When a customer gets a Nationwide insurance quote, they with various options. These options include home, renter, and car insurance. In addition to these basic choices, they can also opt for whole life insurance or renter’s insurance. A quote will be delivered via email after the customer selects the option. This site may also ask for additional information. For added convenience, quotes can be saved and accessed at a later time.

Car insurance

While Nationwide for its low rates for drivers with poor credit, other insurance companies charge higher rates for these drivers. It is important to compare several quotes before you choose a policy from this company, as insurance companies determine your risk based on various factors. Additionally, you want to find the lowest possible rates for young drivers, as teenagers are notorious for taking risks and causing accidents.

One way to find the best auto insurance rates is to compare deductibles and coverage limits between different companies. Check the number of customer complaints filed against the company. A high number of complaints is a sign of poor customer service. There were fewer complaints than most across the country, especially when compared to its size. Apart from this, the company also provides accident waivers.

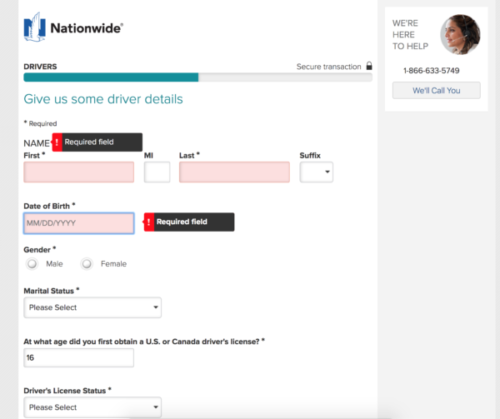

Different car insurance providers will ask you to provide different information. To request an insurance quote, you will need to provide contact information such as your name, phone number, email address, and physical address. Other required information may include your date of birth and social security number. You may also need to enter the VIN of each vehicle.

Discounts are another way to reduce costs. There are many discounts across the country including good student, good driver, multi-car, and bundling policies. Many of these discounts can be stacked together for maximum benefit. However, you may not find the best rates for young drivers nationwide. Likewise, Nationwide is not the best option for people with bad credit.

With a nationwide insurance quote, you can find coverage options that fit your needs and budget.

Home Insurance

If you’re looking for an affordable home insurance policy, consider Nationwide. Their policies can cover all types of homes. It includes different types of endorsements and coverage amounts. Online tools let you manage your policy, file a claim, and get quotes instantly. You can also download the Nationwide mobile app for your smartphone to manage your policy and record claims. Nationwide’s website includes a quote generator, which asks you to provide specific information about your home and personal life. You can then see what your policy will cost and if you qualify for any discounts.

When shopping around for home insurance, it’s helpful to know which companies have the best reputations. Allstate Home Insurance is competitively priced and has a strong rating from AM Best, a financial credit rating agency. Additionally, the company has an above-average J.D. in a study released in 2020.

Overall, Nationwide scores high for customer satisfaction and customer experience. According to the Consumer Affairs website, the company scores 88 out of 100 on a 100-point scale. Nationwide is comparable in customer satisfaction to Allstate and Liberty Mutual. Another popular customer review site, Consumer Affairs, ranks Nationwide on the stability of the company, policy coverage, and customer service. Nationwide Homeowners Insurance receives a 4.2 rating on this site.

With Nationwide car insurance, you can expect options for liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and more.

Renters Insurance

When shopping for renters insurance, consider the costs and benefits of each company’s coverage. You can compare rates with the click of a mouse using the internet. Choose the best coverage for your personal property. Before purchasing a policy, review your home inventory and personal property coverage to make sure you have the right coverage. You may find that you can save a lot of money by paying the annual premium in full.

Buying renter’s insurance can protect you from a range of unexpected expenses, such as living expenses if you own a home. In the event of a natural disaster, your policy will pay for alternative accommodation while you find a replacement home. Likewise, personal liability coverage will protect you if you are sued for injury or property damage. He pays legal fees and medical expenses. A renter’s insurance policy may cover the cost of replacing your belongings.

Nationwide offers a range of coverage that can be beneficial to you. Some policies cover earthquake damage and legal expenses. Renters Insurance Nationwide Plan also protects you against identity theft. It also covers the cost of restoring your identity. Finally, coverage for valuable personal property will protect your expensive collections and valuable possessions. This includes jewelry, engagement rings and watches. Getting this coverage is worth the extra cost when you consider the protection you receive.

When shopping for renters insurance, remember to consider deductibles. The deductible will usually be linked to the premium. Therefore, the lower the premium, the higher the deductible. The deductible can be changed to fit your budget. Finding the best coverage depends on where you live and how much you’re willing to spend. In California, the state and zip code can affect the cost of renters insurance.

For additional coverage options, such as Nationwide insurance gap insurance, inquire during the process.

Whole life insurance

To get a Nationwide whole life insurance quote, you should visit their website and fill out an application. You may submit some medical questionnaires before you apply for coverage. If your medical history is not too complicated, you may only need to take a quick physical to determine your height and weight. If you are healthy, you can do this from the comfort of your home. After you complete the application, you will receive your policy and first premium. You will then need to file it with important documents and notify your beneficiaries.

When comparing whole life insurance quotes, financial strength is an important consideration. Third-party agencies offer ratings for companies following financial crises and catastrophic events. You can also view complaints filed against insurance companies on the Department of Insurance website. If the company you’re considering has a high number of complaints, that should raise a red flag for you.

Whole life insurance policies are popular because they offer a savings component. which allows policyholders to borrow against their cash value. This money will continue to grow till the death of the policy owner. Whole life insurance has many benefits, including the ability to borrow against the cash value of your policy and a death benefit that never declines. You should not spend a lot of money for a whole life policy. A nationwide whole life insurance quote should be available.

Nationwide renters insurance quotes also offer, ensure comprehensive coverage for renters’ belongings and liability protection.