If you’ve been in a car accident and need nationwide auto body repair, you may be wondering whether you should use an in-network shop or go to a nationwide body shop. In this article, we will discuss the costs of auto body repairs and the differences between in-network and out-of-network shops. We will also discuss the reputation of each shop, as well as the quality of repairs provided. To help you make the best choice, we’ve compiled a list of the most popular nationwide body shops.

Cost of auto body repairs – Nationwide Body Shop

If you are considering auto body repair, one of the first questions to ask yourself is: how much are collision repairs? Most of the time, collision repair costs are borne by third parties. such as insurers. The insurance company pays the bill ninety percent of the time, and while they are trying to limit their costs, they can also rob body shops of their profit – and the consumers of the quality of repairs.

What is the cost of auto body repair being repaired? The damage varies depending on how bad it is. In general, minor damage will cost $50 to $1,500, though more severe damage may be more expensive. While your car insurance usually covers the cost of bodywork after a car accident, you should check your policy for any restrictions. For example, some policies only cover cosmetic damage. If your car is only damaged on the outside, you may have to pay for the repairs yourself.

Many caliber collision repair companies use advanced technology to improve the quality of their work. The higher the repair cost, the more likely a customer is to have the car returned to the same shop for another repair. To minimize the risk of a go-back, a body shop should make sure the repair process is painless for the customer. If it is not, they should be sure to follow safety guidelines and abide by industry guidelines.

In-Network vs. Out-of-Network Costs Comparison – Nationwide Body Shop

When you compare the rates of in-network and out-of-Network body shops, be sure to ask about the insurance company’s nationwide preferred body shops. When you don’t need to use their shop. If you choose an out-of-network store. So you can account for the difference. Insurance companies tend to reward high-volume customers with higher rates, but this does not necessarily mean they are giving you the best value. Rather, they reward those who send them a lot of business.

The reputation of in-network and out-of-network shops

When your car crashes. That’s when it’s important to know your rights and the reputation of in-network and out-of-network nationwide body shops. The insurer you have chosen has a certain reputation in the auto insurance industry and may have a recommendation for a body shop. If you want to go with a reputable shop, you can use a search tool on the insurance company’s website. Enter your zip code or name and find a shop in your area.

A good in-network body shop will have a reputation for providing prompt service. The insurance company will send a check directly to the shop. They’ll handle any warranty claims and issues about poor workmanship. The insurer will also handle the insurance claim process. If you’re having a collision, you’ll need a nationwide body shop that knows how to work with your insurance company.

Quality of repairs

The following are important things to look for when looking for a new collision repair shop. Good customer service and quality repairs. Make sure the auto repair shop uses genuine OEM parts. And employees are certified to work on modern vehicles. Also, the shop is backed by a warranty or BBB. Why See Is Customer Satisfaction Guaranteed? Consider all these important details before handing over your vehicle.

Choose a store that is not advertised by insurance companies. Some shops try to boost insurance business by “schmoozing” adjusters and lowering their estimates, which can result in less than adequate repairs. Insurance companies are looking to save money, so shops try to meet their lowball estimates by cutting corners. This can be bad news for customers. Check out reviews online and choose a shop that offers high-quality, reasonable rates.

Ask your insurer about the quality of work. Insurance companies cannot force you to go to a preferred nationwide body shop. Some insurers have lifetime warranties for their repairs, but many do not. If your insurance company has a preferred network of collision repair shops, it may be best to use that body shop instead. However, if you don’t like the quality of work at one shop, you can always choose another one. The quality of repairs at nationwide collision repair shops may vary.

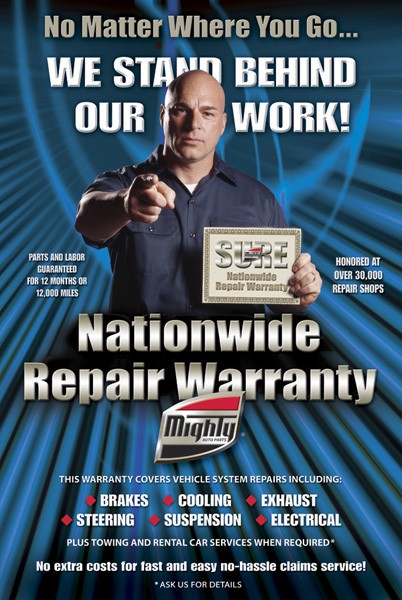

Warranty on repairs

If your vehicle is under warranty. Then reimburses you for repair costs up to the original repair amount. To qualify for the warranty, you must have the original repair invoice and warranty brochure provided by the dealer. If you’re unsure how to exercise your warranty rights, it is important to read the information carefully. The warranty covers repairs, not the labor or parts. During your warranty period, you can call the warranty administrator to have your car repaired.

If your vehicle is not under warranty. Then you won’t be able to complete the task. Your vehicle must be repaired at a participating facility to be eligible for warranty service. If your vehicle is repaired at a non-participating facility. You must then pay for the repair yourself and present the original repair invoice and receipt as proof of repair. If the warranty repair does not apply to the original repair, the Repair Facility must replace it.

When you sell your vehicle. Most body shops will not honor their warranty then. Fortunately, you can transfer the warranty to another person. Just make sure to notify Frank’s Accurate Body Shop of the change within 30 days after you sell your vehicle. You can also ask your body shop to transfer your warranty to a new owner if you don’t mind paying for the repairs yourself. Then, you’ll enjoy the benefit of nationwide coverage.