You’ve come to the right place if you’re looking for a life insurance agents near me. Read on for tips on how to find an independent agent. Additionally, beware of agents who are trying to sell you unnecessary coverage. These agents may be more interested in selling you than helping you choose the best policy. It’s important to choose an agent who is genuinely interested in your needs and wants, rather than focusing on their own financial goals.

Find a life insurance agent in your state

If you’re looking for a life insurance policy but aren’t sure where to begin, the internet is a great place to start. One of the best ways to find trusted life insurance companies near me is by using your state’s Department of Insurance website. These tools let you search for licensed agents and companies in your area. You can also view their credentials and check for any filed complaints. For residents in South Carolina, the SCDOI database provides detailed information to help you make an informed choice. Additionally, checking ratings and reviews through sources like A.M. Best Company helps you compare financial strength and customer service, so you can choose with confidence.

If you’re looking for a life insurance agent in your area, you can search for the state’s department of insurance. These agencies help consumers find agents who are licensed in their state. If an agent isn’t licensed in your state, search their name on a trusted life insurance rating site. Otherwise, you can use your agent’s website to check his or her license status.

Life insurance agents earn their commissions by selling you a policy. The more policies they sell, the more they make. The more expensive the policy, the more the agent makes. That’s why agents can pressure you into buying too much coverage. You should always be wary of agents who try to sell policies you don’t need or want. Moreover, agents who have a history of being honest and ethical are better.

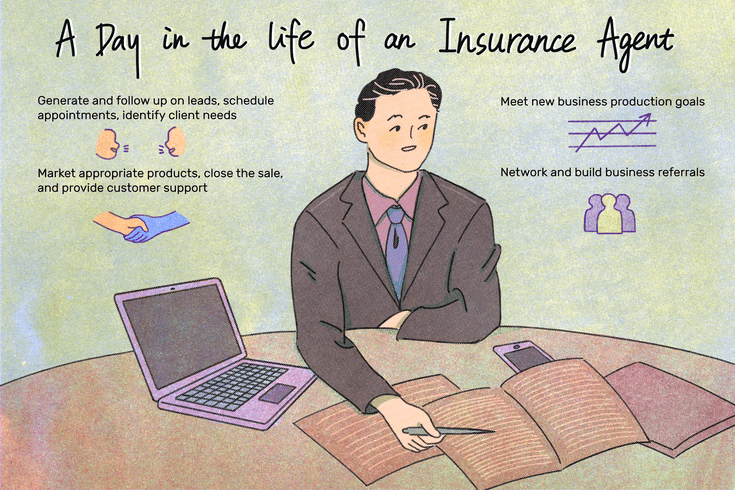

A license is the first step in becoming an insurance agent. This license is issued by the state insurance department. To become an insurance agent, you must apply with a specific insurance company and have their appointment recorded on your state insurance license. Once you have your license, you must actively prospect for clients. Some agents start by writing their insurance and prospecting for friends and family. This helps them understand how the system works and become more comfortable with quoting new coverage.

A good insurance agent can help you understand the world of life insurance and guide you through the entire buying process. While you can apply for a policy on your own, it often involves waiting for the insurer’s response. An agent keeps you updated and manages communication between you and the insurance company, saving you time and stress. They will also make sure that you don’t buy more coverage than you need.

You can also use an insurance broker. Insurance brokers work with many insurance companies and represent buyers. You can contact them to compare policies, and they can even sell you additional products. It’s easy to find a life insurance agent in your state by searching online. They will also be able to give you detailed information on each of the different insurance products. There’s nothing better than being able to discuss your options with a knowledgeable professional!

Find an independent agent

When searching for the best life insurance agents near me, choosing an independent agent can make all the difference in getting a fair and competitive price. Independent life insurance agents are not tied to a single provider, giving them access to a wide range of policies from multiple companies. This allows them to compare options, explain policy details, and offer personalized advice tailored to your unique needs. With their experience and unbiased guidance, independent agents help you make informed decisions about your coverage. For example, companies like Safeco sell their life insurance products exclusively through independent agents, ensuring you receive expert service and a broader selection.

While recommendations from friends and professional advisers are helpful, make sure you research the agent on your own. Do they have a good reputation in the community? Is their approach honest and helpful? Does the company provide a clear process for handling medical issues? Will the agent recommend the most affordable policy? Choosing a life insurance agent is a personal decision, but it’s important to consider their experience and ability to guide you through the process.

Avoid agents who try to upsell you

You’ve probably heard about insurance agents who try to upsell you unnecessary policies. These agents use scare tactics to trick you into thinking you need more coverage, just so they can make more money from commissions. But don’t let them scare you. There are ways to avoid being upsold by insurance agents. Keep reading to find out how. You’ll thank yourself later. And remember that you don’t have to pay for unnecessary policies, either.