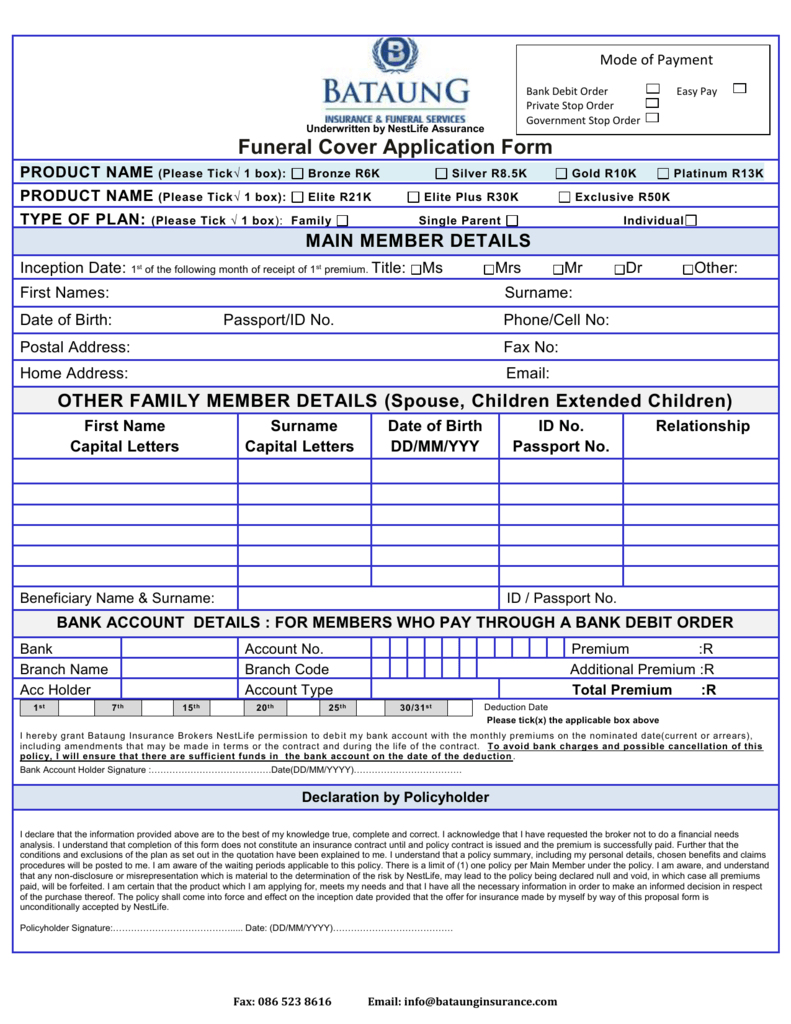

When looking for a life insurance quote, you should compare quotes from similar insurance companies, ensuring they offer the same level of coverage. Compare features offered for free with features charged separately. Some insurance companies offer accelerated death benefits, while others charge extra for this rider. It would be best if you also look at quotes that provide quotes for different payment intervals as monthly payments can be more expensive than annual plans. In some cases, this administrative cost will be reflected in the yearly plan price.

Level premiums

You can also opt for policies that offer level premiums. This means your monthly premium will not change according to your age. This gives you more certainty as you plan for the future. The downside of this policy type is that it can increase your monthly premium sooner than expected. If you are unsure, seek professional advice. However, if you cannot afford the monthly premium, a level premium is the right choice for many people.

As you age, the cost of life insurance can become more expensive. Even if you buy a level-term policy, you may find that it doesn’t cover all your expenses. This is because life insurance companies often charge much higher premiums during the early years of the policy’s life. In these cases, the additional premium is invested by the insurance company. Additionally, level premiums can help you avoid additional premium costs.

One of the benefits of a level premium is that it can help you better budget your insurance costs. For example, you may pay a lower premium on your second year of coverage than on your 12th year. A level premium can also make it possible for you to enjoy more coverage in the early years of your policy, especially if you are in good health. Besides saving money in the long run, a level premium can give you peace of mind as you look forward to the future.

With life insurance term cost being a key consideration, level premiums provide budget-friendly predictability, as payments won’t increase over time.

Cash value

The amount of money accumulated in a cash-value life insurance policy can be used to pay premiums or other expenses. This type of insurance is useful for individuals who have limited cash or live on a fixed income. Some insurance policies are designed to accumulate large sums of cash value slowly but steadily over time. Here are some common examples of policies with high cash values. You should also consider the cost of cash-value life insurance before deciding on it.

Borrowing against the cash value of your life insurance policy is easy and usually comes with low annual interest rates. However, you will be responsible for paying the interest out of your pocket every year. You should also look at the size of your loan compared to the cash value of your policy. If the loan exceeds the cash value of your policy, the policy will lapse. If you don’t make regular payments, you may have to pay income tax on the borrowed amount.

Cash value life insurance is a good investment option. In the event of your death, the remaining money in your policy will be available for use. With proper planning, you can use the money to pay policy premiums or supplement retirement. However, keep in mind that cash-value life insurance is often expensive and subject to market fluctuations. If you are healthy, cash-value life insurance may be the best option for you. This type of insurance is a great way to increase your savings and provide your family with a substantial death benefit.

This makes life insurance and annuities valuable for long-term financial planning. You can access the cash value during your lifetime through withdrawals or loans for various needs like emergencies or retirement.

Age

The age of the policyholder is the most important factor in determining the cost of a life insurance policy. If you’re 44, your policy will start on your half-birthday, but your carrier may use a closer age to determine your premium. A policy that offers more coverage at a younger age will cost less than a policy that offers more coverage at an older age. Here are some things to keep in mind to make sure you’re getting the best rate possible.

Health

The first step in getting a life insurance quote is to fill out a questionnaire about your health and financial needs. Once you fill out the questionnaire, you can get an initial quote from the insurance companies. Once you’ve determined the level of coverage you need, an insurance agent can gather additional information and recommend you get a policy. After you fill out the questionnaire, the insurance company will review your medical records and conduct a brief health exam to determine your premium.

Then, start comparing quotes from different insurance companies to find the best value. You should compare quotes for the same level of coverage. You should also note which features are included for free and which are not. Some insurance companies may include an accelerated death benefit rider, while others charge extra for it. Note the payment intervals, as different insurance companies may charge more for annual plans than monthly. If you are not sure how long you will live, an annual plan will be cheaper than a monthly one.

Health plays a vital role in determining your affordable term life insurance quote and overall eligibility.

Health is a key factor in determining your life insurance quote instant estimate and overall premiums.

Exclusions

You should familiarize yourself with the exceptions in life insurance quotes. These are situations in which the policy will not cover the cost of the event. Typically, these types of incidents are listed after the main coverage sections, such as personal property and liability. You can also find exclusions listed in the endorsements and terms. If you know of circumstances that may trigger an exclusion, you can purchase additional coverage.

Another general exclusion is aviation, which will affect retired pilots and private pilots with separate life insurance policies. This exclusion states that your life insurance policy will not cover you if you die in a plane crash or are on active duty in the armed forces. In such a case, it is worth asking for a policy that does not exclude aviation. In general, it is better to have an underlying activity excluded than an underlying activity.

Certain conditions will disqualify you from getting a life insurance policy. These situations usually include risky activities, alcoholism, and drug use. In some cases, there will also be a suicide clause. You should be aware of these exclusions before purchasing a policy. If you have any concerns about exclusions, consult a financial advisor to find out what they mean. The best way to avoid falling into exclusion is to learn as much as possible about your health.