Online consumer complaint website Pissed Consumer lists 216 complaints against Infiniti. Most of these complaints revolved around a single theme: customers were being charged more for their policies and rates than they were told, and the complaints were made to the Department of Insurance. A good way to summarize all complaints is Infinity Insurance Company. Watched a YouTube video about appearing on the first page of search results. This review will help you decide whether to take an insurance policy with Infiniti or not.

High-risk drivers pay higher rates

Having a poor credit score means that you will be considered a high-risk driver by the insurance company. This is because people with bad credit file insurance claims more often and their rates are higher. Auto insurance companies will only check three years of records before deciding whether or not to offer you insurance coverage. Another factor in determining your rate is the age of the violation. If they are a few years old you will be subject to a higher rate.

Anant does not list accident waiver options on its website. He notes that a driving history with multiple violations is a greater risk to the insurance company. So drivers with multiple violations or poor credit history should be aware that Infiniti will raise their rates. However, the company offers discounts for safe drivers. Which can help you reduce your monthly expenses. Younger drivers have to pay higher fares. Because insurers don’t like to insure them.

Infinity Insurance Company is an insurance company that targets the high-risk market. The company writes standard auto insurance but its market is non-standard. Because of this, drivers with bad driving records will pay higher rates than others with clean driving records. While this may not be true for everyone, you should still consider the high-risk market as an option. You will have access to more affordable auto insurance rates.

High-risk drivers, including those insured by Infiniti Insurance Company, may face higher rates due to a higher likelihood of accidents or violations.

No online claims department

If you’ve been in an accident and aren’t sure how to proceed, the best way to get answers is to call Infiniti’s toll-free number. which can be found on your policy documents. A representative will walk you through the claim process, collect all relevant information, and give you instructions. An Infinity insurance adjuster will investigate the accident and review your policy to determine who was at fault. Infiniti does not offer an online claims department, which is a big problem.

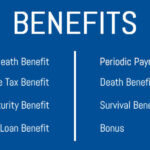

Infiniti offers a variety of auto insurance packages. Its website only lists coverage options when you start the quote process. You will need to call Infinity to get the details of each option, which can be difficult when you are unfamiliar with the details of each plan.

Infinity County Mutual Insurance Company is recognized for its comprehensive coverage for high-risk drivers. It faces criticism for the absence of an online claims department.

For accurate and up-to-date information on Infinity Insurance Company claims, including claims processing and contact details, visit the Infiniti Insurance Company official website of your insurance policy documents.

Preferred repair shop network

The Infiniti Insurance Company Preferred Repair Shop Network allows the insured to choose a repair shop that meets their specifications. Their “Repair Satisfaction Vehicle Program” connects the insured with a preferred provider who will handle all repairs. Even if you choose to choose your repair shop, you are free to do so. Infinity’s FAQ section provides basic answers to some common claims questions.

The training and claims management team is very detail-oriented and concerned with providing the best training for body shops. They train customer service staff and insurance adjusters on how to handle claims. They also conduct clam handling demonstrations and conduct various mechanical courses. Infiniti claims that staff members have a long history in the auto repair industry.

Long claim settlement time

Infinity Insurance Co has received numerous complaints due to long claim settlement time. Customers have complained about long claim processing times, poor customer service, and large rate hikes. Some complaints are specific to Infiniti Insurance agents. Which may explain the long time frame for settlement of claims. There are several ways to get information about your insurance coverage. Listed below are some tips for finding the best insurance company for you.

Taylor’s attorney, Korth, testified that he understood the need to extend the time limit to settle the claim. But failed to recall the understanding. Taylor was the attorney retained by Anant. Internal company memoranda support Taylor’s position. On May 16, Fryer’s retainer letter to Korth specifically referenced Taylor’s May 2 time demand letter, which he enclosed with the letter.

To file a claim, Infinity policyholders should call the toll-free number on the policy documents. The call will be by a representative who will walk the insured through the process. They will take all relevant information and give instructions. Afterward, the adjuster will investigate the accident and review the policy’s coverage. The adjuster will then investigate the accident and determine the fault. However, Infiniti did not provide a timeline for settling the claim.