If you’re looking for a cheap car insurance quote, consider Liberty Mutual Auto Quote. This company has an impressive list of benefits. In California, you may find that insurance is required by law. They also offer usage based insurance and car reimbursement for rental charges. Read on to know more about the benefits of this company. You will be surprised to know that you can save up to 40% on your policy. You can also go paperless and receive email reminders for policy updates and payments.

Car insurance is required in California

The main thing you need to know about car insurance in California is that it is required by law. If you don’t have the right coverage, you may find yourself unable to pay for a collision. The state of California requires drivers to have liability insurance, which can pay for damages caused by another person’s negligence. There are three types of liability insurance, one for each party involved in the accident. Under-insured/under-insured motorist coverage covers you when the driver at fault in an accident does not have enough insurance to meet state minimums.

You may also need some form of liability coverage. While liability insurance is the minimum amount of coverage, you should also carry collision and comprehensive insurance to cover damages caused by the negligence of the other driver. The average cost of full coverage from Liberty Mutual is $2758. If you live in California, you can choose the full coverage option. This will cost you a liability-only policy, but you can also get many benefits with it.

It is important to get the other driver’s insurance information after an accident. The other driver’s insurance details are extremely important to your claim, as you have a limited amount of time to file a claim with the insurance company, as are the guidelines for Fresno California. Additionally, you should contact a car accident attorney to file a personal injury claim against the at-fault driver. California Dream Tellers and Attorneys can review the at-fault driver’s policy as well as your own terms. An attorney can help you obtain maximum compensation through the insurance claims process.

In addition to an excellent reputation in the auto insurance industry, Liberty Mutual has an A (Excellent) rating from the Better Business Bureau. In addition to good BBB standing, Liberty Mutual maintains annual standing with the federal government. Despite its fair ratings, Liberty Mutual is generally cheap, though not the cheapest good option. fresno california map Younger drivers may find it easiest to get coverage with lower premiums.

It is cheaper for drivers with at-fault accident

If you have been involved in at-fault accidents, you may be wondering how to get a Liberty Mutual auto quote. First, you should understand that accident forgiveness is a program that can help you keep your rates low even after an accident. However, this program is only available to Liberty Mutual customers who have been involved in one or more accidents. Liberty Mutual customers who have had more than one accident will experience a larger increase in their rates than non-accident customers. This is a good way to lower your overall insurance rates, as that driver will not be able to drive without the policy unless the other driver.

Drivers who are at fault usually pay more for car insurance, which is normal. This is because insurance companies view at-fault drivers as higher-risk drivers and therefore increase rates accordingly.

When an accident is caused by driver error, their costs can increase by about $767 per year. The average premium for a driver without an accident is $1,548. And the rate hike is not a one-time event. Most accidents stay on a driver’s record for three to five years, so the additional cost of insurance can add up to $2300 over three years.

Drivers who are involved in accidents can lower their monthly premiums by switching to the state-required minimum. The average annual rate for minimum coverage ranges from $713 for an American family to $1,181 nationwide. However, consider getting comprehensive or collision insurance if you are in an accident and are at fault. This may also be required by your lease or loan.

While Liberty Mutual has the lowest rates for drivers with at-fault accidents, and Geico offers even lower rates for younger drivers. A full-coverage policy with Geico costs $158 per month or $2,297 per year. That’s $209 less than Liberty Mutual. The insurance company is also known for its competitive rates for young drivers. Their average 18-year-old driver pays 42% less than Liberty Mutual, and the same policy for drivers with a bad driving history.

It offers usage-based insurance

The Liberty Mutual RightTrack mobile app allows customers to save money on you by using a usage-based program. Through the WriteTrack app, drivers can observe their own driving behavior and get real-time feedback on their habits. They can learn how to drive safely and get a discount of up to 30%. After three months of tracking, RightTrack drivers can lock in their discount for life, so they can enjoy the savings for years to come.

Drivers who use public transportation may qualify for coverage at lower rates, and many insurers offer usage-based insurance. The average driver logs about 11,500 miles per year, according to the Federal Highway Administration. If that driver is not safe and drives less than 11500 miles per year, they are not eligible for this policy. Additionally, users who do not drive on average find it difficult to save money.

Utility-based insurance is another stipulation in auto insurance. It tracks driving habits to determine weather santa barbara ca a driver is a safe or reckless driver. Insurance companies analyze the data to determine which drivers can get discounts. Better drivers get better discounts by reducing their premiums. Good discounts are given to drivers who drive well and low mileage. The data is collected through the vehicle’s telematics system or diagnostic port.

If they drive safely and rarely, they should consider this type of insurance. Usage-based insurance can be worth the money if you drive little or don’t drive often. It can help lower your car insurance costs and get you more benefit from lower premiums. Aside from saving money, drivers should shop around and accurately compare usage-based insurance programs. The savings can be significant. When using a usage-based insurance program, drivers should check the details of the policy.

