What are the benefits of comprehensive and collision insurance? Let’s find out what these policies cover. What are their deductibles and are they worth the money? The average cost of collision and comprehensive coverage should be equal to the total value of the vehicle. If your vehicle is worth $2,500, it doesn’t make sense to choose a $500 deductible. There are other benefits of comprehensive and collision insurance.

Cost of comprehensive and collision insurance

How much should comprehensive and collision insurance cost? As a general rule, the amount you must pay per month should equal about half of the car’s value. However, this average will be less if the car is older or has a lower value. The amount you must pay each year may be significantly less if you have a low deductible. Therefore, it is crucial to understand the ramifications of high deductibles before choosing a collision and comprehensive insurance plan.

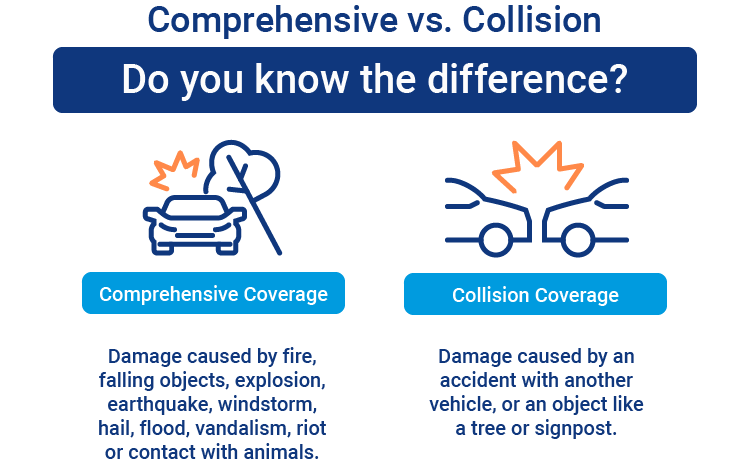

What types of damage are covered? Comprehensive coverage will pay for repairs if you hit another vehicle, but collision coverage pays for all damages to your car, including damage caused by potholes or contact with an object. This coverage pays for repairs and full replacement of your car in the event of an accident, minus the deductible amount. The cost of collision and comprehensive insurance is typically $290 per year, and it will cover damages incurred by objects, such as potholes and other road debris.

When comparing rates, consider what kind of coverage you want. Comprehensive insurance is typically cheaper than collision insurance, but you will have to pay more out of pocket if you need it. If you’re looking for a cheaper insurance policy, you can opt for a $500 deductible and pay less out of pocket. In searching for the lowest premium, however, it is important to check the deductible amount before making a decision.

If you’re purchasing a car on a credit card, you’ll almost certainly need comprehensive coverage. Your lender will likely dictate the deductible amount. If you’re buying an outright car, the decision may depend on whether or not comprehensive coverage is worthwhile. But comprehensive coverage protects you against damage caused by fire, weather, and theft. Therefore, if you’re buying a car on your own, you should consider purchasing comprehensive and collision insurance. It’s worth the extra money.

No rule says you need to buy both types of car insurance. Collision coverage is not mandatory, but it is a great option if you are unable to repair your car. Collision insurance costs about $290 per year. Your rate may vary depending on your driving history and the car you drive. This article examines the cost of collision insurance and explains why you should consider getting it.

Coverage is provided by comprehensive collision insurance

If you have collision coverage, you can add additional coverage for accidents you’ve been in. You can’t add collision coverage if you don’t have comprehensive coverage. If you have both the other driver should have enough insurance to cover the cost of the accident and their insurance is reduced. If not, you still have to pay the deductible. Choosing comprehensive and collision insurance coverage for your car is a personal decision, but you should be aware of what each of these coverage types offers.

However, collision and comprehensive insurance coverage is highly recommended if it is probably required by your state. Comprehensive coverage protects you from various types of circumstances, including flood, hail damage, fire damage, and theft. If you are leasing your car, you might have to purchase both types of insurance. It is best to get both types of coverage while you save money by purchasing both types of insurance separately. So that you will be safe in case of any accident.

