What is key man insurance? It is an important type of business insurance. There is no legal definition of key man insurance, yet it is a necessary protection for shareholders and other business owners. Some of the benefits of key man insurance are listed below. Read on to learn more! How much does key man insurance cost? And how does it protect shareholders? And what are the other benefits of key man insurance? Let’s find out!

Costs of key man insurance

How do you determine the cost of key person insurance? Key person insurance is a great way to protect your business if the owner dies or is injured. It can also provide tax benefits and can be a great way to acquire a competing business. If your business is growing, you may also consider purchasing key person insurance to be covered by another firm. Keyperson insurance has many benefits, but the cost is not cheap.

Key person insurance isn’t cheap and can be a significant investment for your business. Fortunately, the cost of key person insurance will decrease as your business grows. If you don’t replace your key person quickly, the cost of key person insurance will increase with your business. It’s a good idea to purchase this insurance when you have a high-value employee. Then, if that employee dies, you’ll be able to purchase it if you want to continue the business.

The premium depends on several factors including the age, gender, and health history of the insured. Generally, the higher the age, the higher the premium. But if your key man is young and healthy, you may want to buy term life insurance instead. However, term life policies are more affordable than permanent life insurance. If your company is new and you want to protect your key people, buy key man insurance before you change hands.

Term policies generally have a lower key man insurance cost than permanent policies, especially for shorter durations.

key man insurance tax deductible

A policy that covers a principal in your business will generally be a non-deductible expense. However, the premium you pay on the policy is not tax-deductible, and the proceeds of the policy will not be taxable. Because the business owns the insurance policy, the premium paid by the principal is not deductible. Because of this, the principal’s life insurance premium may not be deductible in the U.S.

A keyman policy is not a gender policy; any employee, partner, or business owner can qualify for it. Keyman life insurance covers critical employees and can help a company when a key employee passes away. While keyman life insurance is a valuable employee benefit, the premiums paid on these policies are not tax-deductible as a business expense. Therefore, it is important to consult with your accountant before purchasing a key man insurance policy.

Key man life insurance is typically sold as an equity-building whole life insurance policy. As a result, the company owns the policy and is the named beneficiary. The company can deduct the premium on these policies if it is considered part of the employee’s taxable income. However, these policies are not tax-deductible when the employee is the beneficiary of the policy. However, the cash value of these policies can be used as a retirement benefit.

In some cases, tax implications can vary, so companies should consult a tax advisor for specific advice on Key person insurance tax deductible.

However, the key man business insurance proceeds received by the company upon the insured’s death are typically tax-free.

The protection provided by key man insurance for shareholders

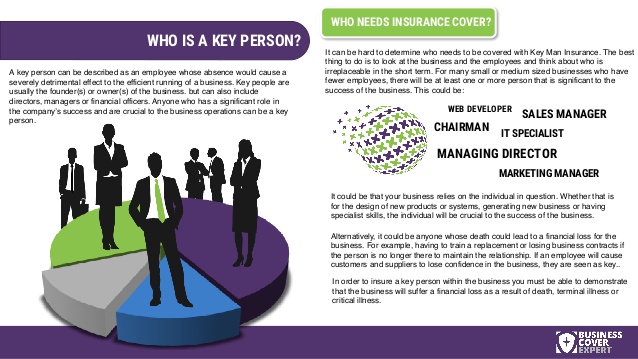

Key person insurance covers the loss of a business if a key employee or director is unable to continue in their role. If one of the key people dies or becomes seriously ill, half of the businesses will cease to exist. As a result, many companies invest in key person insurance to cover the risks. A key person can be any important member of staff or director of the business. They can be someone who makes the business profitable, or they can be the only person with a particular skill set.

Designed to protect public companies as well as private corporations. The policy’s death benefit can keep the business going even after the key person passes away. The death benefit can also help keep the company going during a transition period or protect it from passing on to heirs or others. If you’re considering purchasing for your shareholders, here’s how it works:

Payments from a principal’s insurance policy are generally tax deductible, depending on how the policy is structured, who is insured, and whether the person has any interest in the business. Additionally, the premium is a legitimate business expense, so you can claim the benefit on your taxes. Shareholder protection protects the business by paying out if a critical individual dies, regardless of who owns the majority of the company’s shares.

These key man insurance claims help safeguard shareholder value and ensure business continuity during transitions.

Other benefits of key man insurance

In addition to covering key individuals in a business organization, it can act as collateral for loans from the Small Business Administration. Although the SBA does not make loans directly, it guarantees loans made by approved lenders. Keyman insurance protects the interests of the company and its shareholders. In addition to providing cash flow, key man insurance protects the business from unexpected expenses and loss of profits due to accident or illness.

Keyman insurance is often paid to the company without income tax. The policy death benefit is generally not included in the calculation of the alternative minimum tax for C corporations. However, the death benefit of keyman insurance is included in the employee’s cash value and premium. The death benefit may also be taxable if the policy owner decides to sell the policy. However, if the key person has already passed away and the company wants to reclaim the policy, it must report ownership of the policy to the IRS.

Other benefits include the possibility of claiming tax deductions. The premium for Key Man life insurance will not be tax-deductible, but it is usually tax-deferred. Additionally, the policy is eligible for dividends, which may be tax-free. The policy will last for the life of the key man, so the company can transfer it to the family of a former employee or reassign it to a beneficiary.

Key man insurance for business owners also supports buy-sell agreements, which enable the business to purchase shares from a deceased owner, ensuring smooth transitions in ownership and leadership.