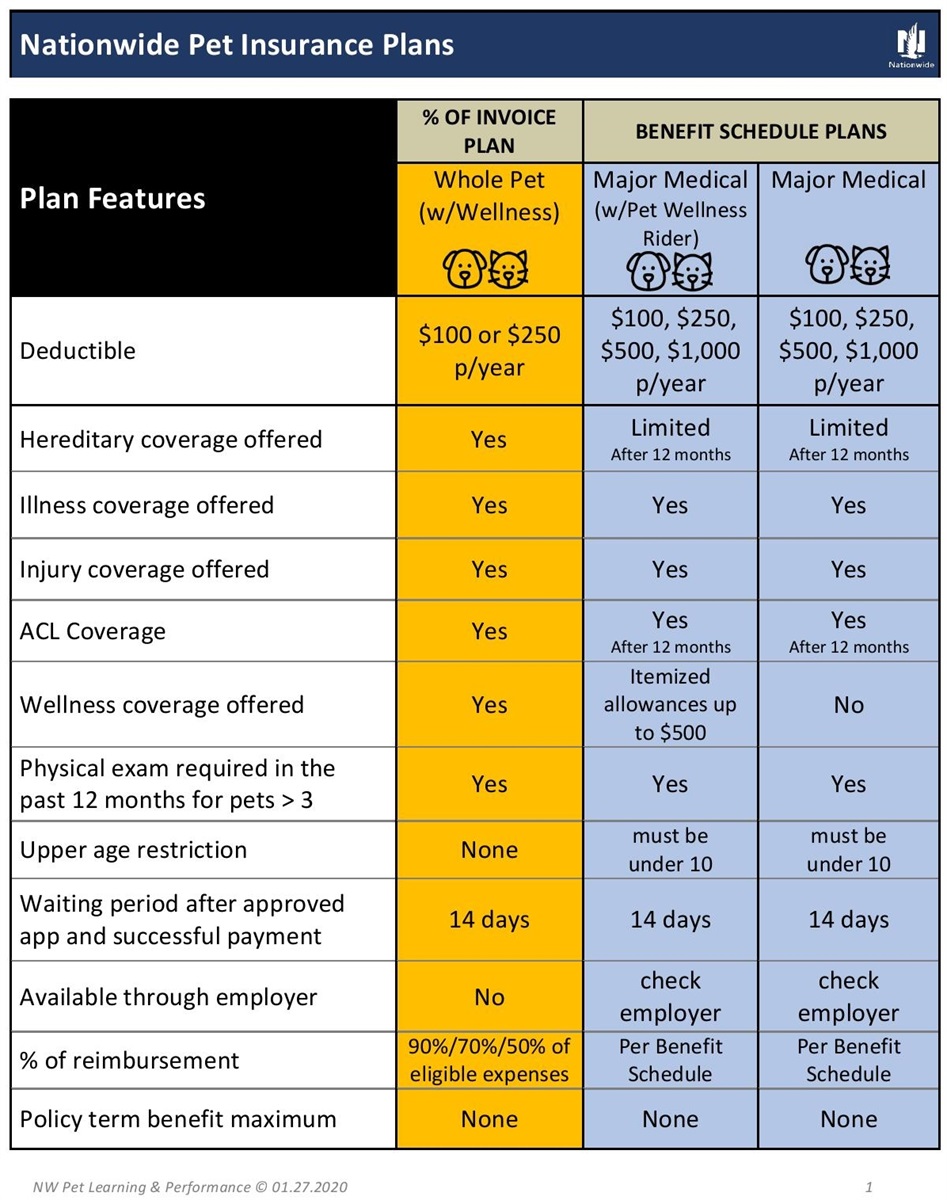

Many pet owners may be confused about the differences between nationwide pet insurance plans and their human counterparts. Nationwide offers one low deductible and several higher deductibles, but the higher deductibles will result in higher monthly premiums. Another downside to Nationwide is that the company makes it difficult to find and download information, such as sample policies and coverage details. Those who want to know more should visit the website directly, as they only post pdfs.

Nationwide Whole Pet Plan – Nationwide Pet Insurance

Whole Pet Plan nationwide pet insurance plans offer several benefits for your pet. This plan covers 90% of your pet’s vet bills, regardless of whether it is sick or injured. Whole Pet plans also cover wellness and preventive care. Whole Pet plans cover dental issues, age-related changes in your pet’s eyes, ears, and skin, as well as nutritional supplements and vaccinations. This insurance also includes coverage for pregnancy and some dental conditions.

The two main types of Nationwide plans are Basic Medical and Complete Pet Wellness. The former covers illnesses and injuries. The latter covers a deductible of $250 per year and covers treatments and exams at any licensed veterinarian. The Major Medical plan offers more comprehensive coverage for illnesses and injuries, but the Whole Pet plan is ideal for people with animals. The Whole Pet plan also covers exotic pets. Among the exotic pets covered by Nationwide are gerbils, rats, and pot-bellied pigs.

Nationwide’s Whole Pet plan is the best choice for pet insurance plans. It includes accident and sickness coverage plus coverage for hereditary or chronic diseases. Whole Pet plan pays 90% of the costs, while lower-tier plans pay according to a benefit schedule. Some health conditions, such as cancer, are not covered at all. However, most pet owners are happy with the nationwide comprehensive pet scheme. As a multi-pet family, you can save money on the Whole Pet Plan by choosing a lower-tier plan.

The most affordable Whole Pet plan from Nationwide is the Major MedicalSM plan. This plan covers everything in the Whole Pet Plan, except cruciate ligament injuries and orthopedic procedures. Nationwide has a 24-hour vet helpline for pet owners, offering general wellness advice and recommendations. While it does not cover in-person care, Nationwide also offers a 5% discount on their plans if you have insurance with Nationwide for your auto and home.