The main difference between collision and comprehensive coverage is in the type of coverage you choose. Collision coverage protects you against collision-related damages, while comprehensive insurance protects you from damage incurred from non-collision events. Comprehensive insurance is required by law if you are renting a vehicle, but fully paid vehicles may not require it. Ultimately, you must decide what type of coverage you will need for your vehicle.

Both collision and comprehensive auto insurance coverage depend on the value of your car. Their payment limit is calculated as a percentage of the value of the car. A vehicle’s value can decrease over time, so you may want to consider dropping the coverage altogether unless you still need it. If you plan to drive your car for a long time, collision and comprehensive coverage might be a good idea. You can always drop one or the other as needed, but the best way to determine the right policy for you is to shop around.

Most lease agreements and finance contracts require comprehensive and collision insurance coverage. Depending on the type of agreement you have with your lender, you may need to purchase both. Although collision and comprehensive coverage are required in some instances, the cost of collision insurance is often higher than the value of the car. You can get an estimated car value online. Several reliable websites will help you compare quotes and find the best coverage for your needs.

How Insurance Covers Acts of God

Generally, collision and comprehensive insurance cover acts of God. Acts of God can include hurricanes, floods, earthquakes, or volcanic eruptions. The amount of coverage for these perils varies by policy and insurer. Some policies specify which perils are excluded, such as earthquakes and tornadoes. But many policies cover acts of God regardless of their source. For instance, a flood or an earthquake can cause severe damage to a vehicle.

While collision and comprehensive insurance pay for damage caused by accidents, acts of God may not be the only source of car damage. Acts of God may pay for the repair or replacement of a damaged car depending on the coverage policy. Comprehensive insurance also covers damage caused by vandalism, animals, and extreme weather events. Fire and falling trees also fall under this coverage. This coverage is optional, but it is highly recommended.

Acts of God are covered by your policy when considering what type of insurance coverage is the best option. Consider why. Many insurance policies do not cover flooding, for example. This is largely due to the grey area surrounding floods in insurance policies. Additionally, your insurance company may not cover regional flooding in flood-prone areas. To be sure, make sure that you read the fine print on your policy to see what your policy covers.

When choosing a comprehensive or collision insurance policy, consider the amount of coverage you need. Collision and comprehensive coverage pay for damages incurred due to an act of God. While comprehensive insurance is the best option for most people, older cars may not be worth the extra expense. Compare quotes from several insurance companies before deciding on which coverage is right for you. For more information, contact an insurance agent today. It pays to shop around to find the best car insurance coverage for your needs.

Cost of collision insurance alone

You can save money on your car insurance premium by purchasing collision insurance alone, but you must consider the cost of collision coverage alone. This type of coverage pays for repairs or replacement of your vehicle, but you must first pay a deductible, which can range anywhere from a few hundred to a thousand dollars. Some insurers require that you pay the deductible before the insurance company will pay the rest. Others deduct the deductible from the payout.

You can skip the collision coverage entirely if you drive an old car with low value. You can also drop it if your deductible is high since it will only pay for repairs up to the value of your car. For example, you probably don’t need collision coverage if you have a $1,500 deductible. However, if you do not drive often, you may want to purchase comprehensive coverage to cover the cost of stolen or vandalism and broken windows.

When choosing collision insurance, you must take several things into account. The first factor is the risk level. Higher-risk drivers may pay more for the same coverage. In addition, the cost of collision coverage may increase if you drive too much. If you drive more than 10,000 miles a year, you may face higher premiums than someone who only drives a few miles per year. Furthermore, insurance companies look at your demographics. Your age, gender, marital status, and home ownership all play a role in the cost of collision insurance alone. Generally, young drivers have higher rates than drivers who drive less.

Some common vehicles are easier on the budget. These cars are also more likely to be involved in accidents than expensive vehicles. They may also be easier to break into, making them more expensive to insure. This can increase the costs of comprehensive claims. Buying collision insurance alone is an important decision. Which you should take after careful consideration of your budget and driving history. Your insurance premium will depend on these factors. So, be sure to shop around!