Endowment life insurance is a flexible, customizable form of life insurance. In addition to death benefits, the policy can offer a maturity value that you can use for your goals. Riders are additional plans that supplement your endowment plan. This may increase the sum insured or cover certain conditions your base policy does not cover. Riders may also be available in case of a change of circumstances or death.

Best endowment life insurance policy

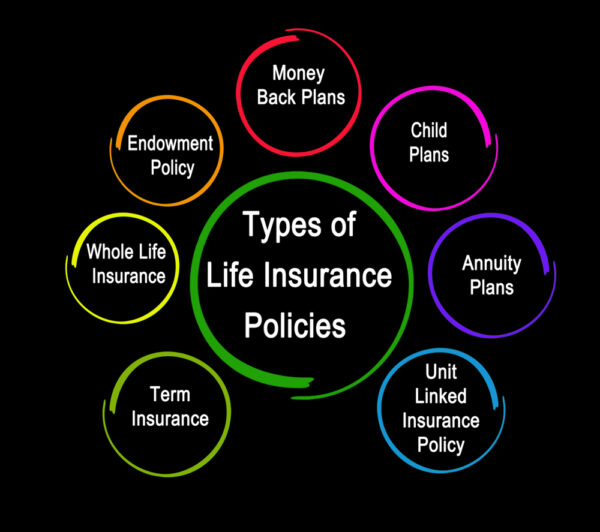

What is an endowment life insurance policy? Essentially, it is a life insurance contract that pays out a lump sum upon your death or after a certain period. Most policies mature in 10, 15 or 20 years. Some endowment policies also pay out in case of critical illness. But which one is right for you? Here are some things to know about endowment life insurance policies.

Endowment plans are one of the safest plans available in the market. It provides life coverage for a fixed period and guarantees the maturity amount. This maturity amount is increased from time to time by policy increments. This amount can be used to fulfill long-term goals. For example, an endowment plan may be a good option if you are in your forties and want to leave an inheritance to your children.

The best thing about an endowment policy is that it can act as a savings account. This way, your money builds faster than a traditional policy. You will also pay higher premiums. The amount you invest will determine the exact cost of the endowment policy. Depending on the amount of time and money you invest, an endowment life insurance policy may not be right.

s a form of life insurance

Endowment life insurance is a form of policy that pays a sum assured on death. These policies are more expensive than traditional whole-life insurance. But it is a good option for people who need a lump sum at a later date. Policies can be used for retirement planning, college expenses, or buying a new home. These policies are also known as “endowment life insurance”.

Endowment life insurance has many advantages. Some insurance companies offer riders as inbuilt coverage. Critical illness and total and permanent disability riders are available. This rider pays a lump sum if the policyholder develops one or more of these conditions. Other benefits include accidental death benefit riders. Death benefits and maturity benefits are tax-free, depending on the plan.

Assess your financial goals and budget to determine if an endowment contract life insurance policy is right for you.

It’s an investment

An endowment life insurance policy is an investment and a life insurance policy all rolled into one. You pay a monthly premium and the insurance provider invests the money for you, and then pays the balance to the policyholder at the end of a pre-agreed term. An endowment life insurance policy can last anywhere from fifteen to twenty-five years. An endowment policy also comes with a cash sum if you die during the policy term.

Endowment plans are a safe investment as they guarantee payment of the maturity amount at the end of the policy term. This maturity amount is guaranteed and increases over time. As long as you maintain premium payments and the insurance company continues to invest, you are guaranteed to receive your maturity amount. The funds can be used to meet your long-term financial goals. Apart from life cover, endowment plans offer tax-free payments on premium and maturity.

Use an endowment life insurance calculator to assess if this policy suits your financial goals and budget.

It’s flexible

Flexible endowment life insurance policies vary in coverage, savings and investment options, premium payment methods, and additional riders. It is important to compare endowment policies before buying them. For example, if you earn a fixed income, it would be better to buy a regular premium plan, while if you earn more variable income, you can consider a single premium plan. Then, you can choose the premium amount paid monthly or annually.

Flexible endowment life insurance plans combine the benefits of protection with the benefits of investment. If the insured dies during the policy term, they pay the death benefit, and if the insured survives the policy term, they pay the survival benefit. The benefits of endowment schemes include guaranteed returns. They are also flexible in terms of premium payments, with some policies offering a limited payment option. But, if you cannot afford to pay the monthly premium, these plans are a good option.

It’s expensive

Term and endowment life insurance have their advantages and disadvantages. Term life insurance is cheaper than endowment plans but provides fewer benefits. The main difference between term and endowment life insurance is cost. While term life insurance does not accumulate cash value, endowment life insurance does. It gives a death benefit to a named beneficiary when the policyholder dies, as well as a maturity benefit when the policyholder has expired. In case of death, the policyholder’s beneficiaries are still compensated for the loss, although the premium is higher.

Another disadvantage of an endowment policy is that premiums are paid regularly, but the amount earned through these premiums is fixed. Ultimately, the amount will be paid as a lump sum with interest and other additions. In some cases, the policy repayment term can be flexible, with the maximum amount you can contribute being seven years. However, if you want to get money early, it is better to invest your money in another savings vehicle.

It’s safe

An endowment plan is a type of policy in which a person contributes a regular amount to a fund which will be returned to the beneficiary at a later date. During the life of the policy, the invested amount will earn a fixed rate of interest and any excess amount will be returned as sum assured. Since this type of plan is flexible, the buyer can pay a lower premium amount or opt for a limited payment plan.

Both term and endowment life insurance are safe investments. Both are affordable for young, healthy consumers. Term insurance is a great way to combine your savings with insurance. Endowment life insurance, however, may not be the best choice for college savings. It doesn’t always maximize the savings you have.

Use an endowment life insurance quote and calculator to determine if this policy aligns with your financial goals and budget.

It offers guaranteed returns

In addition to guaranteed returns, many endowment life insurance plans offer flexible policy options. Salaried professionals can opt for a regular policy, while those with irregular income can opt for a one-time or limited premium payment plan. Unlike other investment options, endowment policies offer tax exemption on premium payments, maturity payments, and final death payments. Additionally, traditional endowment policies are generally considered safer investments than mutual funds, ULIPs, or equity funds.

However, endowment policies may have their disadvantages. Although they are less expensive than mutual funds and other growth insurance schemes, their investment performance may not be as favorable as expected. And unlike a ULIP, an endowment policy cannot pay off a mortgage. Over 25 years, the value of UK endowment policies fell by 78 percent, forcing mortgagors to sell their homes or dip into their pensions. This forced many to rethink their retirement plans.

Another drawback of endowment life insurance plans is that you cannot cash out early. If you need money urgently, you can sell your policy to a third party. If you choose to sell your policy to a third party, you are likely to get more money than you would otherwise. This third party will then own the policy and ultimately receive the payout.

It’s tax-efficient

An endowment life insurance policy combines term life insurance with a savings program. The policyholder chooses the monthly amount and maturity date to save. At maturity, the policyholder is guaranteed a payout, which can used for various things, including paying for college. Alternatively, the policyholder can choose to use the funds for living expenses or to use the funds to pay off debt.

Although endowment life insurance is tax-efficient, it requires a certain amount of time to access the cash value. Early withdrawal may reduce the death benefit. And the contract can be terminated. It is important to check with your financial and tax advisor before making such a decision. A modified endowment contract may require a different time frame for withdrawing money. The time frame depends on the type of policy, but it is usually around five or seven years.