If you want to know more about Farmers Life Insurance, talk to an agent. There are many options for you to choose from. Read on to learn more about policy types including term, universal, and accidental death riders. Choosing the right farmer life insurance plan is critical to your financial future. It’s a good idea to discuss any specific needs and questions with the agent before you make your decision. Your agent will be able to provide you with the right policy for your circumstances.

Farmers Whole Life Insurance

If you are interested in Farmers Whole Life Insurance, you will find a wealth of choices to suit your needs. You will have options to protect your assets for life, including your children’s education or a mortgage. You can also protect a charity such as your church with this coverage. A policy from Farmers will ease the financial burden on your survivors and leave a legacy for a cause of your choice. Farmers’ free online pricing tool will guide you through the process of choosing the best coverage for your specific situation.

Unlike term life insurance, whole life insurance will last for your entire lifetime. The death benefit from a whole life policy is tax-free for the beneficiary. It can also help you plan for the future. Whether you’re interested in securing your family’s future with a permanent insurance plan or just preparing for the unexpected, Farmers Whole Life Insurance can help you achieve your goals. The company offers two types of policies: Basic Universal Coverage and Flexible Universal Coverage. Apart from flexible coverage, you can also decide how your premium is invested. Farmers also offer optional extras, such as the ability to borrow against the value of the policy.

If you are a West Coast resident looking for an affordable, comprehensive insurance plan, Farmers may be the right choice for you. The company was founded in 1928, before the stock market crash of 1929, and still has a long-standing tradition of community involvement. Its founders, John Taylor and Dorothy Levy, created the Taylor Award for environmental achievement. During the 1990s, Farmers employees donated more than $40 million to charities and organizations. Additionally, the company supports veterans, military, and educational programs.

Farmers Term Life Insurance

Term life insurance for farmers can provide many benefits. These policies are designed to protect your family against death and separation. These policies can be very affordable and do not require any medical examination. They are suitable for farmers with long-term obligations, such as mortgage payments. Farmers also offer accidental death insurance, which extends your coverage. It’s affordable and can start as low as $4.50 per month, and it covers you right after you pay. Further, farmers do not require any medical examination.

Life insurance for farmers can be purchased for individuals between the ages of 18 to 65 years. Depending on the age of the applicant, the policy can range from 75 to one hundred and fifty thousand dollars. The premium remains fixed throughout the policy period, so there is no risk of policy lapse. Moreover, this type of insurance is cheap and does not require medical examinations or lab tests. It can be approved within 24 hours.

Apart from the death benefit, Farmers also offers other riders for its policyholders. The first, known as an accelerated death benefit, allows the policyholder to receive the death benefit while still alive. The other, known as the terminal illness rider, pays a portion of the death benefit if the policyholder’s illness becomes terminal or death is expected shortly. On the other hand, the accelerated death benefit rider is optional and does not require an exam.

With Farmers Life Insurance Company, you can enjoy long-term financial security while enjoying the flexibility of increasing cash value, making it a smart choice for permanent coverage and financial planning.

Farmers Universal Life Insurance

Whether you are looking for universal life insurance or term life insurance, Farmers is a trusted name in the industry. Its catchy jingle and wide range of products make it an attractive option for many. The company’s origins date back to 1928 when John C. Tyler and Thomas E. Levy began insuring farmers because they were a low-risk group. Now, the company serves more than 10 million households thanks to a network of around 21,000 agents and employees. Farmers is an accredited business with the Better Business Bureau (BBB) with few complaints. Most of these complaints are related to car and life insurance.

In addition to underfunding, Farmers systematically marketed its policies as permanent insurance. These policies failed to provide lifetime protection and could not pay the promised amount on time. Farmer agents learned about policies using a uniform script and communicated the same to prospective policyholders. This forced consumers to settle for poor coverage. However, these claims did not end in farmers’ lawsuits. Farmers Universal Life Insurance Policy was never a good option for most of people.

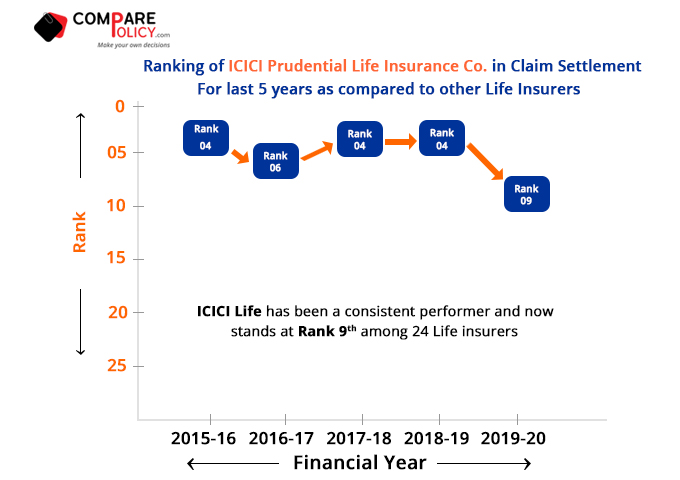

In the event of a claim, the Farmers life insurance claims process is streamlined to ensure a smooth and supportive experience for your beneficiaries.

