A car insurance estimator can give you an educated guess on your rate. It takes into account factors like your driving history, the type of vehicle you own, and your financial situation. This information helps you compare quotes from different insurance companies and calculate your coverage limits. But if you’re still unsure where to start, keep reading for some advice. These are some of the most frequently asked questions about auto insurance. Use this guide to find out how to get the best car insurance for your needs.

Factors that affect car insurance rates

A driver’s zip code, vehicle type, and driving record can all have a significant impact on their car insurance rates. Newer or more expensive cars will have higher premiums than more affordable cars. Custom paint jobs and parts are also likely to increase your premium. Generally speaking, the younger the driver, the lower the insurance premium. But there are exceptions to this rule.

Fortunately, there are ways to lower your car insurance rates. Some of these factors are beyond your control, such as age. However, you can lower your rates by shopping around for the best rates. For example, sports cars typically have higher insurance rates than non-sports cars because they are more likely to be involved in accidents. Insurance companies also consider the cost of repairs, how popular the vehicle is with car thieves, and whether or not it will damage other vehicles.

Age plays a significant role in car insurance rates. Younger drivers have less driving experience, so they are at a higher risk of having an accident. As a result, their auto insurance rates are higher than those of drivers in their forties or fifties. Additionally, drivers over the age of 70 are likely to pay higher insurance premiums. Additionally, car insurance companies use past performance to predict future performance. Therefore, drivers with a history of collisions, citations, or DUIs may pay higher rates.

Using a car insurance estimator to get an educated guess of your rate

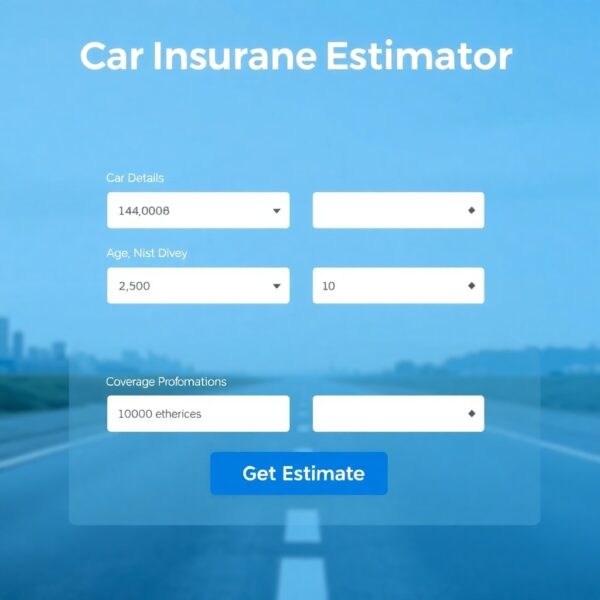

Using a car insurance estimator to determine your rate can help you determine what you need to pay. While this calculator can help you estimate your premium, it is not accurate and you should consult a licensed insurance professional to finalize your rates. The best way to find your exact rate is to compare multiple quotes from different companies. Additionally, car insurance prices are constantly fluctuating due to factors such as your driving profile, company pricing, and state regulations.

Most car insurance estimators will allow you to customize the amount of coverage you need, so it’s possible to tailor it to your specific needs. When determining the amount of coverage you need, keep in mind your budget and what level of coverage you want. Additionally, you should consider the value of your car and whether or not you’re financing it. The calculator takes these factors into account when determining the amount of coverage you need.

Various factors influence your rates. Insurance companies gather people with similar characteristics to determine their rates. The firm decides on the values assigned to these elements. They have informed estimates that take into account the losses experienced by others in similar circumstances. Insurance companies want to charge a certain amount to cover all possible car accidents. As a result, they try to assign a higher value to factors like your driving experience.

Comparing quotes across insurers

You get the cheapest car insurance rates in your area. For this, you can use an online car insurance tool. Depending on your needs, these websites will return real-time or estimated quotes. Real-time quotes are usually more accurate. You should always choose a real-time quote over an estimated one, as they use the most recent data available. Lead-generation sites will sell your information to advertising partners, most often insurance companies.

When comparing car insurance quotes in Houston make sure you are using. The same coverage levels and deductibles when comparing companies. This is to ensure you are comparing apples to apples. Make sure the online form includes all applicable discounts. Different companies will offer different discounts, which can significantly affect your final price. Make sure you know exactly which discount you want first. Compare car insurance quotes in Atlanta across insurance companies.

When comparing car insurance quotes, consider how your credit score affects rates. Drivers with poor credit typically pay more for coverage. Some insurance companies base their rates on credit history, and drivers with bad credit should expect to pay up to three times more than those with strong credit. Some insurance companies double the average rate for drivers with poor credit. Although this factor affects your insurance rates, it is a useful tool for getting competitive quotes. While there is no single best car insurance company, some companies offer the most affordable coverage in your area.

Calculating your coverage limits

Before purchasing a car insurance estimator, consider how much you can afford. Most states require a certain amount of liability coverage. If you choose to carry more than this, you will pay more for your insurance coverage. Liability coverage limits can range from $25/50/25 to 100/300/50. Choosing the right limits can make the difference between overpaying for your coverage or being underinsured. It is important to know how much coverage you need, so you can choose the amount that is best for you.

You can also increase your car insurance coverage limit if you are older or less likely to drive. Younger drivers tend to have more assets, income, and net worth. So it’s important to consider your needs before choosing a policy. Similarly, older drivers will have higher assets and higher medical expenses. So, consider how much it would cost to replace everything if you file a claim and receive a payout.

Your car insurance coverage limit should be based on how many hours you spend on the road each year. The longer you spend behind the wheel, the more likely you are to have an accident. A car insurance calculator can help you determine how much coverage you need based on your driving record, driving experience, and other factors. A car insurance calculator will take all of these factors into account and give you a recommendation for the right coverage.