If you’re considering purchasing a Nationwide High Point 365 policy, there are several features to consider. These options range from New Heights to Select Lifetime Income Benefit Rider. They also include Enhanced Death Benefit Rider. However, you should not expect to be able to combine these features with every policy. The best choice may depend on your situation and financial circumstances. Read on for more information about Nationwide High Point 365.

New Heights

The Nationwide High Point 365 fixed index annuity is a 12-year single-purchase payment annuity with a CDSC schedule. This product is designed for those people. Those who fear the market. Instability, long-term care, and terminal illness. No matter what age you are, this annuity has something for you. Nationwide’s New Heights 12 annuity offers a flexible way to save for retirement while still protecting your money.

The Nationwide New Heights Select 9 annuity tracks potential strategy earnings daily and does not limit the index performance used to calculate earnings. However, the equity-indexed allocation and strategy spread may limit overall growth potential. Still, this annuity guarantees not to lose your investment or credited earnings. Guarantees you lifetime income as long as you meet the minimum age requirements. Policy transfers from one account to another.

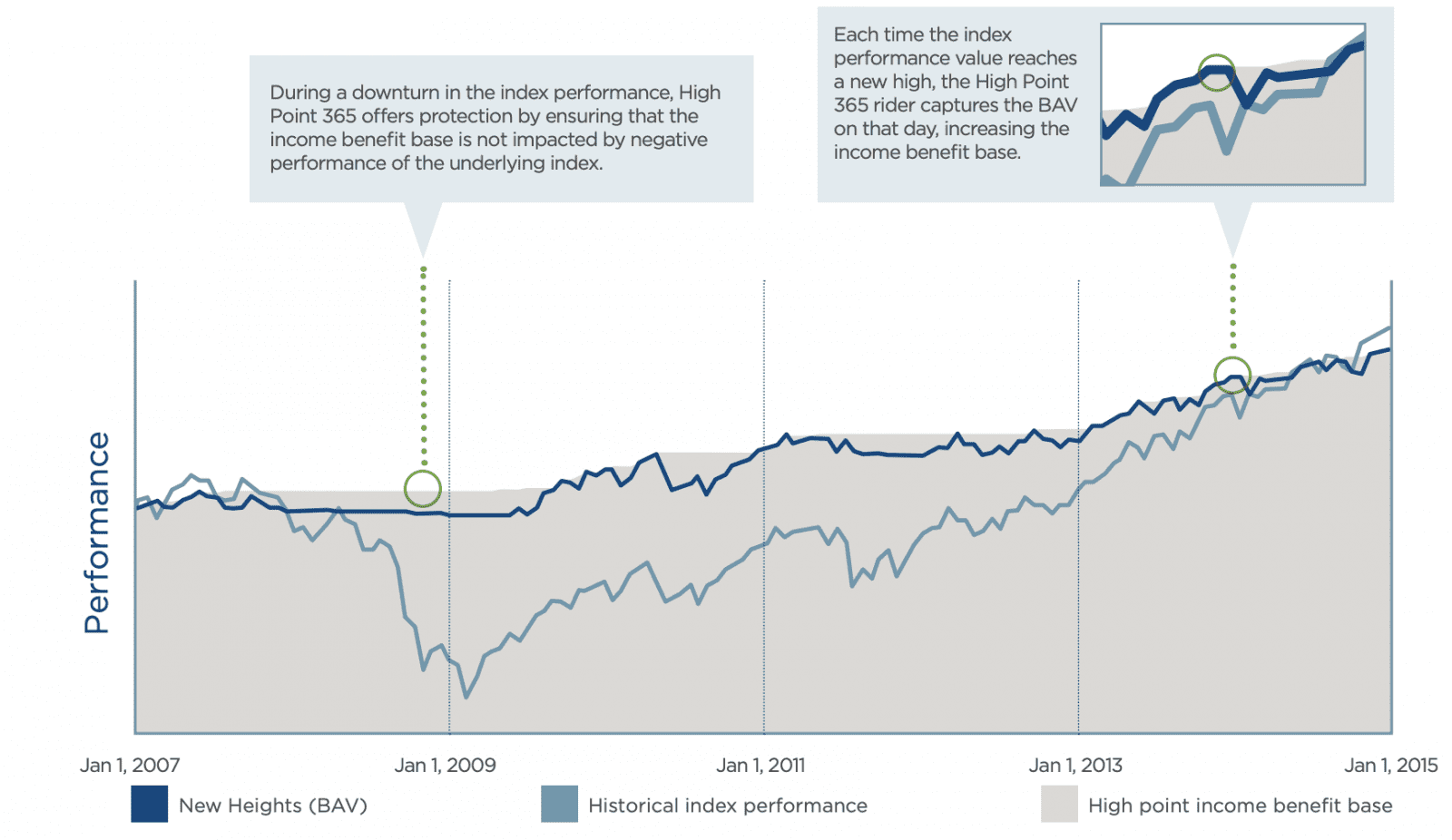

The Nationwide New Heights 365 offers optional income riders. The High Point 365 Income Rider pays an additional 0.95% of the contract value every quarter. Adding this option will increase your lifetime income in retirement. It can grow your money at a 7% compound annual rate, and the rider also tracks two daily values. One of these values is the most balanced. Allotment value and other lowest. Nationwide New Heights income rider otherwise allows you. It allows additional funds to be withdrawn earlier than that.