Accidental death rider

If you are considering purchasing a Farmers life insurance policy, you may want to consider adding an accidental death benefit rider. This type of rider offers a payout to your beneficiary upon your death due to an accident. Commonly known as a double indemnity rider, this coverage is paid to your beneficiary in addition to the standard death benefit you receive if you die of natural causes. Although an accidental death benefit rider is likely to increase your premium, it can be a great way to provide for your family in the future.

Another option is a Farmers life insurance policy that waives the death benefit. It allows you to cover your spouse with 100% of your policy, while children can get up to $25,000 from your policy. You can also add a critical illness rider to your farmer life insurance policy. The benefit can be used for the death benefit of a child or other loved one. There are many benefits to adding a death benefit rider to your Farmers life insurance policy.

Many people purchase accidental death benefits as a means of providing for their families. This type of insurance is often part of an employee benefit or even a company insurance plan. There are also several ways to get accidental death coverage. You can purchase this type of coverage through your employer or an individual life insurance policy. However, it is best to discuss the exact details of the plan with your insurance provider.

Is State Farm Life Insurance good, adding an accidental death rider to their policy may be the best choice. It boosts coverage and provides peace of mind in the event of an unexpected mishap.

Chronic illness rider

Farmers Life Insurance provides quick payment for a portion of the face amount of the Chronic Illness Rider policy if you suffer a chronic illness. You must have experienced an illness for 90 consecutive days and be certified by a licensed health care practitioner. This rider will pay the lump sum in installments of 12% of the original face amount. The annual benefit payment cannot exceed two-fourths of the face amount of the policy. If you get sick, you don’t need to submit a bill to get benefits.

A Farmers Life Insurance chronic illness rider is often included with your policy free of charge. It will provide financial support for your family if you are suffering from an illness that prevents you from carrying out two basic daily activities. If you suffer from a critical illness, you may be eligible for this rider. If you are unable to work or manage your health, a critical illness rider may be the best option. Chronic illness riders are also called accelerated death benefit riders.

Another good reason to buy farmers life insurance is that you can choose to collect your death benefit early if you are diagnosed with a terminal illness. You must have a certain number of years of life expectancy to avail of this rider. Farmers Life Insurance’s chronic illness rider can pay medical bills and other expenses related to your terminal illness. Farmers Life Insurance Chronic Illness Rider is a great option for people with a terminal illness, as it can help their family pay for any expenses they may incur while in the hospital.

Affordable farmers life insurance

When you think about affordable farmers life insurance, you may think about the value of term life. This type of life insurance coverage is not only affordable but also guarantees non-expiration for the first ten years, twenty years, or thirty years. This feature is especially attractive to people with young families who do not want to spend a lot of money on life insurance. Some of the things to keep in mind while choosing a policy include the type of coverage you are looking for and whether it is a term life or whole life policy.

Farmers’ mission is to protect the American way of life. It is owned by a Swiss company, but it has always been based on the American way of life. The company’s primary focus is on agricultural vehicle insurance. Fortunately, Farmers offers independent life insurance ratings. These ratings evaluate a company’s creditworthiness and overall reputation, but not the specific products they offer. You can also check the A.M. Ratings of the best.

Easy to access

Farmers have various plans to meet your needs, including whole life, term life, universal life, and accidental death insurance. The website has a helpful Life Compass tool to help you decide which type of policy is right for you. The tool will also provide links to educational materials to help you learn more about the different types of life insurance coverage and how to ensure you get the right coverage. Another option is a guaranteed issue whole life policy. This type of life insurance is designed to provide level payments for a specified period as well as cash value in the event of death.

Another option is an accidental death rider. This option pays a portion of the death benefit while the insured is still alive. A terminal illness rider allows you to receive a portion of your death benefit if you have been diagnosed with a terminal illness or are expected to die soon. Farmers include this rider at no additional cost. The app is also easy to use. Farmers also offer policies for other types of vehicles. The app has a crash-alert feature that can detect accidents and call for emergency services.