The Independent Order of Foresters operates under the name Foresters Financial. which is a provider of Foresters Life Insurance and financial solutions in Canada, the United Kingdom, and the United States. With offices in Toronto, Ontario, the company provides life insurance and other financial solutions to Canadians and others. To learn more about their products and services, read on to learn more about the three main policies offered by the company. Listed below are the main differences between each.

PlanRight Whole Life

Forrester’s Plan Right Whole Life Insurance Plan has no medical exam requirements and is available for people aged 50 and above. This policy consists of two policy riders including a common carrier accidental death rider. The policy is also permanent, lasting for your entire life until you die or stop paying premiums. The policy’s cash value equals the full death benefit on your 121st birthday. This cash value is paid to your beneficiaries during your death.

One of the most popular final expense life insurance products is Foresters Planright Whole Life Insurance coverage. While all final expense policies have their benefits, PlanRight stands out for its unique features. Many people who buy final expense coverage are in their senior years and are looking for less coverage. They will also appreciate the fact that most plans offer lifetime coverage, a fixed premium, and a guaranteed cash value accumulation account that will grow every year.

Another attractive feature of Foresters PlanRite is its guaranteed cash value growth. Once you start paying premiums, the cash value of your policy will increase. This is especially attractive if you are on a limited budget. Additionally, if you are a smoker, this insurance may not be right for you. It is better to check with your employer to see if you can purchase a similar policy for your spouse.

Foresters Planright policies also offer burial coverage. You can choose from three different versions of this policy. The waiting period will depend on your chosen version of PlanWrite. In addition to policy qualification requirements, Foresters Financial requires a brief interview and access to your Medical Information Bureau file. The entire process is easy to complete online. But, if you are concerned about the long wait, you can call the sales support desk for assistance.

With straightforward underwriting and lifetime protection, PlanRight by Foresters Life Insurance Company ensures affordability and peace of mind for loved ones.

PlanRite Whole Life Insurance Foresters financial life insurance offers lifetime coverage with level premiums and guaranteed death benefits.

Advantage Plus II Whole Life

One of the advantages of buying a policy from Forester is its optional rider system. This add-on allows you to receive additional benefits if you have a critical illness. Additionally, many forester policies include a charity benefit provision, which will allow your beneficiaries to receive a portion of your death benefit in the event of critical illness. Some policies also come with paid-up additions, which increase your death benefit and cash value. Other riders may be free or increase your premium. Other factors that can affect your premium cost include your health condition and gender assigned at birth.

The company offers SMART universal life insurance policies for both men and women. It offers flexible permanent coverage with guaranteed death benefits, as well as cash value growth. The policy also includes a guaranteed 3% interest rate for 10 years. Foresters also offers additional riders at no extra cost, including Disability Income Benefit for two years. These options can significantly increase the amount of money you earn each month. Forester’s Advantage Plus II Whole Life Insurance Policy can help you protect your family with a guaranteed-issue policy.

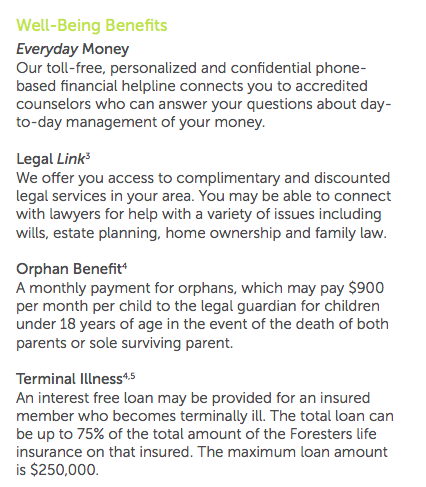

As part of the company’s membership program, Foresters Advantage Plus II offers a participating whole life product, which will reduce premiums. As a member-owned fraternal insurance company, the scheme offers additional benefits to members such as scholarships, family fun events, orphan benefits and traditional life insurance death benefits. It will be beneficial for people who own several houses or are planning a large family. In addition, Forrester members can also participate in special events, such as contests for scholarships.

Advantage Plus II Whole Life Insurance from Foresters Life Insurance Company offers lifelong protection with level premiums, guaranteed death benefits, and the opportunity to build cash value over time.

SMART Universal Life

With Foresters Smart Universal Life Insurance you will never have to leave your home again. The company offers fully underwritten policies with accelerated death benefits and extended issue age. The company also offers guaranteed level premiums and renewable policies up to 100 years of age. However, the policy is not guaranteed and foresters may reject you based on your medical history. However, this insurance company offers several riders to help you customize the policy according to your needs and budget. This includes an accelerated death benefit rider that allows you to receive a death benefit if you or a loved one is diagnosed with a critical illness. This rider is automatically included in your policy.

The company provides a range of financial products and services and claims over the past four years. Its membership includes more than two million members and more than 3.2 million certificates in the United States, Canada, and the United Kingdom. Last year, it paid out more than $600 million in insurance claims to policyholders. This impressive record makes Forester a great choice for life insurance for people of all ages. Apart from being financially stable, the company offers several discounts and financial assistance to its policyholders.

A unique feature of the SMART Universal Life Insurance Plan is its combination of tax-deferred cash value accumulation and lifetime protection. It has a minimum interest rate of 3% and a no-lapse guarantee for the first ten years. Its flexible payment terms allow policyholders to decide how much they want to pay for insurance protection and cash value accumulation. Additionally, it offers several riders including the death benefit, disability income benefit, and cash value accumulation rider.

To explore your options and find the best fit, request a Foresters life insurance quote and secure your family’s financial future today.