If you are considering suing Colonial Life or Unum for disability or cancer insurance, it is important to know the claims process governed by ERISA. A disability attorney will gather evidence to support your case. He or she will also create a record of positive information you can use in court to get Colonial Life to pay you a fair settlement.

Unum

In the United States, Unum is the largest provider of disability insurance. Its products include disability insurance, life insurance, accident insurance, dental and vision care, stop-loss insurance, and absence management support. It also offers disability insurance plans in Europe and Latin America. Unum offers individual and group disability insurance policies. However, many of their clients have decided to process a claim and seek disability insurance coverage elsewhere.

One of the biggest complaints about Unum is the intrusive nature of its field representatives, who often go to people’s homes unannounced to conduct interviews with them. These representatives often feel unwelcome and often encounter hostile interactions. However, COVID has reduced Unum’s home visits.

If UNUM denies your claim, you should understand the details of the denial. Your denial letter from UNM will list your rights and deadlines for appeals. Until you exhaust all internal appeals, you will not be able to reap the benefits. Consequently, it is imperative to consult with an experienced disability insurance attorney as soon as possible.

The terms and conditions of your policy also vary. Depending on the state you live in, some states do not require this. UNUM’s website may not meet these requirements. Its website contains information that is protected by copyright law. Unum owns the copyright in the selection, arrangement, and enhancement of the Content. Therefore, you may not change, modify, or delete any content found on the Unum website.

The ERISA-governed claims process for Colonial disability insurance claims involves several key steps.

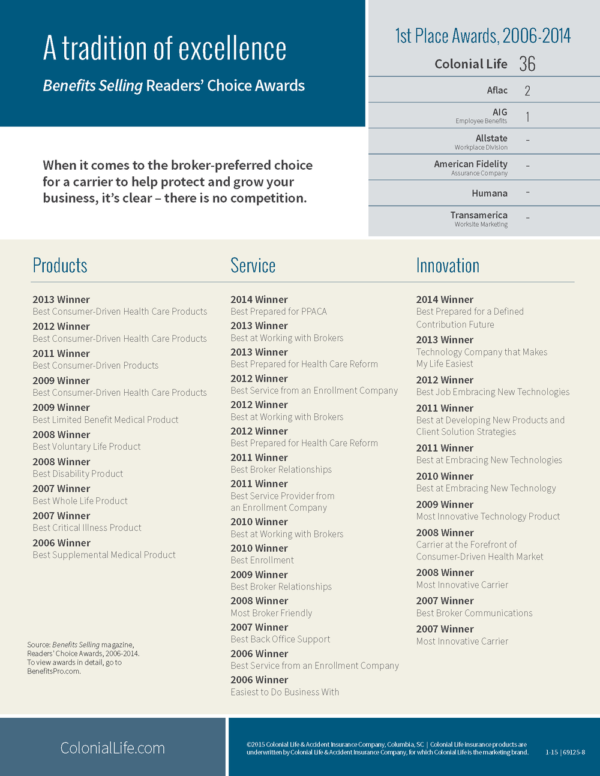

Colonial Life

You may have been offered disability insurance by your employer. Colonial Life offers both individual and group disability insurance policies and you can supplement your employer’s plan with a Colonial Life policy. Most Colonial Life disability insurance policies are short-term and individual policies are portable. But be aware that some of these policies have exclusions. If you’re not sure, talk to a benefits advisor.

When it comes to filing a disability insurance claim, you should make sure you fill out all the necessary forms. The claim form for Colonial Life consists of three sections. You need to fill out a claim form that includes your employer and attending physician information. You also need to fill out a form giving the company permission to access your medical records. Make sure you sign the correct places on your form. If your claim takes longer than expected, it’s best to make sure you get written confirmation of it.

You can also consider adding an individual policy with the same benefits as an employer-provided plan. This way, you can cover yourself for the unexpected, while at the same time offering complementary benefits to your employees. The good news is that this type of insurance is not impossible to obtain. And many employers now provide it to their employees through payroll deductions.

If you are unable to work for more than 90 days, you may want to consider short-term disability insurance. These policies can help you replace some of your income when you are unable to work. This policy can provide you income protection for up to 3 months, but it does not provide long term disability insurance. However, they offer many flexible benefits including the option of premium waiver after 90 days.

