Many insurance companies now offer affordable life insurance coverage for senior citizens. These policies usually last for five to ten years. That means you need to renew it every five to ten years. This is an unfortunate side effect of age; Most insurance policies are renewed every five to ten years. Additionally, most policies for seniors are only five or ten years old, as most insurance companies do not want to offer long-term rates to their older customers. Consider exploring different options to secure the best life insurance for seniors over 60.

Transamerica

The benefits of Transamerica life insurance for seniors over 60 are plentiful. Transamerica offers a variety of plans, including term life and whole life insurance. Premiums are generally low, and terms can range from 10 years to 30 years. Unlike some companies, premiums are level throughout the policy term. Transamerica also offers several living benefit riders, including accelerated death benefits for children. There are several no-medical exam options available.

Transamerica’s final expense policies are easy to apply. Your health and age determine the standard or preferred rating. The company offers three types of final expense policies: term, absolute, and universal. Whole life policies are the most common choice for seniors and can cover final expenses. In addition to term life policies, Transamerica provides burial insurance for seniors and can offer competitive rates with Lincoln Heritage and Colonial Penn.

Whole life insurance policies offer long-term coverage without the risk of rejection. Term life insurance is generally less expensive, but can increase in value over time. A 60-year-old woman in good health can qualify for a $100,000 life insurance policy for between $38 and $52 per month. If she dies tomorrow, the policy will continue, so the policy will be useful for the rest of her life.

Transamerica offers whole life insurance for seniors over 60. Offers lifetime coverage and assured death benefit.

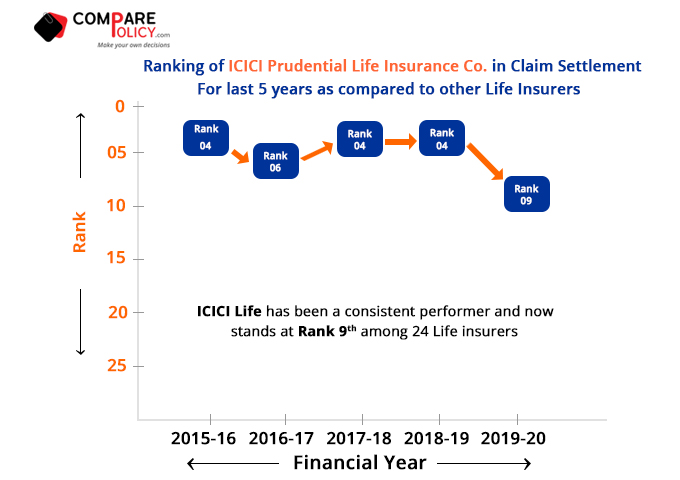

Prudential

When comparing life insurance for seniors over 60, Prudential is a top choice for affordable, flexible policies. The company’s customizable products allow senior customers to adjust premiums to cover aging-related health conditions. Additionally, these policies are easy to use and include flexible income requirements. Some of its riders are designed to help older adults afford coverage, such as those that offer lifetime benefits. And with coverage up to $50 million, Prudential is a great choice for seniors.

Term and whole life policies are available for senior citizens. But their rates are generally higher than in younger individuals. Term life policies are cheaper, and usually require a health exam. But it is a good choice for seniors who want a safety net. The coverage period for senior term life insurance policy ranges from 10 to 30 years. Seniors under the age of 60 should consider a term policy of $150,000, which lasts for 10 to 30 years. Term life insurance is also available without a medical exam and can be more affordable.

Many companies offer life insurance for senior citizens above the age of 60. Some companies, including State Farm, Mutual of Omaha, and North American, allow people over age 60 to renew term life insurance policies as long as they are healthy. In some cases, like some policies, the maximum age may be higher. However, many other companies do not have age limits. While applying for life insurance for senior citizens above 60 years of age, it is essential to consult an independent life insurance agent.

New York Life Insurance For Seniors Over 60

One of the best ways to ensure a comfortable retirement is to buy life insurance from a reputable company like New York Life. While whole life insurance is the traditional way to protect your future, you can also choose from term and universal life policies. A term life insurance policy lasts anywhere from 10 to 20 years. If you die while taking the insurance during the term, your beneficiaries will receive the death benefit. On the other hand, whole life insurance policies offer lifetime coverage and cash value that grows tax-deferred. You may also receive dividends from your policy. New York Life also offers universal life policies and flexible term life insurance policies as well as options for riders.

AARP life insurance policies have many benefits, such as guaranteed acceptance. They are underwritten by New York Life, the world’s oldest life insurance company. These policies have no medical exam requirements and no health questions. AARP members can enroll in the program without undergoing a medical exam. The AARP life insurance program also gives policyholders the option to convert their term life insurance policy into a permanent policy.

Prudential and Protective are other excellent life insurance options for seniors above 60. Both these companies have excellent ratings from AM Best, indicating their ability to meet their insurance obligations. If you have various health conditions, they are excellent options for you. Prudential Life has excellent rates and an easy application process. Its competitive rates make it a great option for senior citizens. In addition to their competitive rates and flexible income requirements, Protective Life offers affordable policies up to $50 million.

New York Life offers some of the best AARP life insurance for seniors over 60. Which offers term and permanent coverage options.

Pacific Life

Among the many features of Pacific Life are accelerated death benefits and fixed premiums over 10 years. These policies are particularly suitable for people who are still working but don’t yet have children, or have a mortgage or other large expenses. Other features of this insurance company include a high financial rating and A.M. “A+” rating of best. The company offers policies in all 50 states and the District of Columbia, and some of its policies do not require a medical exam. To apply for a policy, you have to call the company or use a third-party insurance agent.

As one of the world’s largest life insurance companies, Pacific lives up to its name. It survived the Great Depression and remained steadfast during the subprime mortgage crisis. The company is listed on the Fortune 500 in 2021 and is one of the few companies that has maintained its position through the Great Depression and the subprime mortgage crisis. Additionally, Pacific Life is a mutual company with over $209 billion in assets. It is also financially stable, as Fitch, A.M. Best, and Moody’s have assigned the company an “Aa3” rating.

While most of its competitors offer similar plans. The main difference between Pacific Life and their competitors then is their online experience. Pacific Life can provide a seamless online experience that will allow customers to easily apply and pay for policies and a personalized account portal that will make it easy for senior citizens to find the right coverage. But is it worth it? In today’s market, it is possible to find a low-cost policy that fits your financial situation. The main thing is what you want and what you don’t.