A smoker cannot be denied life insurance if they smoke. Smoking is one of the most important lifestyle habits that affects your premium. Getting an insurance quote can help determine whether you qualify for life insurance for smokers. However, before you can get a quote, you should understand the requirements. Some insurance companies will require you to undergo a medical exam. The process usually includes questions about your general health and medical history and measurements of your height, weight, blood pressure, pulse, and urine output.

AIG

If you are a smoker and looking for life insurance, AIG may be an option. The company writes several types of life insurance policies, including term and universal life. If you are a smoker, the company has several options for you, including the Select-a-Term program, which allows you to choose the exact length of your term policy. If you are a non-smoker, you can also look into the AIG life insurance for smokers rider, which offers benefits of up to $250,000 if you die suddenly. The insurance company is also available through online agents. Smoking can double or triple the premium rate. The policy offers the ability to change premiums and benefits after one year of not smoking.

The best thing about AIG life insurance for smokers is that you don’t have to quit smoking to get coverage. You just need to be nicotine-free for at least a year. Non-smokers can qualify for a non-tobacco rate if they stop using nicotine replacement therapy. This is because the coronavirus pandemic has changed how insurance companies work, and more insurers are adding restrictions to cover certain health conditions and age groups. However, if you want a policy without a smoking restriction, talk to a life insurance agent.

For smokers looking for coverage, AIG is considered among the best life insurance for smokers, with competitive rates and customizable benefits.

Prudential

If you smoke, you should look for a policy that excludes tobacco use from its underwriting criteria. Prudential, a major insurance company, considers cigarettes to be tobacco. But Prudential doesn’t just consider cigarettes to be tobacco. Other tobacco products, including e-cigarettes, are treated the same as traditional cigarettes. That’s why you can get some of the best rates on life insurance from Prudential.

When choosing a life insurance policy for smokers, you should make sure you do your research and choose the right plan for your needs. There are a variety of options available, including the premium payment term and mode, the sum assured of the policy, and many other options. And don’t be afraid to answer all the questions correctly – you don’t want to leave any stone unturned. The right policy will make the difference between a great life insurance policy and a disastrous one.

In addition to life insurance, Prudential also offers policies that will meet the needs of non-smokers. If you are a heavy smoker, your rates may be higher than those of non-smokers. But if you are serious about quitting, you can always apply for a rate review. In addition to the non-smoker rate class, Prudential has life insurance for alternative and smokeless tobacco smokers.

Known for its flexible underwriting, Prudential is a top choice for those looking for life insurance rates for smokers, offering competitive pricing to suit different nicotine-use profiles.

Mutual of Omaha

If you smoke, you might want to consider getting life insurance for smokers from Mutual of Omaha. Although this company is smaller than some of its competitors, it has a fully functional website, as well as profiles on five of the most popular social media sites. There are a few things you should know before purchasing this life insurance. They also have three employment programs to help you find the right life insurance policy. You can learn more about each program by reading our guide.

As for the policy itself, there are many options available. A whole life insurance plan, for example, is more expensive than a term life policy. But it offers more flexibility. In New York State, you can apply for an insurance policy if you are between the ages of 45 and 85. You can choose from an initial coverage amount of $2,000 to $25,000, depending on your age. Mutual of Omaha also offers policies that don’t require a medical exam and guarantee that premiums will never increase.

Even if you smoke, you may still qualify for a final expense life insurance policy from Mutual of Omaha. The best part is that you don’t have to go through a medical exam and your policy will remain in effect until you die. Other companies offer no-medical-exam life insurance for smokers. The only difference is that the policy is usually more expensive, but the cash value accumulation is worth it.

For those seeking term life insurance for smokers, Mutual of Omaha offers competitive rates tailored to individuals with nicotine use.

John Hancock

The best way to get low rates on life insurance is to not smoke, so many people turn to a reputable company for policies. The company has an A.M. Best and Moody’s “A+” financial strength rating. Its financial strength rating is generally in the A-B range. Its financial strength is supported by an A-rated rating from the Better Business Bureau.

John Hancock life insurance for smokers is not available through other companies, but they do offer an excellent Vitality Rewards program for customers who smoke. The program rewards healthy living by offering discounts at popular retailers and grocery stores. Customers choosing John Hancock as their life insurance provider should note that the company has strong financials and very few complaints against it. While their rates are slightly higher than the national average, they offer favorable underwriting for smokers and those in less-than-perfect health.