Utility-based insurance is a growing trend in auto insurance. In fact, Progressive was the first to use telematics for insurance purposes. Since then, more car insurance companies have followed suit, and today, every one of the top ten private passenger auto insurance providers offers some form of UBI. What does insurance mean for consumer drivers? It simply means that insurance companies use telematics to monitor how drivers drive their cars.

It offers rental car reimbursement

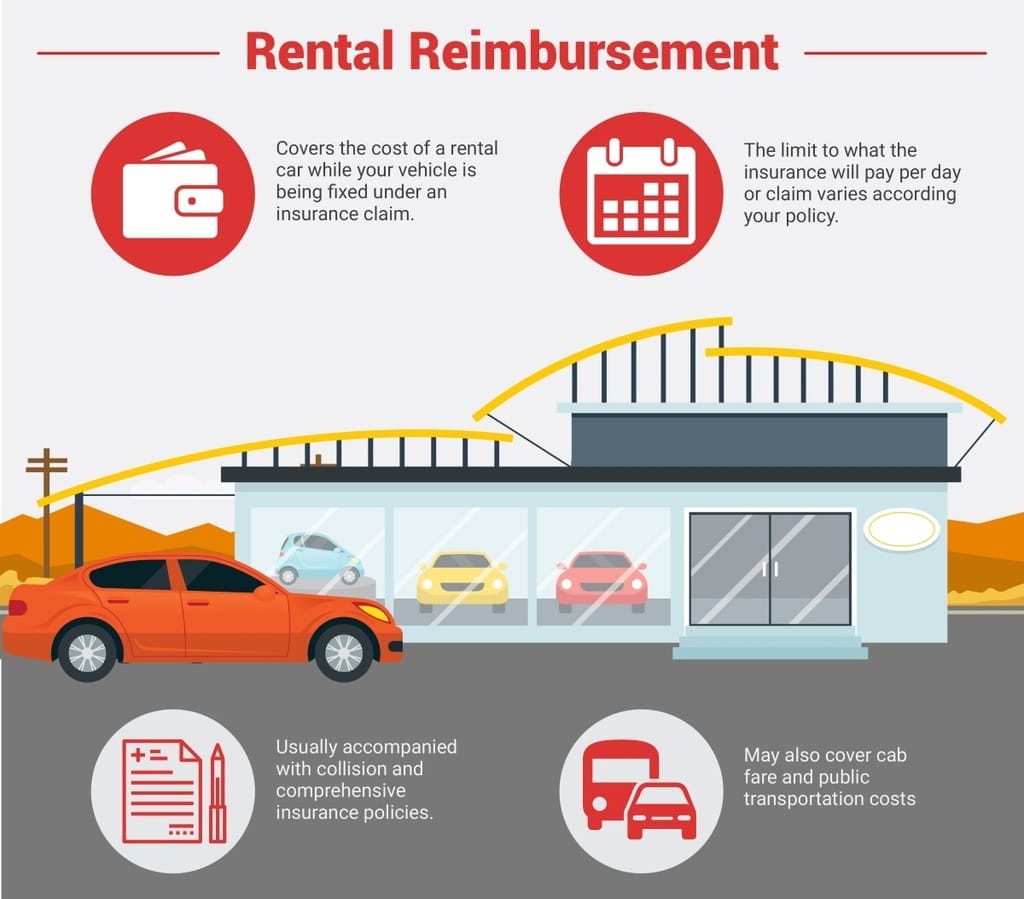

When you need a rental car, you can look into Liberty Mutual’s rental car reimbursement program. This program pays for rental car expenses while your vehicle is being repaired. There is a maximum dollar amount and time limit for this benefit, but the company offers rental cars. For more information, contact your local Liberty Mutual agent. It may also be possible to save money on car rentals if you purchase a rental car reimbursement policy through Liberty Mutual.

For example, if you buy a rental policy through Liberty Mutual, you will be eligible for a 30% discount when you install the app on your phone. These discounts will vary based on your driving habits, so make sure you download the app while it’s available. You can also save money by choosing to drive a hybrid or electric car. This option is not useful for those who do not own a car. Fortunately, this insurance is reasonably priced, so it can be worth it.

Another great feature of this plan is the Better Car Replacement Package, which increases your policy limit to cover the cost of a one-year-old vehicle with low miles. If you drive a new car, you may have to pay for a leased car. This applies to used cars. For example, if you have a new car with 50,000 miles on it and want to replace it with a new car, the Better Car Replacement Package will pay for the rental car.

In addition to rental car reimbursement, Liberty Mutual also offers 24-hour roadside assistance, medical coverage and personal injury protection (PIP) in certain states. When you get into a car accident, your Liberty Mutual insurance will pay for the other driver’s medical expenses and property damage. Liberty Mutual also covers bereavement expenses and provides financial assistance in case of death. Rental car reimbursement can be a lifesaver for those who need it from time to time.