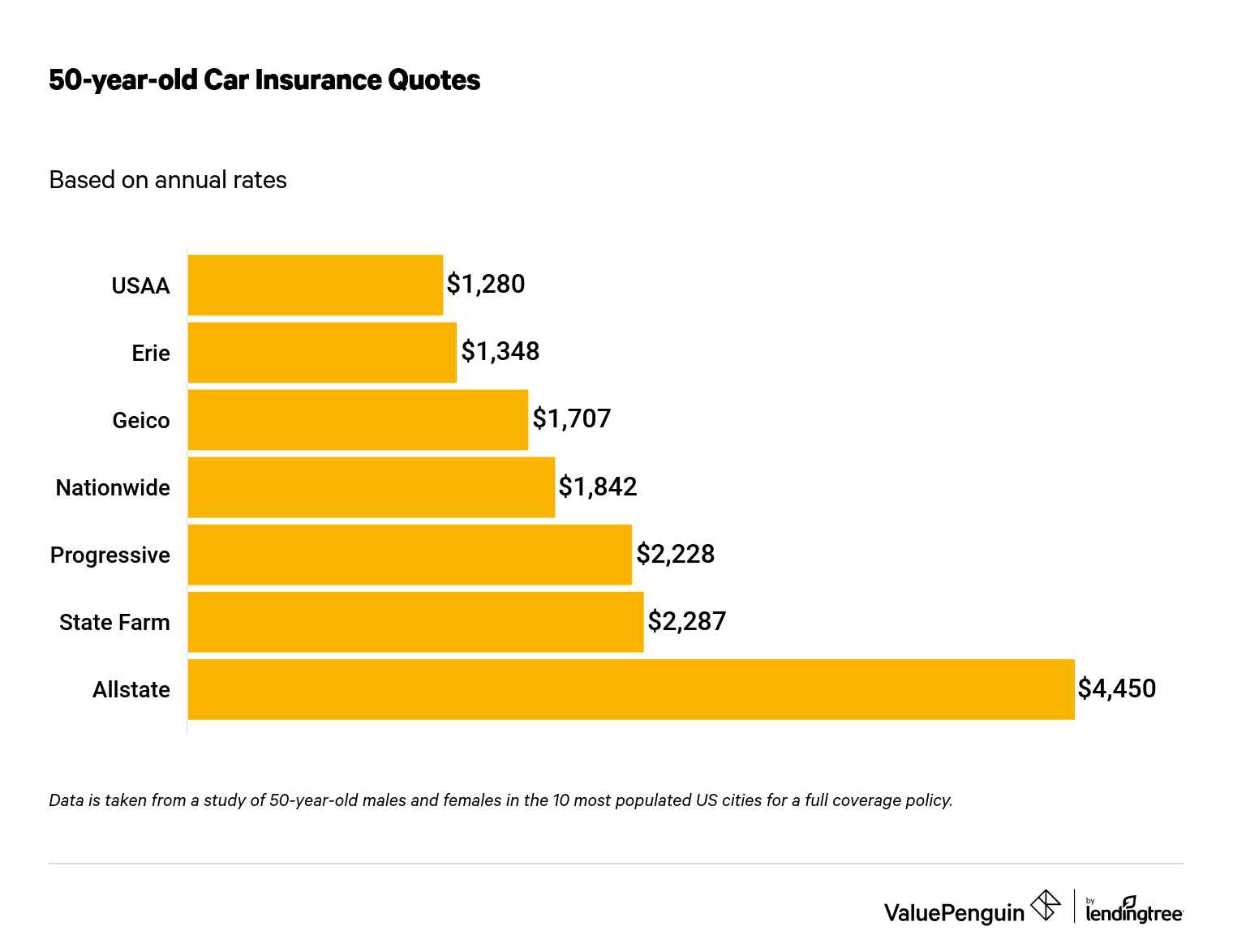

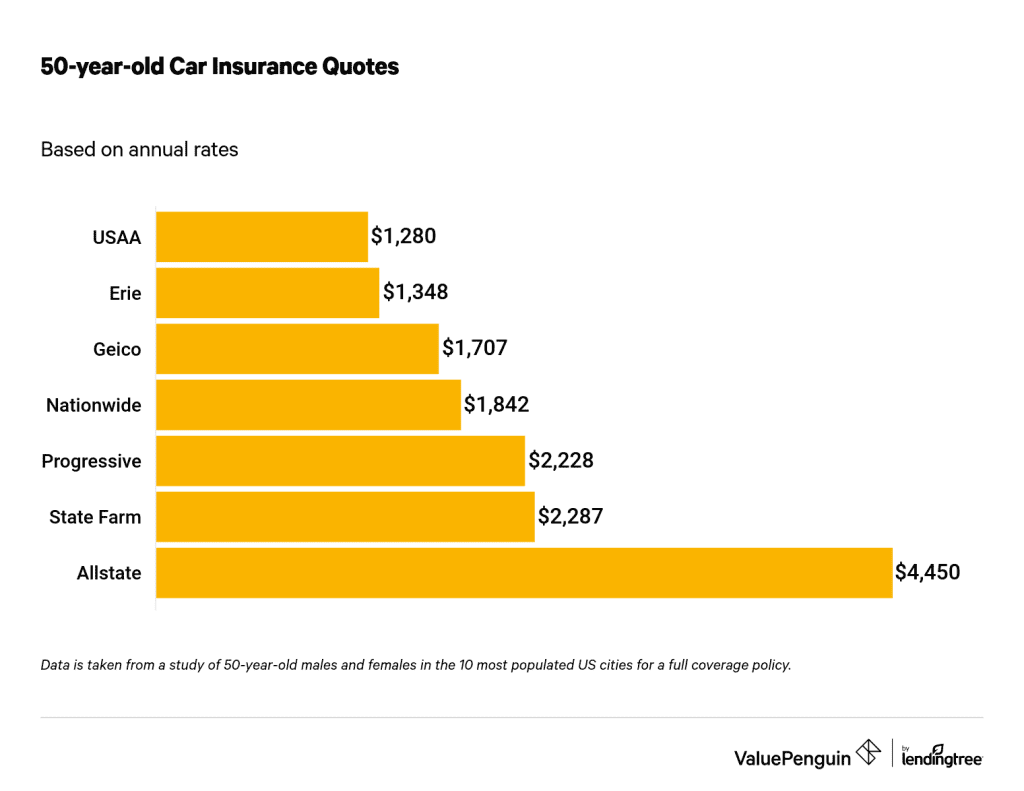

In comparison to GEICO, USAA’s cheap full coverage car insurance rates are the lowest after a speeding ticket. Policyholders with clean driving records can pay $324 less per year. Discounts for air bags, seat belts, and defensive driving courses can also help you save money. USAA is the cheapest full coverage car insurance company for military members, but it’s worth noting that the company offers this type of service only to those in the military.

In the past four years, USAA has steadily increased its market share, from about 1 percent to a record of more than six percent. That growth rate is very good for a company, and is indicative of how well it can fulfill its insurance obligations. However, the company does have some complaints, which is normal for any company. While this is not an indicator of how happy its employees are, it may be a factor in the low BBB rating. Moreover, the company’s complaint index could be indicative of recent government actions against the company. In early 2019, the Bureau of Consumer Financial Protection filed charges against USAA, citing violations of regulations such as the Electronic Fund Transfer Act (EFTA).

Progressive

The price of your car insurance policy will vary depending on a few factors, including how many teen drivers you have, your driving record, and other personal information. However, on average, Progressive premiums are lower than the national average for drivers of a similar age and gender. As with other insurers, Progressive also offers a deductible savings bank for customers to reduce their premium costs every six months. You can also compare prices online by entering specific information about your vehicle and driving habits.

If you are interested in saving money on car insurance, try signing up for the Progressive Snapshot program. By participating, you’ll receive a discount of around $146 per year. Moreover, you can get a discount if you don’t drive much or drive at night. According to a recent study by J.D. Power, Progressive scored 856 points out of 1,000. Other companies such as Geico and USAA scored lower than the average, and this one of the best ways to get cheap car insurance is to join the Progressive Snapshot program.

However, the overall satisfaction of the company’s customers is below the industry average. However, some drivers may find the rates more competitive than the national average. In addition, the company offers a customer portal that allows customers to manage their policies and review coverage. If you have a question, you can always email a representative, who will answer your inquiry as quickly as possible. You can also call or email them at any time.

