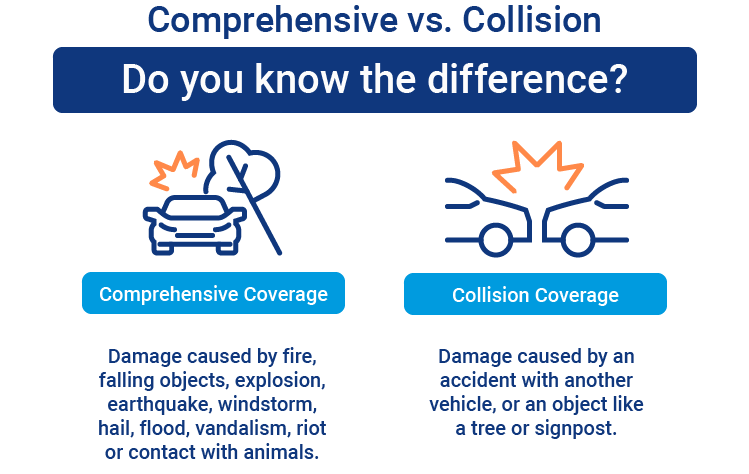

Comprehensive and collision insurance are two types of coverage. Collision coverage pays for damage to your car. But comprehensive coverage will help you if you are involved in an accident. Both types are required by law. While liability insurance is the most important type of coverage, many people don’t realize that they should have both types of coverage. The difference between collision and comprehensive insurance is that comprehensive covers things other than collision.

Other than collision

The difference between comp and collision coverage is that your insurance policy will pay for damage caused by animals, broken glass, and acts of nature, while your collision coverage will pay for repairs to the vehicle. The latter also pays for medical expenses for other people injured in an accident in which you were at fault. While you can purchase other collision coverage without collision coverage, you should still check your policy limits to make sure you have enough coverage.

Comprehensive coverage, also known as Other Than Collision coverage. It pays for damage caused by almost anything other than a collision. It is recommended for drivers who drive a lot, but it is also important to understand its limitations and importance. This type of coverage is essential if you want to avoid any major financial setbacks. Comprehensive coverage, however, is a must for many drivers. While it is usually optional, you should not purchase it unless your lender requires it.

Comprehensive insurance covers most damages that can happen to your car, including mechanical failure, wear and tear, and criminal charges. It can also pay for the actual cash value of your car. Depending on the policy, this coverage can vary significantly. The good thing about comprehensive coverage is that it can pay for the full value of your car if you are involved in a collision. It pays up to the actual cash value, which is great if you have a lot of expensive or valuable possessions.

For added security, pairing OTC with comprehensive accident medical insurance ensures broader protection, covering medical expenses from accidents.

Comprehensive coverage

If you’re wondering what the difference is between comprehensive coverage and collision insurance, read on. These two types of insurance are similar but different in many ways. They both pay out when you’re at fault in an accident, but collision insurance only covers damage to other vehicles. Comprehensive coverage, on the other hand, pays for damage caused by non-collision events like fire, vandalism, and theft. While most people don’t need both types of insurance, you should always get it if you have it.

The difference between comprehensive coverage and collision insurance lies in the amount of coverage each policy provides. Comprehensive coverage, also called other-than-collision coverage, pays for damage that is not caused by a collision. This includes vandalism, fire, flood, and weather-related effects, as well as the effects of animals. However, comprehensive insurance does not cover all types of damage, and both collision and comprehensive may have exclusions.

If you are buying a new car or leasing a used car, you may be required to purchase comprehensive coverage through your lender. However, the financial institution company will not be able to finalize your loan funding until you include this insurance in the deal. Failure to add comprehensive coverage could result in your loan being canceled, or your lender may require you to pay the difference yourself. As a result, comprehensive coverage is essential to your financial health.

Collision coverage

If you own your vehicle outright, you are responsible for paying for repairs and replacements if you are involved in a single-vehicle accident. Your liability coverage will cover the costs if the other driver is at fault, but collision coverage will help you pay for expensive repairs or replacements if you are at fault. This coverage pays for damage to both your car and the other driver’s vehicle.

If you’ve had your car for a decade or more, you may want to consider dropping collision coverage. The market value of your car is usually close to the amount you would receive if it were totaled. If you’re not sure if you need collision coverage, you can research the value of your car online. You can also talk to a State Farm agent to determine what your car is worth. Getting this information from them will help you decide whether or not you should drop collision coverage.

The cost of collision coverage varies from driver to driver. Collision coverage typically costs about $363 per year. But it can be less than half the total cost of a comprehensive policy. Some companies sell collision coverage and comprehensive coverage together. 74% of drivers choose collision and comprehensive coverage. You can save money on both if you have both. While collision insurance is the most expensive coverage, it’s worth getting a little extra coverage for some unexpected expenses.

Gap insurance

Many people have wondered what gap insurance is for comp and collision policies and how it benefits them. Gap insurance pays the difference between the actual cash value (ACV) of the car and the loan amount. In most cases, the actual cash value of the car will be less than the amount outstanding on the loan. This is when gap insurance can be extremely useful. If you owe more than the ACV of the car, gap insurance can be extremely useful for you.

With comprehensive and collision coverage, the auto insurance company will pay the fair market value of your car, even if it is less than the outstanding balance. As a result, if your car is totaled, you may have a gap to pay. However, most auto insurance companies also cover theft, so if you are worried that you will not have enough money to cover the balance, gap insurance may be your best bet.

When purchasing gap insurance for comp and collision coverage, you should be aware that you must still have your state’s minimum coverage requirements. If you are buying a car and need to pay off your loan early, you can cancel the gap insurance policy and get a full refund. Additionally, some auto lenders require that you have full liability and physical damage coverage when you purchase the car. In this case, gap insurance can be beneficial, but your lender will likely insist that you obtain a full liability insurance policy.