The JH Quit Smoking Program is another way for smokers to get cheap life insurance. It only applies to permanent life insurance policies. Those who quit must show evidence that they can live a smoke-free life. In addition, some policies also offer discounts to smokers with certain health conditions. In many cases, smokers with health problems can also get discounted premiums if they qualify for the VitalityGo wellness program.

Offering options such as term, whole, and universal life insurance, the company is a top choice for those looking for cheap life insurance for smokers.

Prudential’s Vitality program

The Prudential Vitality program for smokers is a unique way to track physical activity and save money on individual life insurance. Members of this program have a mobile app that tracks their steps and heart rate and awards them points each day based on these measurements. These points can then be converted into rewards at the end of the week. The program offers many benefits, including discounts at iFood and 99 Cent stores and RitualGym.

The Vitality program was initially designed to help smokers quit but was soon expanded to become Discovery’s flagship product. It was launched in the UK in 2004 in a joint venture with Prudential Assurance, one of the country’s largest insurers. The program was marketed as a unique reward for maintaining healthy habits and predates the proliferation of self-tracking devices in the 2010s.

The benefits of the Vitality program have been recognized by experts. It is one of the only programs that offers premium discounts for smokers as well as additional incentives to change unhealthy behaviors. The company’s Vitality program enables policyholders to lose weight through cycling and monitor their physical activity levels through an app. As a result, members can earn or recoup 100% of the cost of the smartwatch they purchase.

Prudential’s preferred non-smoker rate class

When looking for a life insurance plan for smokers, it’s important to find the plan with the lowest rates. While many companies offer lower rates for non-smokers, Prudential offers a select non-smoker rate class that smokers may qualify for. You can save up to 60% on your premium when you apply with Prudential. If you’re worried you’ll be denied coverage, there are several things you can do to improve your chances of being accepted.

To start, avoid cigarettes. The best way to reduce your risk is to quit smoking altogether. If you have a habit of smoking cigars, for example, you should consider quitting for health reasons. Once you have been smoke-free for at least 12 months, you will be eligible for Prudential’s preferred non-smoker rate class. You can also use e-cigarettes, but most companies consider this to be tobacco use, so check with Prudential to see if your plan is eligible.

While most companies consider regular cigar smokers to be smokers, Prudential is more lenient. They will give them a preferred non-smoker rate if they haven’t smoked in the past 12 months. Other insurers, such as Legal & General America, won’t count you as a cigar smoker if you’ve used e-cigarettes or tobacco products in the past 12 months.

The best life insurance for tobacco users, Prudential offers tailored options that provide affordable coverage despite the high risks associated with tobacco use.

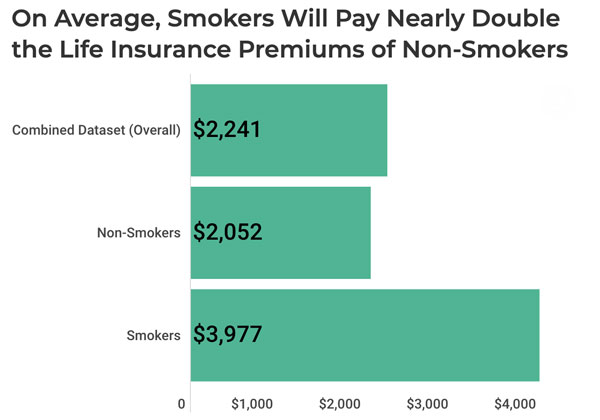

Cost of life insurance for smokers

If you smoke, you may be wondering how to get affordable coverage. There are a few things you can do to reduce the cost of life insurance for smokers. While the cost of insurance for smokers varies by state, the average policy premium for both men and women is $130 per month. You can also get a policy without a medical exam, although quotes will vary. The best way to compare rates is to get several quotes from different companies. Some are more generous than others.

Smokers pay higher premiums for life insurance because of the increased risk of cancer and other diseases associated with smoking. A forty-year-old male smoker can pay 500% more for the same policy than a non-smoker. Those who smoke a limited amount of marijuana can also pay more for their life insurance. However, the benefits of life insurance for smokers outweigh the costs. If you smoke a few times a week, you will have to pay a higher rate.

If you smoke a lot, life insurance for smokers will cost more than for non-smokers. But don’t despair. By following a few simple tips, you can get affordable life insurance for smokers. First, make sure you’re in good health. Smoking is one of the leading causes of death, so you should take steps to quit. If you already smoke, you may be able to find a policy that covers your smoking habit.