Nationwide pet insurance claim forms are great companions and provide unconditional love and company. They also help fight illnesses and depression. It is not surprising that many people want to provide them with pet insurance. Before you submit a claim for your Nationwide pet insurance policy, there are a few things you need to know. Insurance companies go out of their way to deny claims. What do you need to submit?

Nationwide Pet Insurance Review

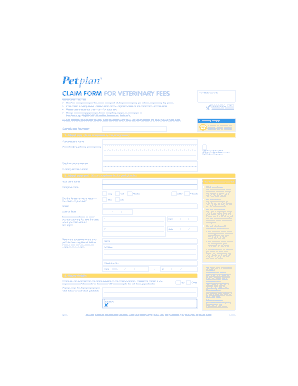

For online claims, there is a simple claim form on the nationwide website. which allows customers to submit their claims online. You can take a photo of your invoice and attach it to the form. You can send it by fax, email, or mail nationwide. The claim form can be submitted within 24 hours. You can find it in your MyEmbrace account. Whether you use the online form or mail it in, filing a claim is easy and efficient.

Nationwide pet insurance claim forms have a good number of benefits for animal health. Covers nationwide wellness care, medical emergencies, and exotic pets. Insurance has limited customization options and does not allow you to change the reimbursement level. Especially for older animals, the prices are very steep. The company offers discounts for bundling insurance or signing up multiple pets. So, if you are looking for an insurance company with a low annual premium, Nationwide can be a good option.

While providing superior nationwide coverage and customer service. Claims can then be difficult to file with them. The claims process is comparable to other insurance companies. If you are not satisfied with Nationwide’s claims process you can always switch to another insurance provider. You should read the fine print before making any final decision. Nationwide pet insurance policies are comparable to other companies. It is important to choose your policy wisely.

Cost of Coverage

Nationwide pet insurance is relatively new compared to human health insurance. It has several features that set it apart from its competitors. It includes a $250 annual deductible and 24/7 access to a veterinary helpline. The policy includes coverage for acute and chronic illnesses, But you must pay the deductible before Nationwide starts paying claims. There is a longer waiting period of one year before certain inherited conditions are covered.

The cost of nationwide pet insurance varies by location and type of pet. Regular annual care costs between $200 and $400 for dogs and $200 for cats. Getting coverage from a company that offers 90 percent reimbursement will help you avoid financial stress in case of a vet visit. The policy covers your pet if something happens to you.

The cost of nationwide pet insurance coverage Depends on the type of plan you choose. Major medical plans pay out on a set schedule of benefits. Specifies the maximum amount you can be reimbursed per condition per year. Although these plans are cheaper than whole stomach plans, they do not cover congenital diseases. You can choose between the Wellness Basic plan and the Wellness Plus plan for about $17 or $22 per month.

The cost of pet insurance coverage varies across the country Your pet’s age, type of coverage, deductible, and type of pre-existing conditions. Nationwide offers many discounts for multiple pet policies. If you already have a nationwide insurance policy, You may be eligible for a 5% discount. If you have another policy through the company, you can get an even bigger discount. The company does not offer coverage for exotic animals.

Exclusions from coverage

When looking at Nationwide’s pet insurance claim form you will notice that there are many things that you are not covered for. Nationwide does not cover pre-existing conditions, so if your pet has diabetes. Then you will not get compensation. It also does not cover non-veterinary fees, boarding, grooming, breeding, and litter disposal. Nationwide also does not cover preventive care or wellness costs. To avoid unexpected medical bills, it’s best to get coverage for these expenses before an emergency arises.

Pre-existing conditions are the most common reasons to exclude your pet. While most pet insurance plans cover regular grooming. Many exclude pre-existing conditions from their coverage. Many companies also include additional coverage for routine treatments and procedures. Which includes bathing and grooming. Some policies have extended waiting periods or bilateral exclusions. Read the policy terms carefully to ensure you are fully covered for your pet’s medical needs.

Exclusions from coverage on the nationwide pet health insurance claim form include exotic pets. If you are concerned about your pet’s health, call customer service to find out if you are covered for your exotic pet. Coverage exclusions on a Nationwide pet insurance claim form may surprise you. Before you sign up, be sure to research benefits and exclusions before enrolling. For more information, visit the Nationwide website.

It has a very high percentage of customer reviews on popular customer review sites across the country. Customers have generally expressed their satisfaction with the service. Many claims were successfully filed saving thousands of dollars. Most approved claims were processed quickly and reimbursed within one to four weeks. Insurance complaints typically revolve around claim denials, often due to pre-existing conditions or coverage exclusions. Asking for a written explanation of the exclusion before submitting a claim can help you avoid any problems later.

Customer service options

Customers who wish to submit nationwide pet insurance claim forms can use the toll-free number available to them. Phone support, they can also submit the form via email, fax, or online. The company also has a social media presence and a frequently asked questions section. While all of these options are convenient, you may need to call customer service to resolve your issue.

To file a claim, you must first submit your contact information and payment details. No need to worry about your pet being covered after the waiting period. Nationwide offers a mobile application. which can be submitted from your computer or your smartphone. You can also file a claim from your phone as long as the carrier allows it. Apart from offering mobile apps nationwide, Nationwide is available to accept claims around the clock.