When shopping for a funeral insurance policy, you may wonder what makes Colonial Penn Burial Insurance a good choice. This article will answer your questions about this company, the types of plans available, and the complaints filed against the policy. You can also know more about the death benefit limit of the policy and what other policies it offers. Finally, you can compare Colonial Penn’s coverage with other companies’ policies to make sure you’re getting the best deal.

Life insurance company

Colonial Penn Life Insurance Company is an American life insurance company based in Philadelphia, Pennsylvania. It was founded by Leonard Davis and is now owned by CNO Financial Group. Company founder Leonard Davis formed the company in 1865 and continued to oversee its operations. If you are thinking of buying a policy from the company, you can read this review first to know more about it.

There are two main points to consider when considering a colonial pen. First, you should know that the company has a higher financial strength rating than other life insurance companies. AM Best assigns grades from A++ to D to life insurance companies. For 2021, Colonial Penn received an A-, which means the company is financially strong. Although this is a high grade, it still falls short of being the best in the industry.

If you have a history of health problems, the best policy to consider is a guaranteed acceptance policy. This type of policy does not require medical examination and the death benefit is low. It can help people with health problems. If you do not use the policy in the first year, it may be cashed out. Supplementary health insurance plans are available that allow you to choose the amount of death benefit that suits your budget.

While Colonial Penn offers life insurance coverage without a medical exam. Its website then has negative reviews. Some consumers reported that Colonial Pay denied their application for coverage because of their current health or past medical history. The company’s website also lacks important information, including how to file a claim online.

Additionally, Colonial Penn life insurance Medicare supplement plans are available. For more insights, you can check Colonial Penn life insurance $9.95 per month reviews and be aware of any Colonial Penn life insurance lawsuit information to understand customer experiences better.

Death benefit limits

Death benefit limits on Colonial Penn burial insurance vary based on your age, gender and location. A woman in her fifties would receive a death benefit of $15,072 if she purchased 8 units of coverage. A man would receive a death benefit of $16,664 if he purchased the same amount of coverage, but the same policy would provide a death benefit of only $12,968 for a woman in her sixties.

Another disadvantage of Colonial Penn’s death benefit policy is that if you die within the first two years, it will not pay the full death benefit. Instead, it will reimburse your premium less than 7% interest. This may not be enough to provide financial security to your family, especially if you are an elderly person. However, other life insurance companies offer higher death benefit limits and do not require a waiting period.

Although most people do not need such a large amount of burial insurance, some consumers were not happy with the $50,000 limit. The company’s no-check policy and friendly customer service are also notable features. However, some users complained that their beneficiaries did not receive their checks on time. Finally, burial insurance can help cover expenses and unpaid debts and help your family with funeral expenses. The best way to find a burial insurance policy that fits your budget is to compare policies side-by-side.

For more details, check a comprehensive Colonial Penn life insurance review to understand these limits better.

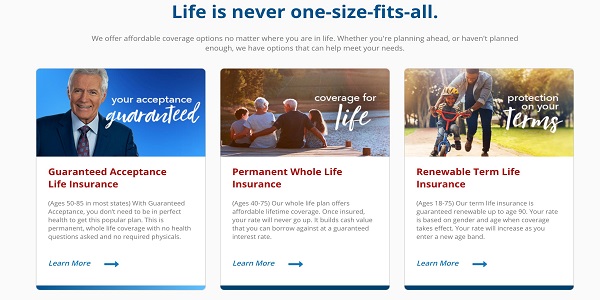

Available plans

Colonial Pen offers several plans including whole life insurance, guaranteed acceptance policies and term life insurance. All these plans require no medical examination and can be renewed indefinitely. If you are over 40 or 50 you can also opt for living insurance payout. Despite the limited underwriting criteria, Colonial Pen’s premium is affordable for healthy people.

The cost of Colonial Penn burial insurance can vary greatly but is competitively priced with many other providers. Its policies help your family pay the final expenses after your death. They may not be the cheapest, but their whole life insurance plans can be on par with some of the most popular plans from other providers. However, you should consider your individual needs before choosing a plan. Although Colonial Pen’s plans are not the cheapest, they offer a lot of features.

Premiums are higher than other burial insurance plans, especially whole life plans, but this may be worth it if you are young or healthy. The colonial pen scheme comes with several features, including the guaranteed acceptance facility. The coverage amount can be as high as $20,000, but it is less. The company sells these plans through its own company, so you won’t find any independent life insurance agents selling the product.

However, it’s essential to research thoroughly, including any Colonial Penn life insurance lawsuit information, before deciding.

Complaints about policy

There are many complaints about Colonial Penn’s burial insurance. They have an unusually high number of complaints compared to other companies in the industry. The company is a member of the National Association of Insurance Commissioners (NAIC) and tracks customer complaints to create a complaint index. This index compares consumer complaints about insurance companies of similar size and type. However, complaints about Colonial pens may not reflect the quality of the company.

The company is accredited by the Better Business Bureau and has an A+ rating. However, the company has accumulated more complaints than average in the last three years. Most consumers complain about pushy salespeople and denial of policies based on guaranteed acceptance. Customers have also complained about the lack of support during the 30-day no-obligation period.

Colonial Penn offers two primary burial insurance plans: Guaranteed Acceptance Whole Life Insurance and Simple Issue Whole Life Burial Insurance. Guaranteed acceptance of whole life insurance is the most popular plan and requires the applicant to answer questions about their health. The simple issue of whole-life burial insurance is a different story. Although you can get a policy through Colonial Pen, you must answer health questions before submitting your application. Colonial pens are also widely advertised.

While Colonial Penn’s flagship policy is relatively inexpensive (about $9.95 per month), it doesn’t cover the entire cost of a funeral. A more effective approach is to work with an independent life insurance agent to compare policies from different companies. If you do, you may be able to get a competitive quote on the same type of policy. There is also a big difference between Colonial Pen’s premium and its competitors’ pricing.

Complaints about Colonial Penn are mostly about their aggressive recruitment of seniors. In addition to aggressive advertising, the company has A.M. Not rated by At best, the company is therefore not rated as highly as some other insurance companies. If you have any questions or concerns, be sure to contact an independent agent or the Better Business Bureau before settling with Colonial Penn. You will be safer in the hands of someone with vast experience in this industry.

By carefully comparing Colonial Penn reviews and other life insurance options, you can make an informed decision that best suits your needs and budget.