In addition to the aforementioned benefits, Progressive also offers rideshare insurance. The coverage extends beyond your personal auto policy to cover the time between accepting a ride and dropping the customer. As long as you’ve had a clean driving record for five years or longer, Progressive won’t raise your premiums. The company also offers discounts for adding teenagers to your policy. It is important to note that the cheap car insurance offered by Progressive is only applicable in certain states.

Erie

There are several ways to get cheap full coverage car insurance in Erie. For example, you can get multiple vehicle discounts by bundling several insurance policies with the same company. Another way to save money on your insurance is to sign up for an annual payment plan. With this plan, you pay your premium in advance and can receive discounts on a number of different coverages. In addition to these benefits, full coverage also covers your medical bills in the event of an accident.

If you’re a young driver, it’s important to shop around for a good rate. The average minimum-coverage car insurance policy in Erie costs $807. This is over 54% less than the state average. If you’re a young driver, you can get the minimum-coverage policy for $1168 per year from Erie. Likewise, if you’ve had an accident in the past, you’ll pay less than the average policy.

In addition, married drivers experience fewer accidents on average and are less of a liability to insurers. Young drivers with no traffic violations are also likely to have lower rates. Furthermore, insurance companies in Erie have the lowest rates for young drivers. Those with recent speeding tickets should look for a policy with full coverage PA. State Farm has one of the cheapest car insurance policies in Pennsylvania at just $1155 for the year. However, you may be required to pay an additional 14% in case of a speeding ticket.

Erie also offers the cheapest full coverage car insurance in Pennsylvania. You can get a full coverage policy for $120 a month through Erie, while competitors like Allstate, State Farm, and USAA offer cheaper policies if you’re older. If you’re younger, you can also save by shopping around and taking advantage of car insurance discounts. If you’re older, you can also opt for minimum coverage to lower your monthly cost.