Colonial disability insurance reviews and understanding the Colonial Life disability policy are important resources for navigating this process.

Cancer insurance

Cancer treatment costs can be high, so a major medical health insurance plan can be a useful safety net. Colonial Life’s cancer insurance covers these costs as well as annual screening tests. The company also offers optional riders to provide additional coverage during the initial diagnosis and hospital stay phase. This insurance is payable directly to the policyholder and many plans are portable. For example, some plans can be made regarding a new job.

The policy may cover a limited number of cancer treatments. Its exclusions and limitations vary by state, so you should check with your insurance agent before purchasing a policy. In many cases, this insurance can help cover unexpected medical expenses, such as emergency room fees, deductibles, and copayments. In addition, the policy may pay benefits for specified cancer screening tests. You can find out what benefits you can get in your policy by talking to your benefits counselor.

Depending on the coverage plan, you may be eligible for a lump sum payment in the event of a cancer diagnosis. The policy may also provide a lump sum benefit if you die of a cancer-related illness. You may also wish to get a life insurance policy that pays out a lump sum in case of death due to cancer. This policy will also save your family from financial hardship.

Regardless of your coverage age, it’s important to save enough to pay for the treatment you receive. It is important to understand that cancer can strike at any time and without warning, making it difficult to cover the cost of treatment. However, with cancer insurance, you can rest easy knowing you have coverage. If you have an emergency or medical problem, the insurance will cover the cost until funds are available.

Understanding the specifics of your Colonial Life disability insurance policy is crucial in this process.

ERISA-governed claims process

A common scenario is the ERISA-driven claims process for total disability insurance. A customer has applied for benefits through Colonial Life and has been rejected. In this case, the person can appeal against the insurance company’s decision before filing a claim. The company will send a letter to the customer stating the reasons for the denial, the appeal process, and the deadline for the claimant to file an appeal.

The company also offers individual policies that supplement group policies covered by ERISA. Generally, these policies cover short-term disabilities. Because of this, they are portable. When employees leave a job, they can take their policies with them. However, they must see a doctor for proper diagnosis and treatment before they are eligible for benefits. If the disability requires more medical care, coverage is likely to decrease.

If you receive a denial letter, you should seek legal representation immediately. While many employers may attempt to cite ERISA provisions in their denial letters, it is important to rely on an attorney during the appeals process. Additionally, you may not submit additional materials after filing an appeal. Getting your appeals right is key to winning in federal court.

The ERISA-governed claims process for estate insurance is separate from federal litigation. In an ERISA-governed claims process, the insurance company pays the employee any outstanding benefits. There is no hearing or testimony. Additionally, claimants are not permitted to testify in court.

The ERISA-governed claims process for Colonial Life disability insurance involves several key steps under ERISA claims procedures.

Pre-existing condition exclusion

If you are a disabled worker, you may be concerned about pre-existing condition exclusions in your federal disability insurance policy. While many companies require medical exams before offering disability insurance, this is not always the case. Colonial has an appeals process, but most policies require an appeals period before a lawsuit can be filed. The appeal period is the claimant’s only opportunity to provide additional medical information. Once the appeal period is over, the claimant may not provide further medical information.

While it is true that Colonial Disability Insurance Company’s policy prohibits coverage for “pre-existing conditions,” the plaintiff’s medical treatment fell within that period. Whether or not this is a valid defense depends on the specific facts of the case. The case will be decided on how the insurer applies the policy’s exclusion. For example, if the plaintiff has multiple sclerosis and receives medical treatment for the condition, she is not entitled to benefits under Colonial’s disability insurance policy.

The definition of “pre-existing condition” is broad. It also includes illness, accident, mental illness, pregnancy, and substance abuse episodes. The policy must have coverage for these conditions when it first starts, so be sure to review your medical records for confirmation of any pre-existing conditions.

This pre-existing condition exclusion is often difficult to apply to immigrant disability insurance, but you should still try. Remember that to get a disability insurance policy, you have to meet certain standards. The criteria for the pre-existing condition exception are relatively narrow and you must meet those requirements to receive coverage.

Colonial disability insurance reviews provide valuable insights into policyholder experiences with claims processes, customer service, and overall satisfaction.