Pumpkin, which is relatively new in the world of pet insurance, offers a Preventive Essentials package. However, this package is not insurance but an optional benefit that can be added to any insurance plan for a monthly fee. Essentially, this package is designed to help pet owners plan for their pet’s health care. Pumpkins Preventive Essentials covers annual wellness. Christmas and major vaccinations as well as important parasite checks.

Despite the similarities in their plans, there are differences between them. Healthy Paws offers a single pet insurance plan and provides higher reimbursement options for some conditions. It is not as comprehensive as Nationwide but does offer more options, such as wellness coverage. Healthy Paws covers hereditary or congenital conditions, prescription medications, and alternative treatments. Healthy paws also offer more flexibility with their plans. Nationwide petinsurance claims are processed within two business days. While the nationwide scheme may take up to 30 days.

Major Medical with Wellness Plan – Nationwide Pet Insurance

Nationwide offers two types of pet insurance plans. First, you can purchase a Whole Pet Insurance plan that will cover both your pet’s wellness and preventive care needs. These policies cover dental care, vaccinations, parasite treatment, and nutritional supplements. They also include behavioral therapy. But be sure to read the fine print – some of these policies don’t cover the cost of behavioral therapy. You can learn more about these plans by reading the fine print and comparing them to others.

Both Nationwide’s Whole Pet and Major Medical with Wellness Plan policies have a 14-day waiting period before they start paying for treatments. The Wellness plan is available on the first day of enrollment, while the Major Medical plan has a two-week waiting period. If you enroll your pet within 14 days of the first day of enrollment, you’ll begin receiving payments for wellness coverage. However, there are restrictions on the Whole Pet plan, including coverage for cruciate ligament problems.

While Whole Pet With Wellness Plan nationwide pet insurance plans are the most comprehensive and cost-effective, these plans often exclude coverage for birds and small rodents. Monthly premiums for a 5-year-old medium-sized mixed-breed dog would cost around $30 a month. If you opt for a Whole Pet plan, the cost would be between $15 and $35 per month. This would pay for two annual physical exams, vaccinations, and behavior exams, while a nationwide whole pet with wellness Plan would cost $87 to $22 per month.

The total annual benefit amount for each Nationwide plan is different. For major medical plans, there is an annual limit of $400. But the whole pet plan has no annual limit, allowing you to choose the amount that best fits your budget. Whole pet wellness plans do not have lifetime benefit limits, but a $400 annual cap is common. But remember that every plan has an annual limit, which makes it important to consider your pet’s health and lifestyle when choosing a plan.

The Whole Pet with Wellness Plan is the best option for most pet owners, as it covers more than just emergencies. Those costs include wellness exams, vaccinations, and even flea and tick treatments. Despite its price tag, Nationwide has made a name for itself in the insurance industry. If you’re unsure if the Nationwide pet insurance plans are right for you, contact their customer service center and get a quote today!

The Whole Pet plan from Nationwide covers hereditary and congenital conditions. It also covers prescription medications, supplements, and diagnostic tests. However, both plans have a waiting period for certain conditions. In the case of an accident or illness, the waiting period can be as long as 12 months. If your pet is older than that, it won’t be covered at all. The Wellness Plan from Nationwide is the best option for older pets. If your pet is older than 15 years, the Whole Pet plan will not cover it.

Trupanion pet insurance

Unlike most pet insurance companies, Trupanion offers its customers one-click enrollment for their pet insurance plans. To purchase a policy, simply input your pet’s information, zip code, email address, and health information. A quote is generated for your pet based on your plan deductible. And you can also add additional benefits like recovery, supplemental care, and pet owner assistance. You can also choose whether or not to include a veterinary hospital or veterinarian. Upon purchase, you will need to wait 30 days before your pet is covered.

While comparing pet insurance companies, it’s important to understand that most policies don’t cover pre-existing conditions, cosmetic surgery, or vaccinations. To make the best choice, consider your pet’s age, breed, and likelihood of getting sick or injured. Despite the numerous negative Trupanion pet insurance reviews on Trupanion’s website, the positive reviews do not point to a consistent pattern of complaints. The company’s website isn’t user-friendly and doesn’t include Sunday hours or live chat.

The main reason for buying Trupanion’s pet insurance plans is their generous perks. The company will not increase your premium based on the age of your pet and no examination fee is required. It does not cover wellness care or preventive care. But it provides coverage for more common ailments. Trupanion’s policies cover ninety percent of medical costs, including foreign body ingestion, which can run into four figures.

Nationwide also offers different plans and offers an add-on option for wellness care for your pet. Nationwide offers a more comprehensive coverage plan for exotic pets, birds, and other pets. The countryside is better for dogs and cats. But customer satisfaction is low. The claims process can be delayed and documentation must be submitted before a claim can be processed. To choose the right policy for your pet, read the fine print.

Trupanion’s plans are more expensive than those of its competitors, but you can still customize your coverage with unlimited per-condition deductibles. The plan also provides a vet direct payment option, which is helpful if you have a limited budget. Other benefits include a lifetime per-condition deductible. It also covers up to ninety percent of the cost of new illnesses and doesn’t increase your rate as your pet ages. However, you’ll need to pay the veterinarian directly for certain treatments, such as surgery or chemotherapy. Additionally, you can purchase a supplement to your policy, if your pet suffers from a chronic disease.

Both Nationwide and Trupanion offer different levels of coverage. The prices for Nationwide vary from $39 to $65 per month, depending on the plan you select. The cost varies based on the species and the area. It also differs according to the age and location of the insured pet. If you have a spayed or neutered dog, the Trupanion quote will be more affordable.