The Nationwide New Height Select 9 annuity has surrender charges and a Contingent Deferred Sales Charge (CDSC). This annuity has a nine-year surrender period. After the first four years, you can withdraw up to 7% of your contract value without incurring any surrender charges. If you do not withdraw any money during this period. So the CDSC charge may be multiplied by the amount you withdraw instead of the free withdrawal amount.

Nationwide High Point 365 Select Lifetime Income Rider with Bonus

Nationwide High Point 365 is an optional life benefit with Life Time Insurance Rider Select Bonus. which can be added across the country. New Height(r) Fixed Indexed Annuity Contract. You should be between 40 to 80 years of age to avail of this rider. The rider is paid quarterly. The amount you receive will depend on the plan you choose, but you can opt-out whenever you wish.

The Nationwide High Point 365 Select life insurance rider has a lower initial investment amount, but a more generous calculation of the Income Benefit Base and flexibility to make earlier withdrawals. Moreover, the Nationwide High Point 365 Select Lifetime Income rider with Bonus offers a bonus of 10% of the purchase payment. The life insurance contract will continue to grow daily at a 7% compound annual rate, and if you choose to take your withdrawals earlier, you can take advantage of the riders.

Additionally, the new Nationwide High Point 365 further expands Select to deliver greater client value. This product features two new indices, increased lifetime income payout percentages on the income rider, and highly competitive accumulation opportunities. In addition, new indices, a diversified portfolio, and more advanced bucketing capabilities offer investors greater diversification. The added value of the Nationwide High Point 365 Select comes from its ability to track index performance and lock in earnings at the end of each strategy term.

The Lifetime Income Rider is one of the most popular riders in the market. It provides a lifetime income for its members when they follow its rules. It has numerous benefits, including the possibility of receiving an increase in your payments if the BAV increases. The benefits of this rider are dependent on your age, BAV, and the type of policy you have. It is important to know that there are bonus offers Selected with high nationwide. Point Lifetime Income Rider 365 is not affiliated with any third-party companies.

Nationwide High Point 365 Lifetime Income Benefit Rider

Nationwide High Point 365 Lifetime Income Benefit Rider Individual Life Insurance policies are available at a normal cost of 1.10% of the base premium. This rider is based on the high-point income benefit base. Deducted quarterly from the contract value. It offers the additional benefits of guaranteed minimum income and flexibility to make withdrawals earlier than originally planned. However, there are some important caveats before you buy this rider.

The benefits of a Lifetime Income Benefit Rider are similar to Deferred Income Annuities. However, the Lifetime Income Benefit Rider pays out 100% of the interest in years where there is interest. This feature provides a better income payout rate than a standard annuity. However, it does require you to make a minimum of $2,500 to receive benefits, which can be quite a bit of money for most individuals.

The lifetime income benefit rider combines the principal of an individual life insurance policy and its interest. Money is deducted as you withdraw. When the person dies early the accumulated value goes to the beneficiaries. This means that, even if you don’t live long enough to collect your income benefits, you can guarantee a stream of monthly income for the rest of your life.

Nationwide High Point 365 Select Enhanced Death Benefit rider

With the Nationwide High Point(r) Enhanced Death Benefit rider, you can take advantage of a higher death benefit. This rider offers a guaranteed growth rate and a bonus credited to your purchase payment. It also provides a joint option, which allows the death benefit to be paid to a spouse or partner, regardless of who dies first. If you are considering using this rider, you should read the Nationwide High Point 365 Select Enhanced Death Benefit Rider Guide to learn more.

This rider allows you to increase the death benefit of the life insurance policy by a percentage. This option can be combined with other rider features to give you more death benefits. This rider is available in various states. So be sure to check with the insurance company to see what’s available in your area. Once you determine the amount you want to raise, you will be able to make a better decision.

This rider offers higher payout percentages than the original plan and allows you to withdraw money early if you want to. If you’d like to maximize your income during retirement, the Nationwide High Point 365 Select Enhanced Death Benefit rider can help you achieve that. The rider costs an additional 0.95% of your contract value each year. Calculates this based on high-point income gains. And guaranteed to double in value by the end of your lifetime.

Nationwide New Height Annuity is a purchase payment. Deferred Annuity. It is meant to help clients prepare for retirement. Savings while protecting them from market volatility. The rider also provides a guarantee subject to the ability of the Nationwide Life and Annuity Insurance Company to pay claims. These riders have many advantages. Aside from helping you meet your income needs, they also provide legacy planning options.