When navigating the world of auto insurance, terms like gap coverage and gap insurance may leave you wondering about their significance. Do I need gap insurance if I have full coverage? “When does gap insurance not pay? In this guide, we’ll examine. Let’s discuss its importance and where to find the best coverage options.

Understanding Gap Insurance

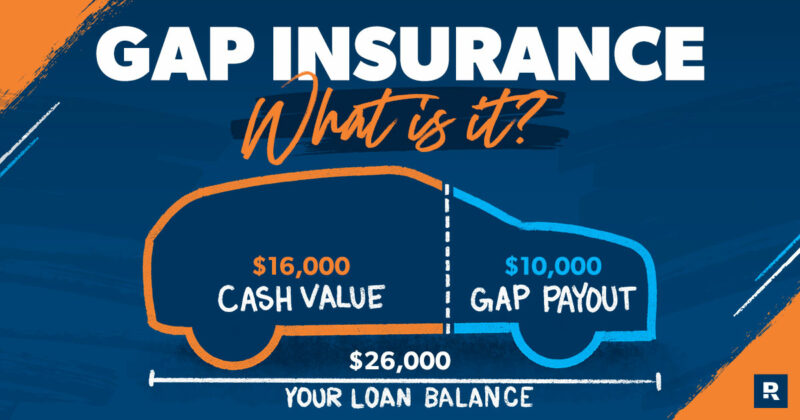

Guaranteed Asset Protection, short for insurance, serves a crucial purpose. It addresses the depreciation issue that vehicles inevitably face. As soon as a car leaves the lot, its value starts decreasing rapidly. If your vehicle is stolen or is declared a total loss in an accident. So your standard auto insurance will offer compensation based on the actual cash value (ACV) of the vehicle at that time. Unfortunately, this ACV can be notably lower than what you still owe on your auto loan.

When Gap Insurance Steps In

It becomes priceless. Gap coverage essentially creates a bridge between your payments and your outstanding loan balance. It prevents you from being financially responsible for paying a car loan for a vehicle you don’t own.

Do Full Coverage Policies Cover the Gap?

While full coverage auto insurance is a wider safety net. It doesn’t always fully cover the difference between the value of your car and the amount of your loan.

- You made a low down payment on your car.

- Your auto loan has a long term with a gradual repayment rate.

- You’re leasing your vehicle.

- Your new car depreciates rapidly during the initial period.

Calculating Cost

The cost of gap insurance can vary depending on factors such as your insurer, the value of your car, and the duration of coverage. Adding to your existing auto insurance policy can set you back $20 to $40 per year. This translates to just a few dollars each month for substantial financial protection.

Where to Obtain Gap Insurance

- Car Dealerships: Dealers often make offers during vehicle purchases. However, it’s wise to compare prices elsewhere to make sure you’re getting the best deal.

- Auto Insurance Companies: Reputable auto insurance providers like State Farm, Progressive, Geico, and USAA offer as an add-on to your policy.

- Specialized Providers: Some companies specialize entirely. Exploring these options can help you find competitive rates and comprehensive coverage.

When Gap Insurance Doesn’t Apply

- Your car’s deductible.

- Outstanding loan balances due to late payments.

- The value of extended warranties, credit insurance, or other add-ons.

Is this Insurance Worth it?

Determining the value of survival depends on your specific circumstances. If the difference between the value of your car and your loan balance is significant. And covering it will strain your finances. So it is a smart investment. It assures that you will not be burdened with significant car loan liability if any unexpected loss occurs.

In Conclusion

It is an essential safeguard against financial vulnerability in case of total loss. Research providers like State Farm Gap Insurance, Progressive, Geico, and USAA Gap Insurance to secure the best gap insurance policy for your needs. By understanding the intricacies of gap coverage and assessing your situation, you can make an informed decision. Which ensures that you are well-protected on the road. Whether you’re looking for auto insurance near me in New Jersey, the right coverage is readily available to give you peace of mind during your travels.