If you’re paying your Nationwide Insurance Bill premium by post, you can do so via their website or your financial institution’s app. It is imperative to note that deferred cost premiums are not paid on time across the country. If you pay your premiums online, you’ll set up programmed withdrawals from your bank account each month to keep a strategic distance from delayed expenses. This is beneficial, no matter what the cost. You should undoubtedly check the recently marked-up terms and conditions for programmed withdrawals. To pay your bill online, you need to fill in the required information across the country – your credit or bank account details and your account information. Your payment will be automatically processed nationwide unless you indicate otherwise.

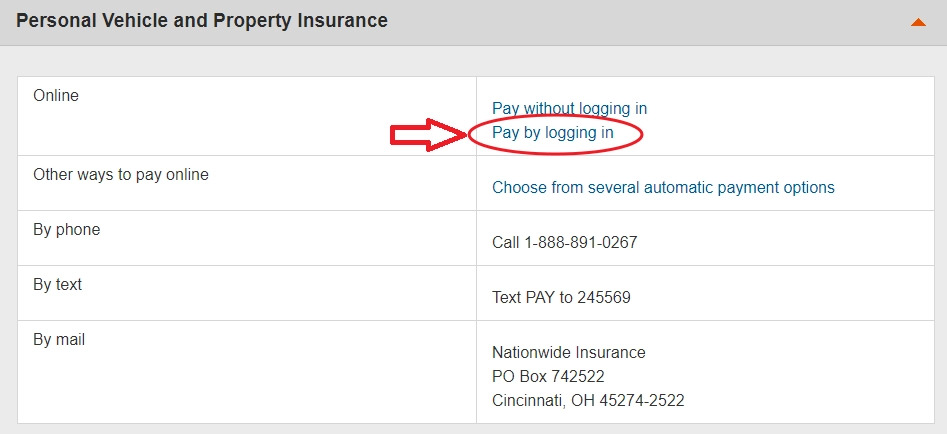

Payment options

You can pay your nationwide insurance bill online. You can either pay your bill in full, make monthly payments, or use an Electronic Funds Transfer (EFT) service. Nationwide also accepts payments through the app for your mobile device. Depending on your coverage, you can set up regular payments that are automatically withdrawn from your checking or savings account. You can make a one-time payment by credit card. The payment method you choose is entirely up to you.

Once you have made a selection, you have to provide the required information. Often, this is similar to a bank account. This is often a helpful option that saves you time. When paying by post, you may need your account number, direction number, and the amount you are paying. This way, you will never miss a payment again. It’s also easy to set up automatic payments from your checking account.

Nationwide Insurance JPMorgan Chase Bank, N.A. Hosted by a secure site and accepts payments by phone. You can send installments through the company’s automatic payment facility. You must include the installment plan account number to avoid bank charges and late charges. This option is especially helpful in such situations. As a result, you need to pay security charges throughout your country. You should remember that your bank will charge you an insufficient funds fee if you choose to use the automatic payment method.

Contact information

If you need to make a payment on a policy or have a question about your policy, you can get help from Nationwide Customer Service. Their toll-free number approach will help you with everything from queries to charging. They will ask you for your approach number, account number, and ID card. You can also use this number if you want to contact them about business insurance.

Recurring electronic funds transfer (REFT) payments

Recurring Electronic Fund Transfer (REFT), an electronic method of payment for nationwide pay bill, has several advantages. Besides being helpful and quick, REFT installments will boost your footing. Set up recurring installments on your protection charges using your protection carrier’s site or specialist administration. The benefits of REFT payments are many, but there are also some drawbacks.

Cancellation of a policy

If you are considering canceling your Nationwide insurance bill policy, there are a few things you should know before doing so. You do not need to tell them the reason why you are canceling your approach. It will help you choose when checking other plans. Auto protection is mandatory in most states. So deciding to cancel your policy will help you avoid penalties.

In New York, cancellation and renewal provisions in state insurance law. “Non-payment of premium” refers to the failure of the customer to pay the premium. This may be directly to the insurer or indirectly under an extension of credit or premium finance plan. If payment is made within fifteen days of the date on the cancellation notice, it is timely. If the insurance company sends a letter, you must ensure that the insurer receives the letter on time.

The insurer argued that Manley’s statement regarding the main problems did not provide sufficient evidence to determine that Act 68 voided the policy. He further contended that the evidence on file supports the finding of revocation vide Act 68. which includes computer printouts. which indicates the date of certain actions and the type of notice sent. Nationwide argues that this argument is based on “Donegal”. Fails to address the insufficiency of evidence presented to the Insurance Commissioner.

In this case, the plaintiffs sued Nationwide Mutual Insurance Company after losing their home in a fire two months before their insurance policy. Nationwide argued that sending the cancellation notice by regular mail violated N.C.G.S. Requirements for notice of cancellation “furnishing” of SS 58-41-15(c). In deciding the case, the trial court agreed with the insurance company.