There are several ways to track the progress of your investments with a national financial institution like Fidelity. We will explore how the Nationwide Fidelity Portal can help you with this. To start, you can check your total account balance and see how much you can expect to withdraw in retirement. Income simulators help you estimate how much money you’ll be able to withdraw in retirement with certain changes in account balances or savings rates. You can view the balance of personal accounts like your pension plan, and stock plan personal account. Quick links are provided to quickly access balance and transactional screens.

Nationwide fidelity overview

The Fidelity Investment Platform is a complete set of research tools and news. Fidelity provides daily updated market news data with a compelling look at the S&P 500, NASDAQ, and Dow Jones Industrial Average key indices. You can see which investments are leading market movers and how your returns stack up against the market.

Business services bonds

The price of a business service bond depends on many factors. Including the total amount of coverage desired, the number of employees, and the state in which the service is provided. Prices vary, with costs starting at $100 per year for a $10,000 bond. Costs can go up to $1,000 per year and the cost will depend on how much coverage you need. In many respects, your credit score will play a major role in the premium cost of the bond.

A business service bond can protect a company from employee dishonesty and give it a competitive edge in the market. Be sure to mention the presence of a professional services bond in your advertisements and proposals to potential clients. A business service bond does not mean that the employee is 100% trustworthy. He must be guilty of dishonesty and the insurance policy will cover the loss.

Fund Window investment options

Nationwide Fidelity Retirement Plan offers two types of funds: Fidelity Advisor Freedom Portfolio and Nationwide Investor Destination Funds. Each helps you achieve asset allocation and diversification. Nationwide offers the Nationwide Retirement Innovator Program. A retirement plan that allows you to choose from a wide range of investments. Fidelity Advisor Freedom Portfolio to provide a diversified mix of assets.

NetBenefits portal

These courses include scheduling participants through the NetBenefits portal and regular universal web workshops. They provide information about asset classes and asset allocation. Participants can use this knowledge to rebalance their portfolios. This enhanced service is available to all plan participants. Regardless of their location experience level.

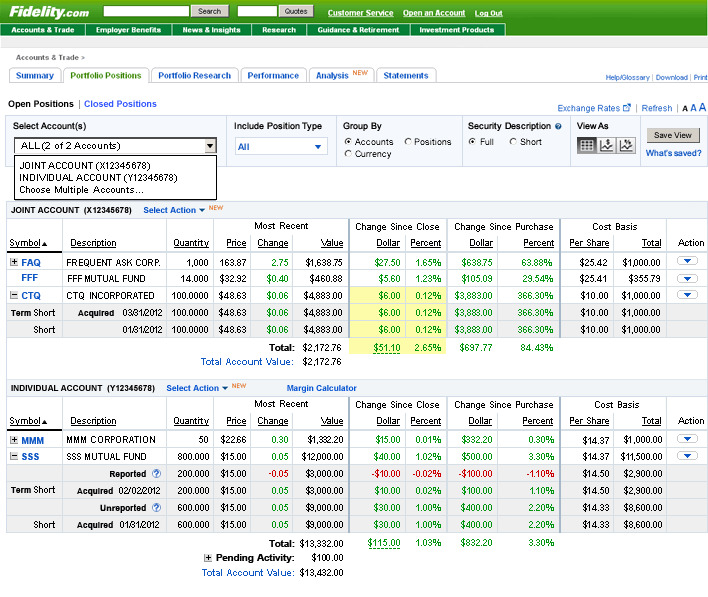

you have registered for the NetBenefits portal, you can view your account summary information. It is easy to track the performance of various investment accounts. You can access information about your health insurance plan 403(b) account. By clicking on the “View Account” tile, you can see the rate of return and year-to-date performance for each investment.

Cyber and crime coverage

Some companies do not require cyber insurance, as their liability and property policies cover cyber damage. A new survey shows that 95% of respondents consider data breaches to be one of their cyber threats. only 36% of respondents currently have cyber-related property damage coverage. They are concerned about gaps in coverage. These questions highlight the need to better understand the coverage provided by various insurance policies. What types of data breaches are covered by cyber policies? How much coverage do you need?

cybercrime insurance policies should cover these expenses. Insurance companies may try to deny coverage for these expenses. Some policies do not cover IT staff salaries. argues that. That it is part of general operating expenses. If you do, the insurance company may refuse to pay the ransom. You will be on the hook to pay the ransom.

Product offerings

If you are considering a career in financial services, you may wonder what the best career options are. Many of these professionals have a comprehensive understanding of insurance products and services. Part of Fidelity’s leadership team to help grow several businesses. Dedicated to bringing innovation and a personal touch to their work.