How Much Will Tesla Model 3 Insurance Cost? How do you find the best price? And how do you know if your credit score will be a factor? This article covers the basics of how much your Tesla Model 3 car insurance will cost. These include restrictions, driving history, and credit score. Continue reading to get a better idea of what to expect. After reading the tips below, you should be able to make an informed decision about which policy to buy.

Cost of Tesla Model 3 car insurance

Tesla Model 3 car insurance is not cheap. Fortunately, there are many ways to get a cheaper policy without sacrificing coverage. Your driving record will determine how much your policy costs, so keep this in mind before you buy. Insurance companies look at a variety of factors when deciding how much to charge for insurance, including your demographics and vehicle characteristics. A high-quality driving record can mean a better rate. And, if you are a good driver, you can apply for many discounts on your policy.

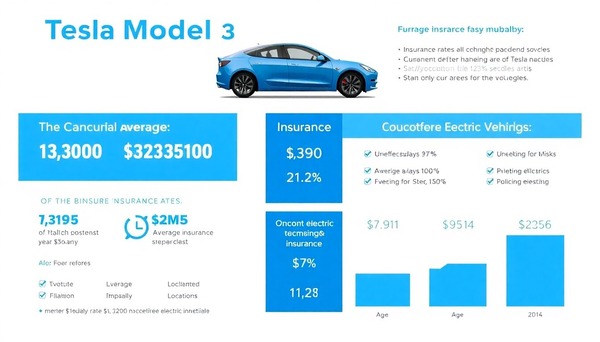

While Tesla’s sticker price is still relatively low. Repair and replacement costs can easily reach several thousand dollars. As Tesla integrates more technology and custom parts. Repair costs may also increase. Insurers will have to consider the size of the claim if Tesla has an accident. Fortunately, the average cost of insuring a Model 3 is $3,386 per year – far less than other luxury models like the Model S. However, the X and Y models may cost more.

Insurers base their prices on averages across the country. So while your Tesla Model 3 insurance premium may be higher than in your home state. Then your location can have a huge impact. MoneyGeek analyzes state-specific auto insurance costs to determine how much Tesla car insurance costs. And don’t forget to compare multiple insurance quotes. This way, you can see what the actual cost of insurance will be in your area.

Restrictions on tesla model 3 insurance

For those who haven’t bought a Tesla Model 3 yet, you may be wondering if you can get insurance for it. It is quite possible. The company has entered the car insurance industry with its program. which is currently operating in California and plans to expand to other states in the future. The company claims that its claim rates are at least 20% cheaper than conventional insurance companies. Some Tesla owners report that prices are significantly higher than what they find elsewhere. In a recent interview with CNN Money, a Tesla spokesperson said it has fixed algorithm glitches affecting its coverage rate comparisons. So it is a better option to shop at the lowest rate.

The company says the premium is based on the car’s actual driving data rather than traditional factors such as gender, age or marital status. While an insurance company’s score is based on anonymized data, it still takes into account five factors that can affect your premium. These factors include your age, gender, driving history, and whether you have been involved in an accident or traffic violation in the past.

To get an insurance policy for a Tesla, you will first need to find an insurance agent who understands the automobile business. It is best to find an agent who has a close relationship with the insurance company’s underwriters. You may want to research each insurance provider’s program limits before signing up to avoid any surprises. If you don’t like your current agent, you should switch to another one. Make sure your agent understands electric cars and more expensive vehicles.

Cost of Tesla Model 3 insurance based on driving history

The cost of Tesla insurance can vary greatly depending on features and driver history. MoneyGeek’s example was for a premium base model, while higher-end models can cost several hundred dollars more. The price of a Tesla itself can be as high as $139,000, and insurance costs can run into the hundreds or even thousands of dollars per year. Listed below are some of the factors that contribute to the cost of Tesla insurance.

The cost of Tesla Model 3 insurance is heavily influenced by the driver’s driving history. For example, a recent speeding ticket can significantly increase the premium on your liability policy. The same goes for multiple speeding tickets. If you have a clean driving history, you can expect to receive a lower rate. You can avail of discounts offered by your insurance provider.

You can save money on your Tesla Model 3 insurance by choosing a state that allows credit-based insurance. As in Michigan, drivers should have a higher level of coverage in the event of a collision. In other states, such as Massachusetts and California, rate adjustments are not possible. In some states, you can save by combining multiple policies. A multi-car discount can also help you save on your premium.

When comparing the cost of Tesla Model 3 insurance, keep in mind that insurance costs are higher than other electric cars. Therefore, it is important to consider the cost of car insurance while calculating your monthly budget. The cost of Tesla Model 3 insurance will depend on many factors, including model year, age, and location. It’s best to get several quotes so you can be sure you’re getting the best deal.

Cost of Tesla Model 3 insurance based on credit score

If you want to get a good insurance rate for your Tesla Model 3, you can compare the rates offered by different car insurance companies. The cheapest insurance provider for Tesla drivers may be progressive, but this is not always the case. Other companies such as Farmers and State Farm may offer better rates for drivers with accidents and speeding tickets. You can save a significant amount on your insurance premium by getting a policy through Tesla.

Your credit score and driving record play an important role in your insurance rate. Having a good driving record is important. Otherwise, you may pay higher insurance rates. You are also required to disclose certain information, including your age and gender. You should know traffic violations, the model and year of your Tesla, how many miles you drive each year, and how long you drive your Tesla.

While you can compare insurance rates offered by different companies, be sure to compare the same deductibles and coverage amounts. Also, be sure to look for customer complaints about the company, as a high number can mean poor service. Some companies offer customer service by phone, online, or in person. Prices for Tesla models vary significantly from $47,000 to $139,000 depending on model and customization.

The cost of Tesla Model 3 insurance depends on your driving record. The price is significantly higher for newer models. The 2020 Model 3 costs $1,802 to insure while the 2015 Model 3 costs $1,749 to insure. The cost of Tesla Model 3 insurance varies widely depending on your state and driving record but will average $2,280 per year for a 40-year-old driver.